With the increasing emphasis on automation and efficiency, industries worldwide are turning to advanced APC systems to optimize processes, enhance productivity, and improve operational decision-making. As businesses strive to remain competitive, integrating artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into APC solutions is emerging as a game-changer. These technologies are reshaping industrial operations, enabling real-time monitoring, predictive analytics, and seamless process control to drive efficiency and profitability.

The rising adoption of APC solutions reflects a growing need for smarter, data-driven decision-making in industries such as chemicals, energy & power, food & beverages, mining & minerals, oil & gas, and pharmaceuticals. As industries modernize their operations, businesses are recognizing the value of APC systems in minimizing downtime, reducing energy consumption, and improving production output. The ability of these solutions to provide real-time insights and automate critical processes is propelling their widespread adoption. Companies are leveraging APC to ensure regulatory compliance, enhance process safety, and optimize plant performance - all while controlling operational costs. The increasing complexity of industrial processes and the need for seamless integration between physical assets and digital technologies are further accelerating market expansion.

The APC market is categorized into hardware, software, and services. The hardware segment generated USD 1.1 billion in 2024, driven by demand for high-performance control systems that optimize plant efficiency without requiring extensive infrastructure upgrades. Businesses are drawn to APC solutions because of their cost-effectiveness, as they help maximize production capacity without significant capital investment. These systems allow industries to streamline operations, minimize inefficiencies, and achieve higher output with minimal intervention.

Segmented by end-use industries, the APC market is witnessing significant traction across multiple sectors. The chemical industry accounted for a major share, with a projected 20.7% of the market in 2024. Companies in this sector rely on APC technologies to enhance profit margins, maintain stable production environments, and ensure regulatory compliance. By integrating real-time monitoring and predictive control capabilities, businesses in the chemical industry are optimizing their manufacturing processes to achieve consistent output and operational efficiency.

U.S. Advanced Process Control Market reached USD 1.1 billion in 2024, reflecting the country’s strong push for technological innovation and stringent regulatory adherence. With increasing regulatory requirements and a focus on sustainability, industries in the U.S. are adopting APC solutions at an accelerated pace. Companies are leveraging these advanced systems to meet evolving compliance standards, improve process efficiency, and gain a competitive edge. The growing need for precision control, resource optimization, and enhanced operational flexibility is further fueling market growth across various industrial sectors in the U.S.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Advanced Process Control market report include:- ABB Ltd.

- Aspen Technology Inc.

- AVEVA Group plc

- BASF SE

- Emerson Electric Co.

- Endress+Hauser Group

- General Electric Co.

- Honeywell International Inc.

- KLA Corporation

- Lam Research Corporation

- Linde plc

- Mitsubishi Heavy Industries

- Nova Measuring Instruments Ltd.

- Panasonic Corporation

- Rockwell Automation Inc.

- Rudolph Technologies Inc

- SABIC

- SAP SE

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | March 2025 |

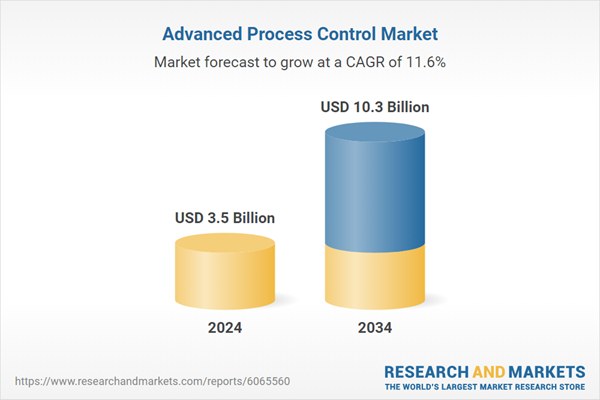

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 10.3 Billion |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |