Marine SCR systems play a crucial role in reducing nitrogen oxide emissions from marine engine exhaust gases. These advanced technologies use a catalytic converter and a urea-based reagent that triggers a chemical reaction, transforming harmful NOx into harmless nitrogen and water vapor. As international trade expands and maritime activity increases, the demand for efficient emission control solutions is expected to surge. Shipping companies and vessel operators are under growing pressure to comply with stringent environmental regulations, including the International Maritime Organization's (IMO) Tier III standards, which mandate significant reductions in NOx emissions.

The adoption of SCR systems enables compliance with these evolving regulations while minimizing the environmental impact of maritime operations. Additionally, the growing awareness of climate change and the need for sustainable practices in the maritime sector are accelerating the integration of SCR technologies. Governments worldwide are pushing for greener initiatives, and the focus on reducing air pollution from marine vessels is at the forefront of global environmental policies. As the maritime industry prioritizes sustainable solutions to meet regulatory requirements, the market for marine SCR systems is poised for steady growth.

The increasing emphasis on meeting both international and regional environmental standards is driving the demand for SCR systems across various marine applications. These systems offer an effective solution for reducing emissions and aligning with international maritime laws. As regulatory frameworks evolve and environmental concerns intensify, shipping companies are becoming more proactive in adopting sustainable technologies to enhance their compliance efforts. Marine SCR systems are also gaining traction due to their ability to significantly lower the environmental footprint of shipping operations. With the rise in global seaborne trade and the growing focus on operational efficiency, the adoption of SCR systems is expected to witness continuous growth over the forecast period.

The commercial application segment of the marine SCR systems market is anticipated to grow at a CAGR of 5.5% between 2025 and 2034. The growth of international trade and the increasing dominance of commercial vessels are driving the adoption of SCR systems. Shipping companies are under mounting pressure to implement sustainable practices, and as awareness about environmental issues grows among stakeholders, the push to meet regulatory standards is expected to intensify. Furthermore, major shipping hubs worldwide are enforcing strict local NOx emission control standards, adding to the impetus for commercial vessel operators to install SCR systems to ensure compliance.

The U.S. Marine Selective Catalytic Reduction Systems Market generated USD 540 million in 2024. Stringent regulations aimed at reducing emissions, coupled with efforts to modernize aging fleets, are expected to fuel the demand for advanced emission control technologies. As emission standards become more rigid and the number of shipbuilding projects rises globally, the need for efficient SCR systems will continue to grow. These factors underscore the critical role that SCR systems play in ensuring compliance with emission standards and promoting environmental sustainability in the marine sector.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Marine Selective Catalytic Reduction Systems market report include:- Caterpillar

- Ceco Environmental

- DEC Marine

- H+H Engineering & Service

- HHI Engine & Machinery

- Hitachi Zosen Corporation

- Hug Engineering

- Lindenberg-Anlagen

- Mitsubishi Heavy Industries

- Nett Technologies

- Panasia

- Wartsila

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | March 2025 |

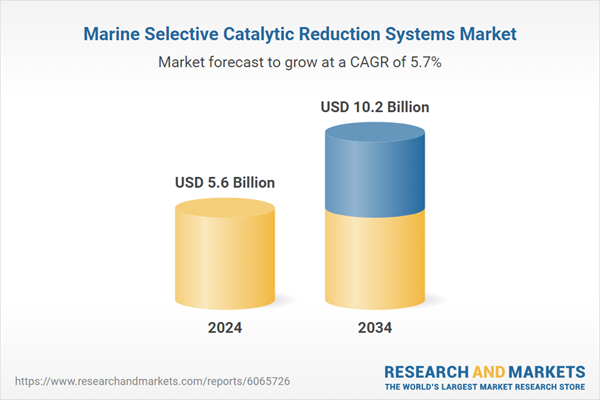

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.6 Billion |

| Forecasted Market Value ( USD | $ 10.2 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |