Rising limitations in available land and the push for faster implementation timelines are fueling the need for space-efficient, adaptable mounting solutions. Strong momentum around decarbonization and energy independence, especially in commercial and utility sectors, continues to drive structural integration of solar PV systems. Increased investments in intelligent infrastructure and digital energy management systems are further accelerating market development. The momentum behind floating solar installations, supported by climate-driven global funding and favorable policy frameworks, is also contributing to the growing need for advanced and highly specialized mounting technologies.

The tracking systems segment is anticipated to reach USD 16.8 billion by 2034 as more utility-scale projects adopt these systems to maximize solar exposure and improve output. Their ability to align with the sun’s path throughout the day results in significantly higher energy generation compared to fixed alternatives. Advanced software-driven control systems and growing integration across grid-scale installations are solidifying their market position.

Ground-mounted solutions captured a 63.9% share in 2024 due to their scalability and ease of maintenance. Their ability to deliver improved energy performance through optimal tilt configurations and reduced shading influence has made them a preferred option for solar farms and utility applications. Expanding solar infrastructure across undeveloped land further supports segmental expansion.

Asia Pacific Solar PV Mounting Systems Market is forecasted to register a CAGR of 5.1% between 2025 and 2034, with growing urbanization, favorable government targets for renewable energy adoption, and declining installation costs driving regional demand. Increasing involvement from private firms in solar project tenders, coupled with a shift toward local production of mounting components, will help streamline deployment and promote broader market penetration.

Key companies active in the Global Solar PV Mounting Systems Market include FTC Solar, First Solar, GameChange Solar, Mounting Systems, Jinko Solar, Trina Tracker, Arctech, Soltec, Clenergy, PV Hardware, SunPower Corporation, Valmont Industries, Xiamen Grace Solar New Energy Technology, Unirac, Schletter Group, Versolsolar Hangzhou, Ideematec, K2 Systems, Array Technologies, and Nextracker.

Leading players in the solar PV mounting systems industry are adopting several strategic initiatives to expand market reach and strengthen their competitive edge. A primary focus is on technological innovation - developing lighter, more modular systems with higher corrosion resistance and compatibility with both rooftop and floating solar installations.

Companies are investing in digital platforms that provide real-time monitoring, predictive maintenance, and automated alignment to optimize energy generation. Regional expansion through partnerships, joint ventures, and local manufacturing facilities is enabling access to high-growth markets. Additionally, players are aligning with national and international sustainability goals by offering low-carbon, recyclable mounting materials.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this solar pv mounting systems market report include:- Arctech

- Array Technologies

- Clenergy

- First Solar

- FTC Solar

- GameChange Solar

- Ideematec

- Jinko Solar

- K2 Systems

- Mounting Systems

- Nextracker

- PV Hardware

- Schletter Group

- Soltec

- SunPower Corporation

- Trina Tracker

- Unirac

- Valmont Industries

- Versolsolar Hangzhou

- Xiamen Grace Solar New Energy Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | June 2025 |

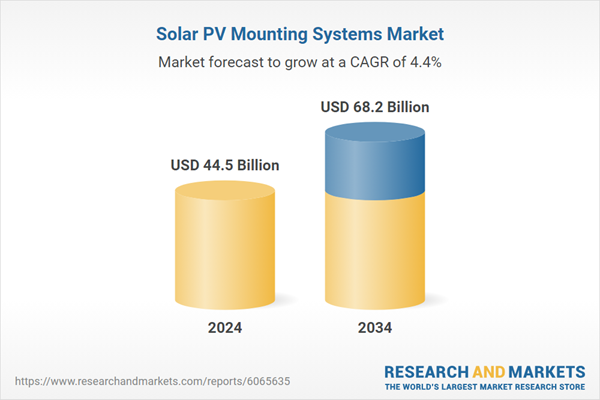

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 44.5 Billion |

| Forecasted Market Value ( USD | $ 68.2 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |