The increasing adoption of intelligent and IoT-enabled electric hoists is revolutionizing material handling by integrating real-time monitoring, predictive maintenance, and automated systems. These advanced hoists come equipped with IoT sensors, AI-powered tools, and wireless controls that allow industries to remotely monitor performance, optimize work processes, and prevent equipment failures. Unlike traditional hoists that require periodic inspections and scheduled maintenance, smart hoists rely on real-time data to detect early signs of wear, minimizing downtime and reducing operational costs. They also enhance workplace safety by mitigating risks such as overload, overheating, and machinery breakdowns. Sensors monitor load capacity, vibrations, and system performance to halt operations when anomalies are detected, ensuring higher efficiency and worker safety.

Remote monitoring and control systems further strengthen the demand for smart hoists by enabling managers to track hoist performance, load conditions, and energy consumption from any location. These systems are particularly beneficial for industries that operate multiple hoists across large facilities or remote sites. The data collected from smart hoists aids in improving performance, reducing energy usage, and automating critical tasks, making them indispensable in modern industrial settings.

The electric hoist market is segmented by type into chain and wire hoists. Wire hoists generated USD 1.8 billion in revenue in 2024 and are expected to grow at a CAGR of 5.6% over the forecast period. Wire rope hoists dominate the market due to their strength, durability, and ability to handle heavy loads, making them suitable for applications in automotive, construction, shipbuilding, aerospace, and heavy machinery industries. They offer greater speed and efficiency than chain hoists, allowing materials to be moved quickly and minimizing production downtime. Wire rope hoists are preferred in environments that require minimal maintenance and longer operational life, including high-temperature, high-dust, and corrosive settings. Their ability to provide smooth, quiet operation enhances workplace safety and efficiency.

In terms of end-use industries, the electric hoist market caters to sectors such as aerospace, automotive and transportation, construction, energy, marine and shipping, logistics, material handling, oil and gas, and agriculture. The automotive and transportation segment accounted for over 12% of the market in 2024 and is projected to grow at a CAGR of 6.3% until 2034. The increasing demand for electric hoists stems from the growing need for automation, material handling, and heavy lifting in automotive manufacturing, maintenance, and logistics. Industry 4.0 technologies are driving the adoption of electric hoists with IoT integration, which is vital for handling lightweight EV components and automating assembly lines in advanced manufacturing facilities.

Distribution channels in the electric hoist market are categorized as direct and indirect sales. Indirect sales dominated in 2024, accounting for a 74.4% share, due to the extensive network of distributors, dealers, and third-party suppliers that manufacturers utilize to reach a broader customer base without building costly sales systems. Indirect channels help manufacturers penetrate developing markets where local distributors have strong customer relationships and regional expertise. Financing and leasing options provided by dealers also make electric hoists accessible to SME, supporting market expansion.

Asia Pacific led the global electric hoist market in 2024, holding around 30.9% of the market share and generating approximately USD 600 million in revenue. The region's dominance is driven by significant investments in manufacturing, infrastructure, and construction across key countries, leading to higher demand for material handling equipment. The availability of low-cost labor and raw materials contributes to the region’s position as a hub for electric hoist production and export. The increasing adoption of automation and the rise of e-commerce in the region is further driving the need for electric hoists, solidifying Asia Pacific’s leadership in the global market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Electric Hoist market report include:- ABUS Cranes

- Columbus McKinnon

- Crosby Group

- Demag Cranes and Components

- Hitachi Industrial Equipment Systems

- IMER International

- Ingersoll Rand

- JASO Industrial Cranes

- KITO

- Konecranes

- Kran Direkt

- Street Crane

- Tianjin Kunda Hoisting Equipment

- Verlinde

- Yale

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

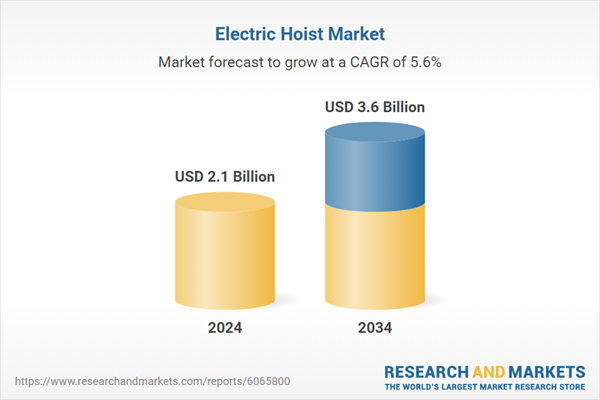

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |