The increasing demand for high-speed data transmission and the growing adoption of fiber-optic networks have driven the need for advanced spectrum analysis solutions in optical communication. With the expansion of data centers, cloud computing services, and high-bandwidth applications, optical spectrum analyzers have become essential for optimizing signal integrity, measuring wavelength accuracy, and detecting signal distortions. Hence, the optical communication segment acquired 30% revenue share in the market in 2023. The rise of photonic technologies and the deployment of wavelength-division multiplexing (WDM) systems has further fueled the adoption of optical spectrum analyzers.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2025, Rohde & Schwarz GmbH & Co. KG unveiled its VNA portfolio with the R&S ZNB3000, offering top RF performance, high accuracy, and speed. With frequencies up to 26.5 GHz, it suits RF labs and production. Its scalability, stability, and uncertainty calculation enhance efficiency, supporting high-volume production and next-gen technology development. Additionally, In January, 2025, Anritsu Corporation unveiled its Signal Analyzers (MS2830A/MS2840A/MS2850A) with software updates, extending spectrum measurement to the millimeter-wave band using VDI or Eravant external mixers. These advancements enable applications in medical, automotive, and security fields, improving millimeter-wave device quality for a safer, more secure society.

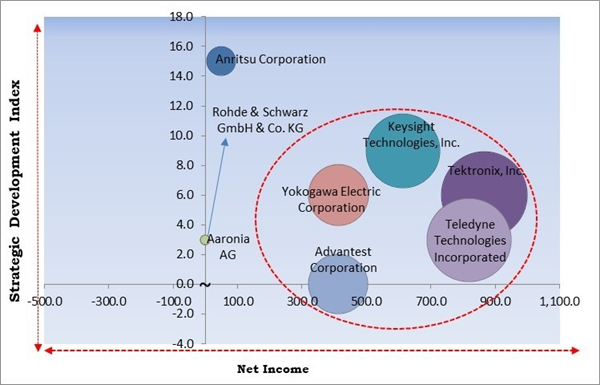

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Tektronix, Inc., Keysight Technologies, Inc., Advantest Corporation, Teledyne Technologies Incorporated, and Yokogawa Electric Corporation are the forerunners in the Spectrum Analyzer Market. In February, 2025, Yokogawa Electric Corporation unveiled the AQ6361 optical spectrum analyzer, a high-speed, compact, and cost-effective solution for testing datacom and telecom components. Companies such as Anritsu Corporation, Rohde & Schwarz GmbH & Co. KG, and Aaronia AG are some of the key innovators in Spectrum Analyzer Market.Market Growth Factors

The growing demand for high-speed internet, driven by expanding broadband services, 5G networks, and IoT connectivity, has intensified the need for spectrum monitoring solutions. As businesses and consumers depend more on wireless communication for remote work, digital transactions, and smart device connectivity, the adoption of spectrum analyzers is expected to surge, fostering market growth in the coming years. Thus, increasing demand for wireless communication technologies across various industries drives the market's growth.The defense sector also benefits from portable spectrum analyzers, as military and security personnel use them for tactical signal intelligence, countermeasure testing, and threat detection. Detecting unauthorized transmissions and potential security breaches in real-time enhances operational effectiveness. In conclusion, as industries increasingly prioritize mobility and quick response capabilities, the demand for real-time and portable spectrum analyzers is expected to grow, driving market expansion.

Market Restraining Factors

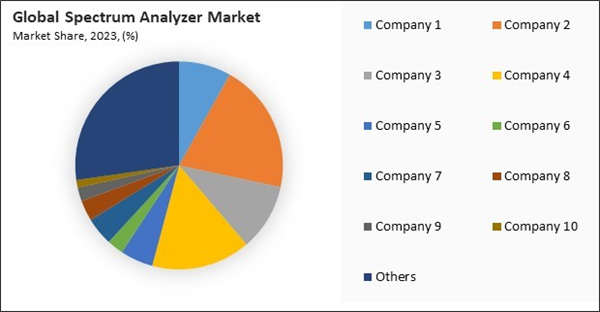

As the demand for high-frequency and real-time spectrum analysis increases, manufacturers focus on developing more cost-effective solutions with enhanced capabilities. However, the gap between affordability and performance remains challenging, particularly for emerging markets where cost-sensitive businesses struggle to invest in premium-grade spectrum analyzers. In conclusion, limited frequency range and performance constraints in lower-end spectrum analyzers are hampering the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Increasing Demand for Wireless Communication Technologies Across Various Industries

- Growing Demand for Real-Time and Portable Spectrum Analyzers for Field Testing Applications

- Rising Deployment of 5G Networks and Need for High-Frequency Testing

Restraints

- High Initial Cost of Advanced Spectrum Analyzers Limiting Adoption Among Small Enterprises

- Limited Frequency Range and Performance Constraints in Lower-End Spectrum Analyzers

Opportunities

- Rising Adoption of Internet of Things (IoT) and Smart Devices Driving Market Expansion

- Growth in the Electronics and Semiconductor Industry Worldwide

Challenges

- Rapid Technological Advancements Leading to Short Product Life Cycles and High Replacement Costs

- Availability of Cost-Effective Alternatives and Software-Based Signal Analysis Solutions

Analyzer Type Outlook

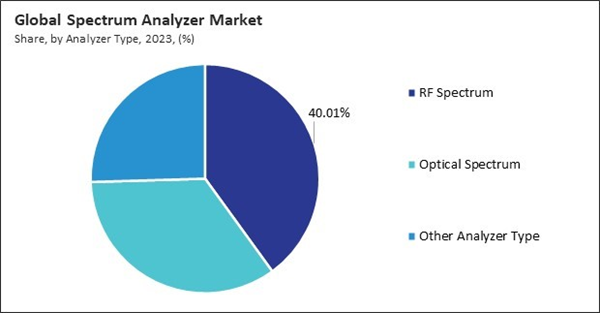

Based on analyzer type, the market is characterized into RF spectrum, optical spectrum, and others. The optical spectrum segment procured 35% revenue share in the market in 2023. The rising deployment of optical communication networks, driven by the increasing need for high-speed data transmission, has significantly contributed to the segment’s growth. The rapid expansion of fiber optic networks, particularly in data centers, telecommunications, and research institutions, has created a strong demand for optical spectrum analyzers to ensure signal quality and optimize network performance.Product Type Outlook

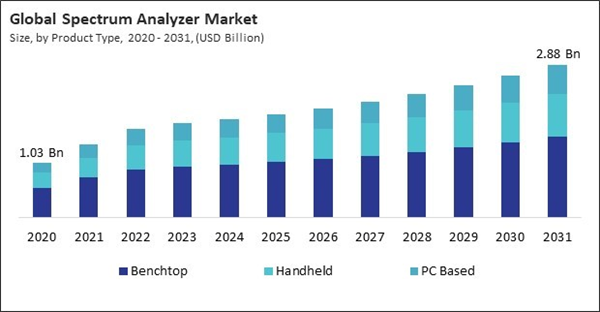

On the basis of product type, the market is classified into benchtop, handheld, and PC based. The benchtop segment acquired 54% revenue share in the market in 2023. This growth was primarily driven by the widespread adoption of benchtop spectrum analyzers in industries. These analyzers offer high performance, advanced measurement capabilities, and superior accuracy, making them essential for RF testing, signal analysis, and component characterization applications. The increasing demand for precise frequency analysis in wireless communication networks and the expansion of 5G infrastructure has further fuelled the adoption of benchtop spectrum analyzers.Bandwidth Outlook

By bandwidth, the market is divided into 1khz to 5khz, 5khz to 9khz, 9khz to 3Ghz, and above 3Ghz. The 5khz to 9khz segment witnessed 14% revenue share in the market in 2023. This growth was primarily driven by its extensive use in applications requiring precise frequency measurements, including industrial electronics, telecommunications, and research laboratories. The increasing demand for accurate signal analysis in wireless communication networks, particularly for RF and microwave testing, has fuelled the adoption of spectrum analyzers in this bandwidth range.Application Outlook

Based on application, the market is segmented into telecom, optical communication, radar & radio system, digital signal processing, network, and others. The network segment held 13% revenue share in the market in 2023. The increasing complexity of digital communication systems and the rising demand for efficient processing have driven the adoption of spectrum analyzers in-network processing applications. As organizations rely on high-speed networks to manage large-scale data transmission and cloud-based operations, spectrum analyzers are critical in optimizing network performance, latency reduction, and signal integrity. The expansion of artificial intelligence (AI), machine learning (ML), and edge computing technologies has further increased the need for precise spectrum monitoring to ensure seamless data processing.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment witnessed 36% revenue share in the market in 2023. The region’s growth can be attributed to the rapid expansion of the telecommunications sector, increasing industrial automation, and rising investments in smart manufacturing and 5G infrastructure. Countries like China, Japan, South Korea, and India have been at the forefront of technological advancements, driving the demand for spectrum analyzers in applications such as wireless communication, automotive electronics, and semiconductor testing. The growing emphasis on research & development in photonics, optical communication, and radar systems has further supported market expansion.Recent Strategies Deployed in the Market

- Jan-2025: Yokogawa Electric Corporation unveiled the AQ6377E optical spectrum analyzer, enhancing speed, accuracy, and MWIR measurement capabilities. It improves sensitivity, pulsed light analysis, and SMSR evaluation, addressing customer demands. Featuring advanced chopper performance and dynamic range, it ensures precise laser analysis.

- Nov-2024: Keysight Technologies, Inc. unveiled its FieldFox handheld analyzers to 170 GHz. This lightweight, cost-effective solution enables precise mmWave signal analysis and generation for 5G, 6G, aerospace, and automotive radar testing, enhancing network design and reliability in both field and lab environments.

- Aug-2024: Tektronix, Inc. unveiled the TAP1500L, an advanced active probe with a 7-meter cable, enhancing automated testing flexibility. Offering ≥1.5 GHz bandwidth, < 267 ps rise time, and seamless TekVPI integration, it ensures precise signal acquisition. Ideal for flying probe testers, it supports high-speed designs, manufacturing, and research applications worldwide.

- Jun-2024: Anritsu Corporation unveiled the MS27200A, a self-contained microwave spectrum monitor module (9 kHz-54 GHz) with 110 MHz RTSA bandwidth and -164 dBm DANL. Ideal for Military, Aerospace, and 5G/LTE applications, it enables seamless integration, real-time RF monitoring, and IQ signal streaming with advanced spectrum analysis performance via SCPI commands.

- May-2024: Anritsu Corporation unveiled the Site Master MS2085A and MS2089A, integrating cable, antenna, and spectrum analysis for telecom, aerospace, and defense industries. These advanced tools enhance efficiency, accuracy, and reliability with Real-Time Spectrum Analysis, IQ capture, and PIM hunting, redefining field testing standards with superior functionality and streamlined workflows.

List of Key Companies Profiled

- Tektronix, Inc. (Fortive Corporation)

- Keysight Technologies, Inc.

- Anritsu Corporation

- Rohde & Schwarz GmbH & Co. KG

- Advantest Corporation

- B&K Precision Corporation

- Teledyne Technologies Incorporated

- Yokogawa Electric Corporation

- LP Technologies Inc.

- Aaronia AG

Market Report Segmentation

By Analyzer Type

- RF Spectrum

- Optical Spectrum

- Other Analyzer Type

By Product Type

- Benchtop

- Handheld

- PC Based

By Bandwidth

- 9khz to 3Ghz

- 1Khz to 5Khz

- 5Khz to 9 khz

- above 3 Ghz

By Application

- Optical Communication

- Telecom

- Radar & Radio system

- Network

- Digital signal processing

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Tektronix, Inc. (Fortive Corporation)

- Keysight Technologies, Inc.

- Anritsu Corporation

- Rohde & Schwarz GmbH & Co. KG

- Advantest Corporation

- B&K Precision Corporation

- Teledyne Technologies Incorporated

- Yokogawa Electric Corporation

- LP Technologies Inc.

- Aaronia AG