The rising global demand for electricity, rapid urbanization, and the continuous expansion of power transmission and distribution networks are fueling market growth. As countries move toward upgrading their power infrastructure, GIS technology is increasingly being adopted across industrial, commercial, and utility sectors. Its superior performance in terms of space efficiency, reliability, and low maintenance costs gives it an edge over traditional air-insulated switchgear (AIS). GIS is becoming essential for managing power systems in dense urban environments, large-scale industrial setups, and regions with extreme weather conditions, as it offers high durability and uninterrupted performance.

The market is witnessing increased investments from both government and private players to modernize power grids and ensure energy efficiency. As the energy transition gains momentum, integrating renewable sources into existing grids is becoming a priority. GIS plays a pivotal role in facilitating this shift, providing compact and high-performance solutions that align with sustainability goals. Additionally, advancements in insulation technologies and digital monitoring capabilities are enhancing GIS efficiency, making it a preferred choice for next-generation power infrastructure. The demand for smart grid solutions and intelligent power distribution systems is further accelerating GIS deployment, particularly in regions focusing on reducing transmission losses and improving grid stability. With rising concerns over environmental sustainability, many market players are also exploring eco-friendly gas alternatives to minimize the carbon footprint of GIS systems.

The high-voltage segment remains the dominant force in the market, with GIS systems rated above 150 kV holding a substantial share. These high-capacity switchgear solutions are widely deployed in power plants, heavy manufacturing industries, and large-scale utility projects to ensure stable and efficient electricity distribution. Their compact designs and ability to function reliably in high-risk environments make them ideal for applications where space is limited and operational efficiency is paramount. Industries such as oil and gas, mining, and transportation are increasingly integrating GIS technology to meet stringent safety and performance requirements while optimizing power management systems.

The medium-voltage GIS segment is projected to experience significant growth, with an expected CAGR of 8.3% through 2034. The rapid expansion of urban infrastructure, alongside the rise of smart cities, is driving the demand for efficient and reliable power distribution solutions. Modernization initiatives in commercial and residential sectors, coupled with the growing focus on renewable energy integration, are fueling the adoption of medium-voltage GIS. Industries prioritizing sustainability and automation are shifting toward GIS technology to enhance operational efficiency and minimize power outages.

North America Gas Insulated Switchgear Market generated USD 3.2 billion in 2024, with the United States leading investments in power transmission upgrades. As the country modernizes its aging grid infrastructure to meet increasing electricity demand, GIS is playing a crucial role in supporting next-generation power distribution systems. The growing emphasis on smart grids and advanced power management solutions is further strengthening GIS adoption. With investments in renewable energy and digitalized grid networks on the rise, GIS is set to become a cornerstone of North America's power sector transformation.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Gas Insulated Switchgear market report include:- ABB

- Bharat Heavy Electricals

- CHINT Group

- CG Power and Industrial Solutions

- Eaton

- Fuji Electric

- General Electric

- HD Hyundai Electric

- Hitachi

- Hyosung Heavy Industries

- Lucy Group

- Mitsubishi Electric

- Ormazabal

- Schneider Electric

- Siemens

- Skema

- Toshiba

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | March 2025 |

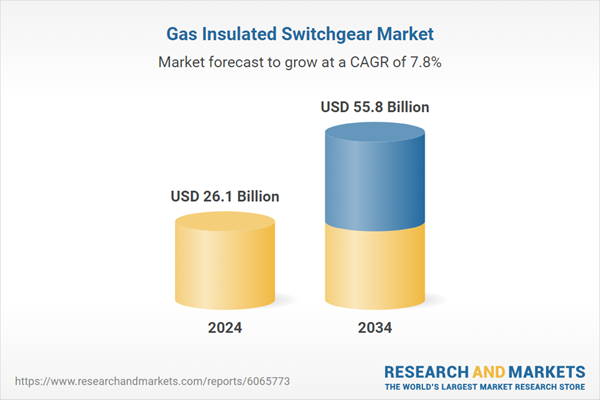

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 26.1 Billion |

| Forecasted Market Value ( USD | $ 55.8 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |