This growth is primarily driven by the continent’s transition toward a greener energy landscape, where integrating renewable energy sources like wind and solar necessitates more efficient distribution systems. Oil-filled distribution transformers remain an essential component of this transition due to their high capacity and ability to withstand extreme weather conditions. These transformers play a pivotal role in ensuring efficient energy transmission, particularly in regions with high renewable energy generation. Additionally, the increasing push to reduce carbon emissions has prompted various countries to invest heavily in the renewable energy sector, further boosting the demand for distribution transformers.

The surge in electric vehicle (EV) adoption across Europe is another critical factor driving market growth. With the growing popularity of EVs, there is a corresponding increase in the need for charging stations, which rely on distribution transformers to ensure stable power delivery and grid reliability. As EV sales continue to rise, the installation of these transformers becomes essential to maintain a seamless charging infrastructure and support smart energy solutions across the region.

The market is segmented based on core type into closed, shell, and berry. The closed core segment is anticipated to surpass USD 4.8 billion by 2034. This growth is fueled by the increasing modernization of power grids and the automation of energy flow, where closed core transformers are preferred due to their compact design and ability to minimize energy losses. Their suitability for small spaces and growing application in renewable energy-based grids further contribute to their rising demand.

By insulation type, the Europe distribution transformer market is segmented into oil, gas, solid, air, and others. Oil-insulated transformers dominated the market with a 59% share in 2024, and this segment is expected to maintain its dominance through 2034. Increasing industrialization and the transformation of aging grids into modern infrastructure, along with favorable government initiatives, continue to boost demand for oil-insulated transformers. Furthermore, rising energy demand and the expansion of transmission networks drive the need for consistent battery backup systems integrated within power grids, further increasing the demand for oil-insulated transformers, particularly in substations and offshore networks.

In Germany, the distribution transformer market recorded values of USD 822.4 million in 2024. The nation’s growing EV sales and high adoption of renewable energy are significantly contributing to the increasing demand for distribution transformers. Moreover, government policies promoting energy efficiency and investments in smart grid technologies are fueling the growth of advanced distribution transformers across Germany and other European countries.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Europe Distribution Transformer market report include:- CG Power & Industrial Solutions

- Eaton

- Elsewedy Electric

- General Electric

- Hitachi Energy

- HYOSUNG HEAVY INDUSTRIES

- IEO Transformers

- IMEFY GROUP

- Koncar

- Mitsubishi Electric

- ORMAZABAL

- Schneider Electric

- SGB SMIT

- Siemens

- Toshiba Energy Systems & Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

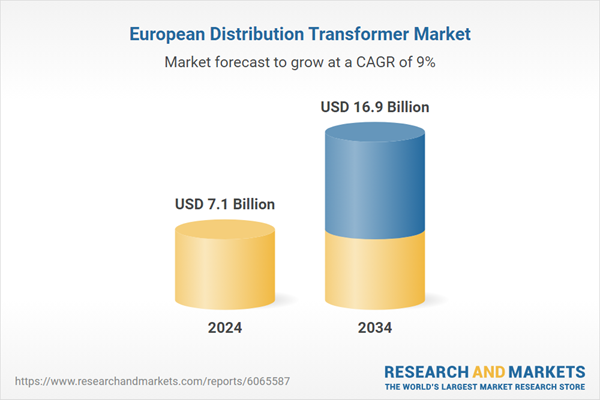

| Estimated Market Value ( USD | $ 7.1 Billion |

| Forecasted Market Value ( USD | $ 16.9 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 16 |