Petcoke, a carbon-rich solid derived from oil refining, remains a key fuel source for industries such as power generation, cement manufacturing, and steel production. Its high calorific value and cost-effectiveness make it a preferred choice over conventional fuels. However, rising environmental concerns and regulatory pressures are prompting industries to explore alternative energy sources. Governments worldwide are implementing stringent policies to curb coal usage due to its adverse environmental impact, particularly high carbon and sulfur emissions. This shift is pushing companies to either adopt cleaner alternatives or implement advanced emission control technologies to continue using petcoke.

The increasing expansion of refinery capacities is a crucial factor contributing to the growing availability of petcoke. As more crude oil is refined, higher volumes of petcoke are produced as a byproduct of processing heavy oil. Additionally, the steady demand from cement and steel industries further propels market growth. These industries rely on petcoke for its affordability and high energy output, ensuring a consistent demand for the material.

The petcoke market is segmented into fuel-grade and calcined petcoke. Fuel-grade petcoke holds a dominant share due to its widespread use in cement plants, power stations, and steel production facilities. It remains a cost-effective alternative to coal despite concerns regarding its high sulfur and metal content.

Market segmentation by application includes power plants, cement, steel, and aluminum industries, among others. In 2024, the power plant sector accounted for over 19.7% of the total petcoke market share, highlighting its critical role in energy production. Thermal power plants continue to rely on petcoke, especially in regions where cleaner fuels are not readily accessible.

The U.S. petcoke market has experienced notable growth, with valuations of USD 8 billion in 2022, USD 8.2 billion in 2023, and USD 8.4 billion in 2024. The expanding steel and power industries drive this demand, capitalizing on petcoke’s economic advantages, high energy yield, and role as a carbon source in blast furnaces. In 2024, U.S. consumption reached 54.4 million metric tonnes, primarily for these industrial applications. The cost-efficiency of petcoke compared to natural gas and coal remains a key factor supporting its sustained demand.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Petcoke market report include:- BP

- Chevron Corporation

- Exxon Mobil

- HF Sinclair Corporation

- Husky Energy

- Marathon Petroleum Corporation

- Oxbow Corporation

- Phillips 66 Company

- Reliance Industries

- Saudi Aramco

- Shell plc

- Valero Energy Corp

- Indian Oil Corporation

- Rosneft

- TotalEnergies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | March 2025 |

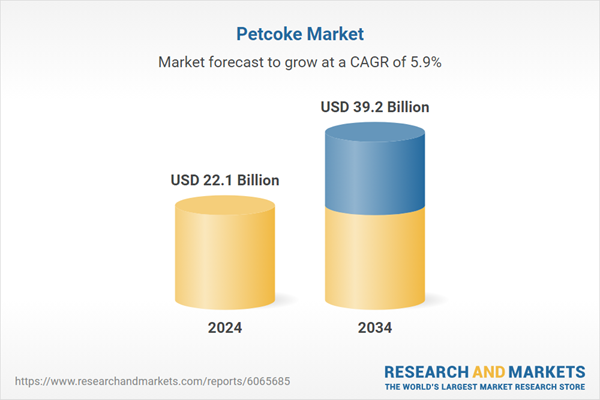

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 22.1 Billion |

| Forecasted Market Value ( USD | $ 39.2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |