Non-Hodgkin lymphoma (NHL) dominates the market due to its higher prevalence and multiple subtypes, resulting in a larger patient population worldwide. Increasing incidence rates continue to propel the market’s growth. The use of monoclonal antibody therapies, such as Rituximab, has revolutionized lymphoma treatment. Rituximab targets the CD20 molecule on B lymphocytes and has proven effective in managing both NHL and nodular lymphocyte predominant Hodgkin lymphoma (NLPHL). The therapy enhances response rates, prolongs remission duration, and boosts survival rates, reinforcing its position as a cornerstone in lymphoma treatment.

Parenteral administration accounted for 78.7% of the market share in 2024, underscoring its dominance. This method, which involves injecting medication directly into the bloodstream, ensures rapid drug absorption, making it ideal for aggressive lymphomas requiring immediate intervention. Parenteral routes allow for precise dosing and controlled delivery, which is critical for advanced therapies such as immunotherapy, CAR T-cell therapy, and high-dose chemotherapy. Patients who are unable to tolerate oral medications due to severe symptoms or bowel issues benefit from this approach. Furthermore, parenteral administration remains the preferred method for relapsed or refractory lymphoma cases that do not respond well to oral treatments.

Hospital pharmacies held the largest market share at 45.9% in 2024, driven by the widespread use of hospital-administered therapies such as chemotherapy, immunotherapy, and CAR T-cell therapies. These specialized treatments require careful preparation and monitoring, which is best handled within a hospital setting. Hospital pharmacies remain the primary source for these tailored medications and high-cost biologics. The growing volume of hospital admissions for specialized oncology care further reinforces the segment’s substantial market share.

In the United Kingdom, the lymphoma treatment market is expected to witness consistent growth between 2025 and 2034. The increasing prevalence of lymphoma in the region is driving demand for innovative treatment solutions. Advancements in precision medicine, immunotherapy, and CAR T-cell therapies are meeting this demand. Additionally, initiatives such as the Life Sciences Industrial Strategy and Brexit-driven devolution efforts are strengthening the UK’s capacity to innovate and produce domestic treatments, boosting the region’s overall market growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Lymphoma Treatment market report include:- AstraZeneca

- Bayer

- Biogen

- BioGene

- Bristol-Myers Squibb

- Celgene

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Gilead Sciences

- Incyte

- Johnson & Johnson

- Juno Therapeutics

- Merck

- Novartis

- Seattle Genetics

- Takeda Pharmaceutical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | March 2025 |

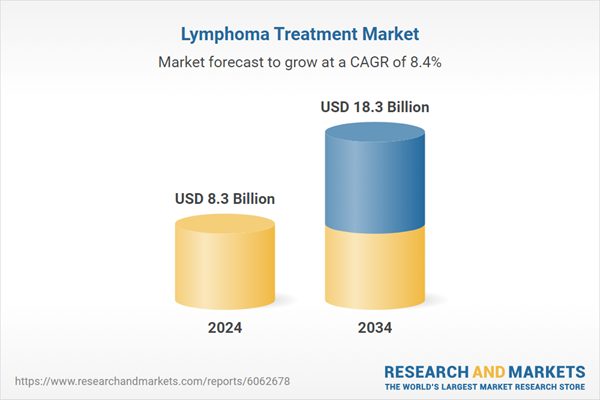

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 18.3 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |