This remarkable growth is driven by the rising adoption of cloud services, social media platforms, video streaming, and the proliferation of IoT devices across industries. As organizations shift towards cloud-based infrastructure and digital storage, the need for efficient and automated data center operations has become paramount. Automation not only improves operational efficiency but also reduces human errors, ensuring seamless management of vast amounts of data. With increasing data complexity and volume, businesses are turning to advanced technologies like machine learning (ML), artificial intelligence (AI), and cloud computing to enhance scalability and performance.

These technologies optimize system processes, minimize downtime, and support predictive maintenance, allowing companies to stay competitive in a rapidly evolving digital landscape. Moreover, the growing emphasis on cybersecurity and data protection is pushing organizations to implement automation in data centers, ensuring real-time threat detection and secure data handling. As more industries adopt hybrid and multi-cloud environments, the demand for data center automation solutions is expected to surge, paving the way for innovative advancements in automation technologies. Government initiatives promoting the adoption of digital infrastructure and cloud technologies further strengthen the market, making data center automation a critical component of modern business strategies.

The data center automation market is primarily segmented into solutions and services. The solution segment dominated the market with a 60% share, generating USD 7 billion in 2024. Automation software helps organizations optimize resource allocation, automate routine tasks, and increase the uptime of data centers, ensuring seamless operations. As businesses strive to enhance operational efficiency, the demand for advanced solutions that enable real-time data management and workload automation continues to rise. Meanwhile, the service segment is growing rapidly as organizations seek expert guidance and ongoing support in implementing and maintaining automated systems. As technological advancements accelerate, companies rely on expert insights and strategic consulting to maximize the value of their automation investments and ensure long-term success.

In terms of deployment mode, the data center automation market is divided into on-premises and cloud-based solutions. The cloud segment held a 57% share in 2024, driven by the growing preference for remote accessibility, security features, and flexibility. Cloud solutions enable seamless access to data from any location through an internet connection, making them ideal for remote teams and individuals working across multiple devices. With data security becoming a top priority, cloud providers are enhancing their security measures by offering encryption, multi-factor authentication, and real-time threat monitoring to protect sensitive information.

North America data center automation market accounted for 35% of the total market share, generating USD 3 billion in 2024. The rapid adoption of AI, ML, and other advanced technologies across data centers in North America is driving significant growth in the region. Businesses are increasingly turning to AI-driven automation to enhance operational efficiency, strengthen security, and enable predictive maintenance, contributing to the surging demand for data center automation solutions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Data Center Automation market report include:- ABB

- Arista Networks

- BMC Software

- Broadcom

- Cisco

- Citrix

- Fujitsu

- HPE

- Huawei Enterprise

- IBM

- Juniper

- Microsoft

- NTT Communications

- Open Text (Micro Focus)

- Progress Chef

- Puppet (Perforce)

- Rockwell Automation

- VMware

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | March 2025 |

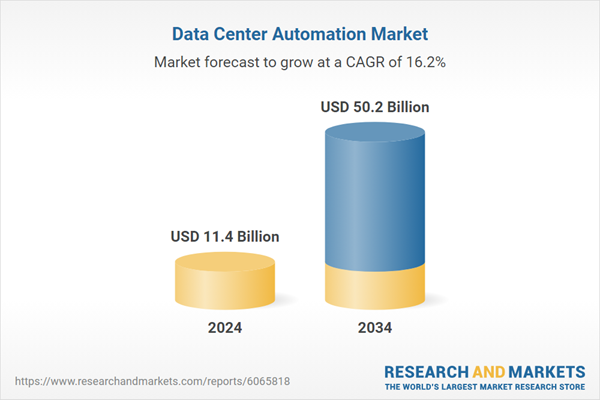

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 11.4 Billion |

| Forecasted Market Value ( USD | $ 50.2 Billion |

| Compound Annual Growth Rate | 16.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |