Market growth is supported by increasing emphasis on emission reduction, accelerating electrification initiatives, and the rising integration of hybrid heating systems across commercial facilities. Industry momentum is further strengthened by the expansion of district heating infrastructure and the growing preference for modular and packaged boiler solutions that offer installation flexibility and operational efficiency. Commercial boiler systems are engineered to deliver reliable, high-capacity heating through advanced thermal transfer design, intelligent automation, and precise combustion control. Adoption of low-emission and energy-efficient technologies continues to rise as regulatory requirements become more stringent. Continuous innovation focused on simplified system architecture, improved energy performance, and lifecycle efficiency is enhancing product appeal. Advancements in digital monitoring, connected controls, and predictive service capabilities are also increasing adoption rates. The growing alignment between district heating development and the deployment of packaged boiler systems in commercial environments continues to influence overall market dynamics.

The natural gas-powered commercial boilers segment accounted for 40% share in 2025 and is projected to grow at a CAGR of 7% from 2026 to 2035. Market preference continues to shift toward high-efficiency gas-fired systems that deliver lower emissions and improved operational performance. Technological advancements emphasize precision combustion control and efficiency optimization across varying load conditions, reinforcing long-term adoption.

The commercial boiler segment reached USD 3.5 billion in 2025, supported by sustained investment in commercial property expansion and increasing demand for consistent indoor climate management. Continued focus on occupant comfort and energy efficiency is expected to sustain segment growth over the forecast period.

United States Commercial Boiler Market held an 80% share in 2025, generating revenue exceeding USD 2.4 billion. Growth is driven by continued investment in commercial infrastructure and rising demand for advanced heating systems that support operational efficiency and regulatory compliance.

Key companies operating in the Global Commercial Boiler Market include Bosch Industriekessel, Cleaver-Brooks, VIESSMANN, A.O. Smith, Fulton, Weil-McLain, Miura America, Babcock Wanson, Bradford White Corporation, Parker Boiler, Vaillant Group, Hurst Boiler & Welding, Superior Boiler, Columbia Boiler Company, Precision Boilers, Ariston Holding, FERROLI, FONDITAL, WOLF, Clayton Industries, PB HEAT, Atlantic Boilers, BURNHAM COMMERCIAL BOILERS, Babcock & Wilcox, and AERCO. These companies maintain strong positions through broad product portfolios and global distribution capabilities. To strengthen their presence in pharmaceutical and healthcare applications, commercial boiler manufacturers are prioritizing high-reliability systems that support uninterrupted operations and strict environmental compliance. Companies invest in research to enhance energy efficiency, emissions performance, and system redundancy, which are critical for healthcare facilities. Strategic partnerships with healthcare infrastructure developers and facility management providers support long-term demand. Manufacturers are expanding service networks and predictive maintenance offerings to ensure operational continuity.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Commercial Boiler market report include:- A.O. Smith

- AERCO

- Ariston Holding

- Atlantic Boilers

- Babcock & Wilcox Enterprises

- Babcock Wanson

- Bosch Industriekessel

- Bradford White Corporation

- BURNHAM COMMERCIAL BOILERS

- Clayton Industries

- Cleaver-Brooks

- Columbia Boiler Company

- FERROLI

- Fonderie Sime

- FONDITAL

- Fulton

- Hurst Boiler & Welding

- Miura America

- PARKER BOILER

- PB HEAT

- Precision Boilers

- Superior Boiler

- Vaillant Group

- VIESSMANN

- WM Technologies

- WOLF

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 225 |

| Published | January 2026 |

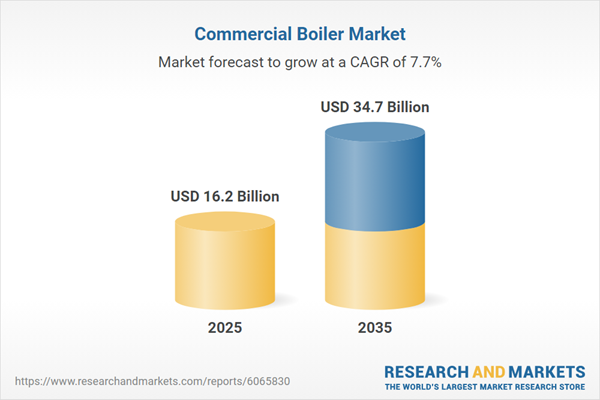

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 16.2 Billion |

| Forecasted Market Value ( USD | $ 34.7 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |