Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Recent industry statistics indicate a sustained upward trend in material consumption vital for these applications. According to the International Copper Study Group, global usage of refined copper is expected to rise by approximately 3% in 2025. While this strong demand highlights the material's indispensable role in industrial progress, the market faces complex supply dynamics. A major obstacle restricting steady growth is the volatility of raw copper prices, often triggered by mining disruptions or geopolitical instability, which can squeeze profit margins and delay critical infrastructure projects.

Market Drivers

The development of power transmission and distribution networks acts as a primary catalyst for market advancement. As nations shift toward renewable energy sources, the need to link remote wind and solar generation sites to consumption hubs requires significant cabling infrastructure. This structural evolution compels utilities to upgrade aging electrical grids, directly boosting the volume of conductive materials needed for high-voltage lines and local distribution systems. According to the International Energy Agency's 'World Energy Investment 2024' report from June 2024, global investment in electricity grids is projected to hit USD 400 billion in 2024. This capital supports the deployment of modern wiring systems designed to manage variable energy loads and ensure grid stability.Additionally, the accelerating electrification of the automotive sector further intensifies the demand for copper wire. Electric vehicles require a substantially larger amount of wiring for batteries, inverters, and electric motors compared to internal combustion engines, establishing the automotive industry as a crucial end-user. This trend encompasses charging infrastructure as well, which depends heavily on robust copper cabling for efficient energy transfer. As per the International Energy Agency's 'Global EV Outlook 2024' released in April 2024, electric car sales are expected to reach roughly 17 million in 2024. To support such extensive industrial requirements, material availability remains a key priority; the Chilean Copper Commission projects global refined copper demand will reach 26.78 million tonnes in 2024.

Market Challenges

The volatility of raw copper prices constitutes a significant barrier to the consistent growth of the Global Copper Wire Market. This instability establishes a precarious landscape for wire manufacturers, who frequently operate with narrow profit margins and cannot immediately pass sudden cost increases onto end-users in the energy and automotive sectors. Consequently, unpredictable material costs complicate long-term inventory planning and capital allocation, forcing companies to utilize conservative procurement strategies. When prices spike unexpectedly, downstream clients often delay the initiation of large-scale infrastructure and grid modernization projects to await market stabilization, directly reducing the immediate volume of wire orders.Supply-side constraints are a primary driver of this price instability, as material availability often fails to align with industrial requirements. According to the International Copper Study Group, global copper mine production growth for 2025 was revised downward to just 1.4% following significant operational disruptions at major mining sites. This restricted output growth exacerbates the gap between supply and demand, fueling further price fluctuations. Such market tightness prevents wire producers from securing consistent raw material flows, thereby stalling production capacity expansions despite the broader trends favoring electrification.

Market Trends

The deployment of high-frequency copper cabling for 5G networks and hyperscale data centers is emerging as a vital growth avenue, fueled by the exponential rise in cloud computing and artificial intelligence. Unlike traditional power transmission, this sector necessitates specialized, high-performance wiring designed to handle the intense power density and heat dissipation requirements of modern server racks. This digital infrastructure boom is causing a structural shift in consumption patterns, elevating the metal's role beyond standard utility grids as tech giants aggressively expand their computational capacity. According to a BHP article from January 2025 titled 'Why AI tools and data centres are driving copper demand', global copper demand from data centers is projected to grow six-fold to approximately 3 million tonnes annually by 2050.Simultaneously, the expansion of green copper initiatives and closed-loop recycling is reshaping supply chain strategies to mitigate raw material volatility and reduce carbon footprints. Wire manufacturers are increasingly integrating secondary smelting capabilities directly into their production lines, enabling them to recover high-purity metal from post-consumer scrap and industrial waste. This circular approach not only secures a stable material feed independent of mining disruptions but also aligns with stringent environmental regulations and client demands for sustainable sourcing. As stated in Nexans' 'Nexans supports a circular economy' report from May 2025, the company processed 90,540 tons of recycled copper in 2024, achieving a recycled content rate of 21% across its manufacturing operations.

Key Players Profiled in the Copper Wire Market

- Prysmian S.p.A.

- Nexans S.A.

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- General Cable Corporation

- Belden Inc.

- Encore Wire Corporation

- Leoni AG

Report Scope

In this report, the Global Copper Wire Market has been segmented into the following categories:Copper Wire Market, by Sales Channel:

- Direct

- Indirect

Copper Wire Market, by End Use:

- Power Generation & Transmission

- Electronics

- Building & Construction

- Automotive & Transportation

- Others

Copper Wire Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Copper Wire Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Copper Wire market report include:- Prysmian S.p.A.

- Nexans S.A.

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- General Cable Corporation

- Belden Inc.

- Encore Wire Corporation

- Leoni AG

Table Information

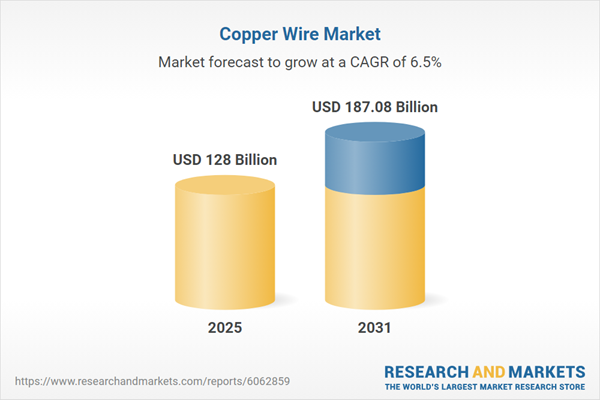

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 128 Billion |

| Forecasted Market Value ( USD | $ 187.08 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |