As many individuals find it difficult to meet monthly repayment schedules, the demand for professional debt settlement services is witnessing a sharp upturn. These services not only help consumers avoid defaults but also enable them to negotiate substantial reductions in outstanding balances, offering a more sustainable way to manage and resolve debts. The growing adoption of technology-based financial services, along with increased consumer awareness about debt negotiation options, is accelerating the growth trajectory of the debt settlement market. Financial stress among younger populations, especially millennials and Gen Z facing student loan debt and rising living costs, is also contributing to the market’s expansion, making debt settlement a preferred alternative to bankruptcy or prolonged delinquency.

The debt settlement market is primarily segmented based on the type of debt, including credit card debt, personal loan debt, medical debt, student loan debt, and business debt. Among these, credit card debt accounted for a dominant share of 40% in 2024. Credit card debt remains the most widespread form of unsecured debt, and its high interest rates make repayment a significant challenge for consumers. Debt settlement companies are actively working to negotiate favorable settlements with credit card issuers on behalf of clients, allowing borrowers to significantly reduce their overall debt burden. Due to the scale and frequency of credit card borrowing, this segment continues to hold the largest share of the global market and is expected to retain its dominance through the forecast period.

Service providers operating in the debt settlement market include debt settlement companies, law firms, and financial advisors. Debt settlement companies held a substantial 43% market share in 2024, as they are typically the first resource individuals approach when looking to manage or settle unsecured debts. These companies offer tailored repayment plans, negotiate directly with creditors, and provide structured solutions that help consumers avoid the complexities of credit counseling or legal actions. Their affordable and personalized services make them indispensable in today’s debt-ridden economy.

The U.S. Debt Settlement Market alone is projected to generate USD 4 billion by 2034. Rising levels of credit card and personal loan debt, combined with increasing interest rates, are driving the need for structured settlement solutions across the country. Companies in the U.S. are adopting advanced digital platforms and personalized financial counseling services to engage consumers more effectively and deliver better debt resolution outcomes. Moreover, the regulatory framework, driven by agencies like the Consumer Financial Protection Bureau (CFPB), is reinforcing transparency, fair negotiation practices, and greater consumer protection, making the U.S. the largest and most influential market in the global debt settlement landscape.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Debt Settlement market report include:- Accredited Debt Relief

- American Debt Enders

- Century Support Services

- ClearOne Advantage

- Credit Associates

- CuraDebt

- Debt Rx

- Debtmerica Relief

- DebtWave Credit Counseling

- DMB Financial

- Financial Rescue

- FREED

- Freedom Debt Relief

- National Debt Relief

- New Era Debt Solutions

- Oak View Law Group

- Pacific Debt Inc.

- Rescue One Financial

- Superior Debt Relief Services

- United Debt Counselors

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

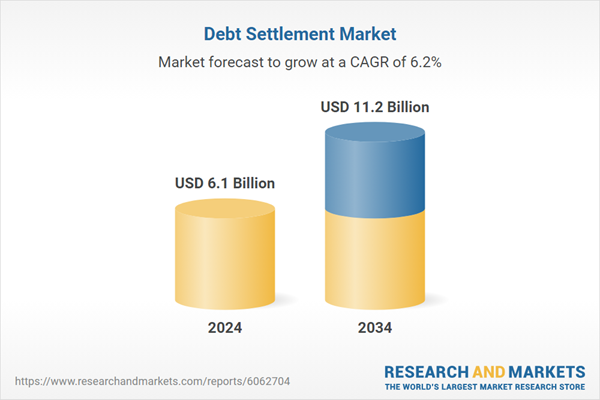

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 6.1 Billion |

| Forecasted Market Value ( USD | $ 11.2 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |