This steady growth is fueled by the increasing demand for chocolate and other confectionery items worldwide. Cocoa powder, a crucial ingredient in a variety of desserts such as cakes, mousse, and pudding, is especially popular among bakeries. Its essential role in creating rich, chocolate-flavored pastries, cookies, and cakes makes it indispensable in the food industry. As consumer preferences shift toward indulgent yet natural desserts, the demand for cocoa powder is expected to surge. Moreover, growing interest in healthier and cleaner-label products has led to a rise in the use of minimally processed ingredients, further boosting the market. Cocoa powder, known for its rich antioxidants and potential health benefits, aligns well with the evolving preferences of health-conscious consumers, driving consistent demand.

Additionally, the increasing popularity of home baking and the rise of premium, artisanal chocolate products contribute to market expansion. Consumers are experimenting with high-quality ingredients, and cocoa powder remains a top choice for creating gourmet and innovative treats. Food manufacturers are also leveraging the versatility of cocoa powder by incorporating it into protein bars, smoothies, and plant-based snacks, aligning with the growing trend of functional foods. With a strong foothold in both commercial and household baking, the cocoa powder market is set to witness sustained growth in the coming years.

The cocoa powder market is categorized into natural cocoa powder, Dutch-processed cocoa powder, blended cocoa powder, and cocoa rouge. Among these, the natural cocoa powder segment generated USD 8.7 billion in 2024 and is projected to grow at a CAGR of 4.4% through 2034. Natural cocoa powder, made from roasted cocoa beans, has a distinct, bitter taste and is light brown. It is commonly used with baking soda in recipes and is highly valued for its minimal processing and retention of nutritional benefits. As consumers increasingly seek less processed and more natural food products, natural cocoa powder continues to gain traction among both manufacturers and consumers.

In terms of cocoa variety, Criollo cocoa beans dominate the market, accounting for 75.4% of the market share in 2024. Criollo beans are known for their unique flavor profile, characterized by a complex and refined taste that appeals to premium chocolate manufacturers. Despite representing a small fraction of global cocoa production, Criollo beans are highly sought after due to their rarity and superior quality, making them a preferred choice in the production of premium chocolate products.

The U.S. cocoa powder market generated USD 4.5 billion in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2034. This growth is driven by the increasing consumption of chocolate products per capita and the continued trend toward healthier, premium-quality confections. The U.S. remains one of the largest importers of cocoa powder, contributing significantly to global demand. The rising interest in gourmet and organic chocolate products, coupled with the growing awareness of the health benefits associated with cocoa, is expected to sustain market growth. As consumers continue to seek indulgent yet nutritious options, the U.S. cocoa powder market is poised for consistent expansion over the forecast period.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Cocoa Powder market report include:- Barry Callebaut

- Belcolade

- Blommer

- Cargill

- Cocoa Processing Company

- Cocoacraft

- Indcresa

- JB Foods

- Newtown Foods USA

- Olam Cocoa

- Plot Enterprise

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 360 |

| Published | March 2025 |

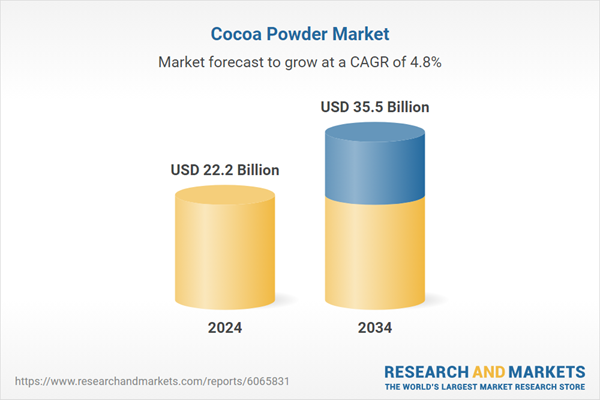

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 22.2 Billion |

| Forecasted Market Value ( USD | $ 35.5 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |