The market is segmented based on components, with implants and electronic components as the primary categories. Implants accounted for 83.4% of the market revenue in 2024 and are projected to reach USD 8.9 billion by 2034. These implants, particularly for knee and hip replacements, are widely used to treat degenerative bone conditions, which drives their market dominance. The integration of advanced technologies like sensors and artificial intelligence (AI) enhances implant performance, leading to better patient outcomes and greater adoption rates.

By application, the smart orthopedic implants market includes spinal fusion and fixation, VCF treatment, motion preservation/non-fusion, and spinal decompression. Spinal fusion and fixation dominated the market with a value of USD 860.4 million in 2024. These procedures are commonly used to treat herniated discs, scoliosis, and spinal stenosis, particularly among the aging population. The integration of sensors for real-time monitoring and improved fixation techniques enhances the effectiveness of these procedures, ensuring their continued market leadership.

When segmented by procedure type, the market includes total replacement, partial replacement, and other procedures. Total replacement emerged as the dominant segment, accounting for 55.7% of the revenue share in 2024, and is estimated to reach USD 5.9 billion by 2034. The rising incidence of degenerative joint diseases and an aging population drive the demand for total replacement procedures, particularly for knee joints. These procedures provide comprehensive solutions for severe joint conditions, offering better functionality and long-term relief, which reinforces their market dominance.

Based on end use, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and other facilities. Hospitals held the largest revenue share of 44.1% in 2024 due to their capability to manage complex surgeries and provide comprehensive post-operative care. Their advanced surgical capabilities, specialized equipment, and multidisciplinary care make them the preferred choice for orthopedic procedures involving smart implants.

In the United States, the smart orthopedic implants market accounted for USD 748.5 million in 2023 and is expected to grow significantly, reaching USD 4.1 billion by 2034. The country’s emphasis on healthcare innovation, robust infrastructure, widespread insurance coverage, and increasing awareness of cutting-edge orthopedic solutions drive the adoption of smart orthopedic implants across diverse patient demographics.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Smart Orthopedic Implants market report include:- Canary Medical

- Exactech

- Medtronic

- SpineGuard

- Stryker

- Zimmer Biomet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

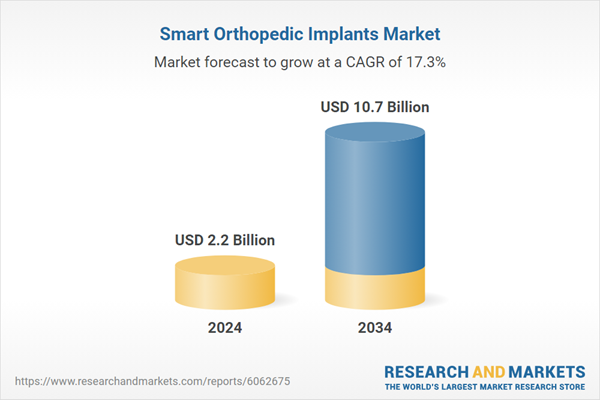

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 10.7 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |