The market is expanding due to the rising number of blood banks, increasing stem cell research, and the growing use of IVF procedures that rely on cryopreserved sample handling. The prevalence of chronic diseases, advancements in regenerative medicine, and the broader application of cryopreservation in healthcare are contributing to market growth. The use of cryopreservation techniques in cell therapy, gene therapy, and personalized medicine has fueled the demand for warming and thawing devices. These devices are essential in blood banks and biobanks to maintain the quality of cryopreserved samples such as blood products, stem cells, and embryos, which are critical for research and treatment. The rising incidence of chronic conditions such as cancer and cardiovascular diseases has further increased demand for these devices in hospitals and transfusion centers.

Investments in stem cell research and regenerative medicine are also contributing to market growth. Private and government entities are funding the development of advanced thawing devices to improve sample preservation and utilization. Additionally, the increasing cases of infertility have led to a growing demand for IVF procedures, where warming and thawing devices play a crucial role in handling oocytes, embryos, and semen samples. Maintaining strict control over sample handling during these processes is essential, which drives the continued demand for these devices.

Thawing devices, in particular, have a significant role in the market, generating USD 164.6 million in revenue in 2024. These devices ensure the viability of cryopreserved samples and are extensively used in blood banks for thawing plasma and platelets required for transfusions and surgical procedures. Advanced thawing systems with temperature control features provide effective and safe thawing of sensitive samples such as stem cells and embryos. With the growth of regenerative medicine and stem cell therapies, the demand for thawing devices is expected to remain strong. Their increasing use in biobanks and IVF clinics also supports the leading position of this segment.

The manual segment, which is more cost-effective and suitable for small-scale operations, is expected to grow at a CAGR of 8.6%, reaching over USD 412.9 million by 2034. Manual devices are widely used in developing regions where automation is less accessible. These devices, which are easy to operate and require minimal infrastructure, are ideal for small laboratories and clinics. They are also preferred for handling samples that need close attention during thawing or warming, such as semen and tissue samples.

Blood products dominate the market by sample type, with this segment expected to grow at a CAGR of 8.7%, reaching over USD 291.8 million by 2034. Blood products such as plasma, platelets, and red blood cells require precise handling during transfusion and surgical procedures. These devices ensure the safety and efficacy of blood products used in emergency and routine medical procedures. Increasing surgical procedures and cancer treatments further drive the need for these devices in hospitals and biobanks.

Blood banks and transfusion centers held a dominant market position with a 31.9% revenue share in 2024. These facilities handle large volumes of plasma and platelet thawing necessary for emergency and surgical transfusions. The adoption of automated and rapid thawing systems is improving operational efficiency in these settings.

In the U.S, the biomedical warming and thawing devices market was valued at USD 87 million in 2024 and is projected to grow at a CAGR of 8.4% through 2034. The U.S. market holds a significant share in North America due to the increasing prevalence of chronic diseases and a high volume of surgical procedures. Hospitals and healthcare institutions in the U.S. are integrating modern thawing systems to manage the growing demand for blood products in emergencies and surgical settings. The emphasis on applied research and development in regenerative medicine and IVF has further bolstered the adoption of these devices.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Biomedical Warming and Thawing Devices market report include:- Arctiko

- Barkey

- BioCision

- BioLife Solutions

- BOEKEL

- Cytiva

- eppendorf

- Haier Biomedical

- Helmer SCIENTIFIC

- IVF tech

- LABCOLD

- pHcbi

- SARTORIUS

- Thermo Fisher

Table Information

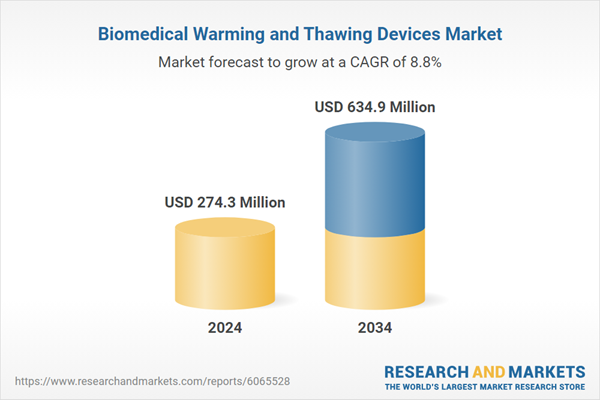

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 274.3 Million |

| Forecasted Market Value ( USD | $ 634.9 Million |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |