The growing shift toward renewable energy sources is rapidly elevating HVO's role as a sustainable fuel alternative across industries. As global economies pivot to reducing dependence on fossil fuels, HVO is emerging as a critical solution for meeting decarbonization goals. Its ability to serve as a drop-in replacement for traditional diesel, combined with cleaner combustion and lower greenhouse gas emissions, is pushing demand among major sectors, including transportation, aviation, and industrial power generation.

Several governments, particularly in North America and Europe, are stepping up mandates to cut carbon emissions with policy frameworks like tax credits, blending mandates, and emission caps that directly encourage the use of HVO. These policies are opening new growth opportunities for HVO producers and reinforcing their importance in the global shift toward greener energy. Increasing public and private investments in advanced biofuels and next-generation feedstocks are further enhancing the market outlook as companies explore innovative ways to scale HVO production while keeping costs competitive. As more industries seek to meet ESG (Environmental, Social, and Governance) goals, the focus on clean-burning, low-carbon alternatives like HVO continues to intensify, fueling rapid adoption across both developed and emerging economies.

In 2024, the food and feed crops segment dominated the HVO market with a 68.7% share and is anticipated to grow at a CAGR of 12.4% through 2034. The widespread use of food and feed crops in HVO production is largely driven by their abundant availability, robust supply chains, and the well-established agricultural framework supporting them. Crops like soybeans and rapeseed are pivotal in supplying the oils required for efficient HVO production, ensuring a steady feedstock supply to meet growing biofuel demand. While concerns around food security and land use are gaining attention, policies across regions still back crop-based biofuels, further propelling market growth.

The market is also segmented by grade, covering premium grade, standard grade, basic grade, and specialty grade. Among these, the standard grade HVO segment generated USD 10.6 billion in 2024 and is set to grow at a CAGR of 12.7% from 2025 to 2034. Standard grade is increasingly preferred due to its balance of cost, performance, and versatility, making it an ideal choice for transportation, industrial operations, and power generation. It meets stringent emission norms while remaining economically viable compared to higher-end premium grades that are typically used in niche, high-performance sectors.

Regionally, Europe's Hydrotreated Vegetable Oil Market reached USD 10.3 billion in 2024 and is projected to grow at a CAGR of 12.6% through 2034. Europe continues to lead the global HVO landscape, driven by powerful regulatory backing and escalating demand for renewable fuels. The European Union’s RED II directive and rising biofuel blending mandates have greatly accelerated HVO integration, positioning Europe at the forefront of global efforts to transition to low-carbon energy.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Hydrotreated Vegetable Oil market report include:- ALFA LAVAL

- Cepsa

- Desmet

- DIAMOND GREEN DIESEL

- Neste

- Preem

- Repsol

- Shell

- TotalEnergies

- UPM Biofuels

- Valero Energy

- World Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

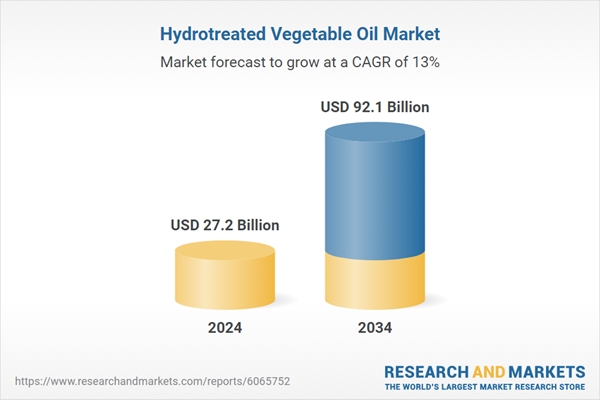

| Estimated Market Value ( USD | $ 27.2 Billion |

| Forecasted Market Value ( USD | $ 92.1 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |