As industries such as construction, automotive, and manufacturing intensify their focus on sustainable production methods, the demand for DRI continues to gain momentum. This high-quality metallic product, derived from iron ore, is revolutionizing the iron and steel industry by offering a cleaner, more energy-efficient alternative to traditional iron ore-based production. With a growing shift toward environmentally responsible steelmaking, DRI is becoming a key substitute for conventional ironmaking processes, reducing carbon emissions and optimizing energy consumption.

The DRI industry is undergoing rapid transformation, driven by technological advancements and increasing global emphasis on sustainability. One of the primary growth catalysts is the adoption of hydrogen-based and natural gas-based reduction processes, which significantly cut down CO₂ emissions compared to coal-based methods. Steel manufacturers are increasingly integrating DRI into electric arc furnaces (EAFs) to reduce reliance on scrap steel and enhance product consistency. Furthermore, the adoption of hot briquetted iron (HBI), a more compact and transport-friendly version of DRI, is streamlining logistics and expanding market reach. As global regulatory frameworks tighten carbon emission norms, steel producers are accelerating their transition toward cleaner alternatives, positioning DRI as a vital component in the future of sustainable steel manufacturing.

The cold direct reduced iron (CDRI) market generated USD 57.2 billion in 2024. CDRI is a preferred choice for high-quality steel production, particularly in electric arc furnaces, where it seamlessly integrates with steelmaking processes. Its superior purity and reduced impurities make it an ideal raw material for premium steel grades used in infrastructure, heavy machinery, and automotive applications. With stringent environmental regulations pushing industries toward lower-emission solutions, CDRI continues to gain traction as an eco-friendly alternative to traditional ironmaking.

In terms of production technology, the coal-based segment accounted for a dominant 78.3% share in 2024. Despite the growing emphasis on cleaner alternatives, coal-based DRI production remains the most cost-efficient and widely adopted technique, especially in regions abundant in coal resources. The process enables large-scale production at relatively low operational costs, making it an attractive option in rapidly industrializing economies. Steel manufacturers continue to rely on this method to meet increasing demand while balancing economic feasibility, ensuring the segment's continued market dominance.

The South Africa direct reduced iron market generated USD 8.5 billion in 2024. As global industries intensify their commitment to reducing carbon footprints, regions such as South Africa are witnessing a surge in DRI adoption. Government policies aimed at improving energy efficiency and promoting carbon neutrality are driving steel producers to invest in sustainable technologies. With a strong focus on green manufacturing, the region is positioning itself as a key player in the transition toward eco-friendly steel production.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Direct Reduced Iron market report include:- ArcelorMittal

- Essar

- JFE Steel

- JSW Steel

- Kobe Steel

- Metinvest Holding

- MIDREX Technologies

- Mobarakeh steel

- NLMK Group

- NUCOR Corporation

- Qatar Steel Company

- Sinosteel Corporation

- Tata Steel

- Tenova

- Ternium

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 360 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

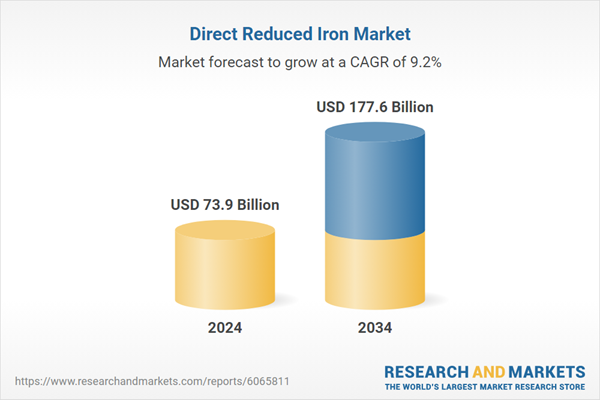

| Estimated Market Value ( USD | $ 73.9 Billion |

| Forecasted Market Value ( USD | $ 177.6 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |