This rapid expansion is driven by the growing need for high-speed connectivity and the increasing adoption of flat panel antennas in point-to-point communication systems. As businesses, governments, and consumers demand faster and more reliable Internet solutions, traditional satellite networks and cellular infrastructure face limitations due to their fixed positions and geographic constraints. These challenges lead to high latency and restricted bandwidth, particularly in remote and underserved regions. The shift toward more efficient, high-performance flat panel antennas is bridging these gaps, transforming modern telecommunication networks.

The demand for flat panel antennas is experiencing a significant surge as industries look for advanced solutions that support seamless connectivity in diverse environments. Unlike conventional communication systems, flat panel antennas offer high-speed data transmission over broader, less developed areas, making them ideal for emerging digital infrastructures. Their ability to integrate with cutting-edge technologies like 5G and the Internet of Things (IoT) enhances their market appeal. With global digital transformation accelerating, the need for robust and scalable communication infrastructure is at an all-time high, positioning flat panel antennas as critical components in the future of telecommunications. Moreover, advancements in satellite technology, increased government initiatives for digital inclusion, and the rise of smart cities are further fueling the market.

The market is categorized into electronically steered and mechanically steered flat panel antennas. The mechanically steered segment held a 46.59% share in 2024. These antennas are highly valued in aerospace and defense industries, where precision, reliability, and durability are paramount. Their long-standing presence in the market and proven track record in meeting stringent industry standards ensure sustained demand. As companies seek to enhance signal strength and coverage, mechanically steered antennas continue to play a vital role in next-generation satellite and communication networks.

Flat panel antennas are primarily classified based on operating frequency into C and X bands and Ku, K, and Ka bands. The Ku, K, and Ka band segments generated USD 346.1 million in 2024, benefiting from strong adoption due to their cost-effectiveness, high performance, and suitability for advanced technological applications. These frequency bands are integral to the expanding fields of 5G and IoT, where high-speed, low-latency communication is crucial. With growing investments in next-generation networks and satellite connectivity solutions, these segments are expected to experience robust growth in the coming years.

U.S. Flat Panel Antenna Market was valued at USD 3.1 billion in 2024, driven by increasing investments in space exploration and the rising demand for compact, high-performance antenna systems. The surge in satellite launches and the growing adoption of electronically steered phased array antennas are expected to further accelerate market expansion. As advancements in satellite communication and digital infrastructure continue, the U.S. remains a dominant force in the global flat panel antenna market, leading the charge toward a more connected future.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Flat Panel Antenna market report include:- ALCAN Systems GmbH i.L.

- ALL.SPACE Networks Limited

- BAE Systems

- C-COM Satellite Systems Inc

- China Starwin Science & Technology Co. Ltd.

- Thales

- Gilat Satellite Networks Ltd.

- Hanwha Phasor

- Inmarsat Global Limited

- Intellian Technologies Inc.

- Kymeta Corporation

- Celestia TTI

- ThinKom Solutions Inc.

- Starlink

- L3Harris Technologies

- ST Engineering iDirect Inc.

- Kuiper Systems

- MTI Wireless Edge Limited

- NXT Communications Corporation

- RadioWaves Inc.

- SatPro Tech

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

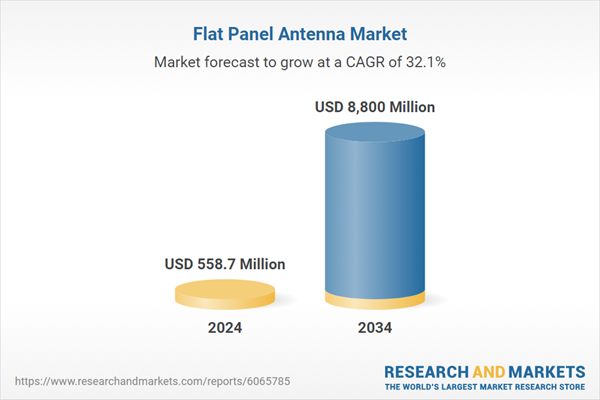

| Estimated Market Value ( USD | $ 558.7 Million |

| Forecasted Market Value ( USD | $ 8800 Million |

| Compound Annual Growth Rate | 32.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |