Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers:

Increased Awareness of Food Safety

Growing awareness of food safety is a key driver in the Vietnam Bacteriological Testing Market. For example, a study analyzing food safety risks in pork samples from pig farms, slaughterhouses, and pork shops in Nghe An and Hung Yen provinces found Salmonella contamination in 35%, 30%, and 37% of the samples, respectively. As awareness of foodborne illnesses and contamination rises, both consumers and businesses are increasingly demanding stricter food safety practices, directly boosting the demand for bacteriological testing services.In 2020, the average pork consumption per capita in Vietnam was 25 kg. However, concerns about food safety have escalated due to practices such as the misuse of antibiotics, excessive use of lean substances, and growth hormones, leading to a decline in consumer confidence. High-profile food-related incidents have fueled this decline, prompting consumers to become more vigilant about foodborne pathogens like Salmonella, E. coli, and Listeria.

The widespread availability of information on foodborne diseases, driven by social media and global health organizations, has increased public sensitivity to food safety risks. This growing awareness is leading consumers to choose food products from companies that prioritize high food safety standards, including comprehensive bacteriological testing. As a result, food producers, particularly in the food and beverage sector, are investing more in testing technologies to meet the demand for safe and reliable products.

Key Market Challenges:

Limited Testing Infrastructure and Technological Barriers

A significant challenge hindering the growth of the bacteriological testing market in Vietnam is the lack of robust testing infrastructure, particularly in rural and less-developed areas. While larger cities such as Ho Chi Minh City and Hanoi benefit from modern laboratories and testing facilities, smaller cities and rural regions struggle with outdated or inadequate resources. This creates a disparity in testing capabilities, limiting the ability of smaller food producers and other industries to implement comprehensive testing protocols.Furthermore, despite advancements in testing technologies such as PCR and rapid microbiological testing, many businesses still rely on traditional, slower methods due to cost constraints. This technological gap not only affects the speed and accuracy of testing but also hampers Vietnam’s ability to meet international standards, especially in food exports to markets with stringent safety requirements. The high initial investment required for advanced testing technologies, combined with a shortage of skilled professionals, exacerbates these challenges.

Key Market Trends:

Adoption of Rapid and Real-Time Testing Technologies

The increasing demand for faster and more efficient testing solutions is a prominent trend driving the future growth of the Vietnam Bacteriological Testing Market. Traditional testing methods, which can take days to provide results, are being replaced by advanced real-time diagnostic technologies that offer quicker turnaround times and more accurate outcomes. Techniques such as Polymerase Chain Reaction (PCR) testing, enzyme-linked immunosorbent assays (ELISA), and next-generation sequencing (NGS) are gaining traction in both food safety and healthcare testing.Real-time testing technologies allow food producers to detect pathogens like Salmonella, E. coli, and Listeria more rapidly, reducing the risk of contamination and enabling quicker corrective actions. This speed is particularly valuable for industries that must comply with international food safety standards, ensuring the timely delivery of safe products. Moreover, these technologies provide more precise results, which are essential for both consumer safety and brand protection. The increasing affordability of rapid testing solutions is expected to expand market access, especially for small and medium-sized enterprises (SMEs) in the food and beverage sector, thereby driving a surge in demand for bacteriological testing services nationwide.

Key Market Players

- GS Vietnam

- Bureau Veritas Vietnam Limited

- Intertek Group plc

- Eurofins Scientific

- TÜV SÜD

- ALS Limited

- 3M

- Thermo Fisher Scientific, Inc

- Merck Vietnam Company Ltd

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

Report Scope:

In this report, the Vietnam Bacteriological Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Bacteriological Testing Market, By Bacteria:

- Coliform

- Salmonella

- Campylobacter

- Listeria

- Legionella

- Others

Vietnam Bacteriological Testing Market, By Technology:

- Traditional Technology

- Rapid Technology

Vietnam Bacteriological Testing Market, By End Use:

- Food & Beverage

- Water

- Pharmaceuticals

- Others

Vietnam Bacteriological Testing Market, By Component:

- Instruments

- Test Kits

- Reagents & Consumables

Vietnam Bacteriological Testing Market, By Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Bacteriological Testing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GS Vietnam

- Bureau Veritas Vietnam Limited

- Intertek Group plc

- Eurofins Scientific

- TÜV SÜD

- ALS Limited

- 3M

- Thermo Fisher Scientific, Inc

- Merck Vietnam Company Ltd

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | April 2025 |

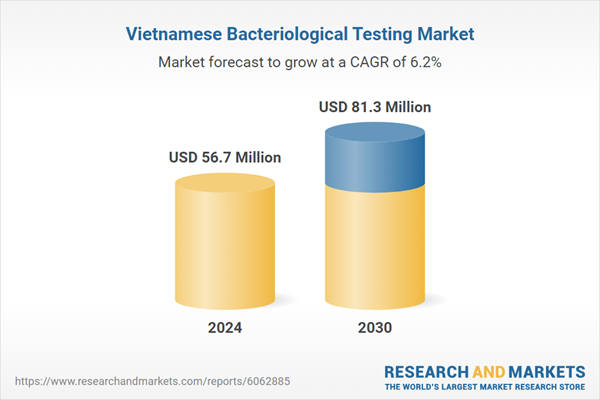

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 56.7 Million |

| Forecasted Market Value ( USD | $ 81.3 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 11 |