The market is experiencing significant momentum due to a combination of factors, including increasing maternal awareness, evolving healthcare policies, and the rising cost of hospital births. Expectant mothers are seeking options that promote autonomy in childbirth while ensuring high-quality care. Freestanding birth centers and hospital-affiliated facilities both play a role in meeting this growing demand, offering tailored services that align with modern maternity care preferences. Additionally, industry players are focusing on regulatory compliance, insurance coverage expansion, and technological advancements in prenatal and neonatal care. These efforts are making birth centers more accessible and appealing to a wider audience, further driving market growth.

The market is categorized into freestanding birth centers and hospital-affiliated birth centers. The freestanding birth centers segment generated USD 201.4 million in 2024, driven by cost-effectiveness and patient-centered care. Many expectant mothers prefer freestanding birth centers due to the growing awareness of out-of-hospital birth benefits, including lower cesarean section rates and reduced medical expenses. These facilities emphasize supportive staffing and minimal medical intervention, making them an attractive option for those seeking a more natural birth experience.

In terms of services, the market encompasses obstetric care, neonatal care, gynecological care, and lactation support. The obstetric care segment held a 34.8% market share in 2024, reflecting the increasing demand for comprehensive maternal care. Birth centers specializing in obstetric care offer essential services such as prenatal monitoring, labor and delivery assistance, and postpartum care. With advancements in obstetric technology and the availability of skilled professionals, these centers are delivering high-quality maternal and neonatal care, reinforcing the dominance of obstetric services in the market.

The Florida birth centers market generated USD 15.6 million in 2024, with strong growth prospects driven by the state’s large population and high birth rates. The rising interest in non-traditional childbirth methods is further propelling market expansion. Florida's extensive network of licensed birth centers, along with increasing awareness of their benefits - such as reduced medical intervention and lower healthcare costs - is fueling the sector’s steady development.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this U.S. Birth Centers market report include:- Alma Midwifery

- Barnes-Jewish Hospital

- Cedars-Sinai Medical Center (Cedars-Sinai)

- Cleveland Clinic

- Houston Methodist Hospital

- Mayo Clinic

- Norton Healthcare

- NewYork-Presbyterian Hospital

- Prisma Health Baptist Hospital

- Rose Medical Center

- St. David's Healthcare

- The Mount Sinai Hospital

- TriStar Centennial Women's and Children’s Hospital

- The Mother Baby Center

- UCLA Health

- UCSF Medical Center

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

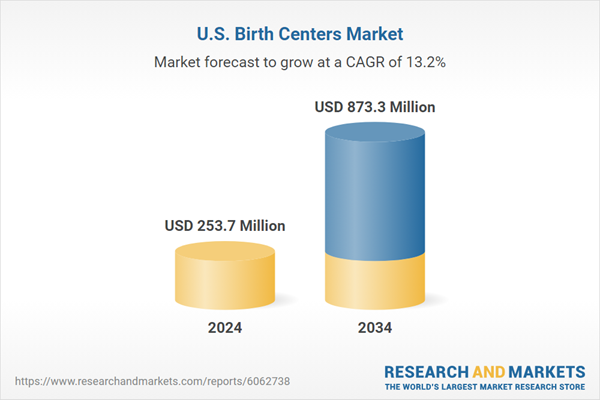

| Estimated Market Value ( USD | $ 253.7 Million |

| Forecasted Market Value ( USD | $ 873.3 Million |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 17 |