HVDC technology enables the transmission of high-power electricity over long distances with minimal energy loss, making it an ideal solution for interconnecting power grids, integrating renewable energy, and improving grid stability. As the region accelerates its transition towards a more sustainable energy infrastructure, the Australia high-voltage direct current transmission systems market observes heavy adoption, positioning the market for steady expansion in the coming years.

The growing investments in renewable energy projects are a key driver of the Australia high-voltage direct current transmission systems market growth. With an increasing focus on reducing carbon emissions and achieving energy security, the region has been actively developing large-scale solar, wind, and hydroelectric power projects. HVDC technology plays a critical role in efficiently transmitting electricity generated from remote renewable energy sources to urban centers and industrial hubs. By minimizing transmission losses and enhancing grid reliability, HVDC systems facilitate the seamless integration of renewable energy into the national power grid, supporting Australia’s sustainability goals and decarbonization efforts.

The demand in the Australia high-voltage direct current transmission systems market is also fueled by the need to enhance grid interconnection and stability. As Australia’s electricity grid expands and evolves, there is a growing requirement for advanced transmission technologies to address the challenges of fluctuating power generation and demand.

HVDC technology allows for better control over power flow, reducing congestion and ensuring a stable supply of electricity across different regions. This is particularly important in a country with vast geographical distances, where the ability to transfer power efficiently between states and territories is crucial for maintaining a reliable and resilient energy network.

The offshore wind energy sector is another emerging area that is contributing to the Australia high-voltage direct current transmission systems market value. The region is exploring offshore wind projects as part of its renewable energy expansion, and HVDC technology is essential for connecting offshore wind farms to the mainland power grid. The ability of HVDC systems to transmit electricity over long distances with reduced losses makes them a preferred choice for offshore wind applications, ensuring efficient power delivery and grid integration. As offshore wind development gains traction, the demand for HVDC infrastructure is expected to rise, further driving market growth.

The increasing focus on cross-border electricity trading and interconnectivity is also influencing the Australia high-voltage direct current transmission systems market dynamics. The region presents ample opportunities for manufacturers to enhance energy trade with neighboring countries, such as Indonesia and Singapore, through HVDC interconnectors. These high-capacity transmission links enable the efficient exchange of electricity, optimizing energy resources and improving grid reliability. The development of such projects not only strengthens international energy cooperation but also enhances Australia’s position as a key player in the regional energy market.

Government policies and regulatory frameworks play a crucial role in shaping the Australia high-voltage direct current transmission systems market trends and dynamics. The government has been actively supporting energy transition initiatives through funding programs, incentives, and regulatory reforms aimed at promoting the adoption of advanced grid technologies.

Investments in smart grid infrastructure, energy storage solutions, and grid digitalization further complement the deployment of HVDC systems, enhancing overall grid efficiency and reliability. As policymakers continue to prioritize sustainable energy solutions, the HVDC market is likely to benefit from favorable policies and increased investment in grid modernization.

The role of private sector investments and collaborations is also significant in driving Australia high-voltage direct current transmission systems market development. Leading energy companies, technology providers, and infrastructure developers are actively participating in HVDC projects, bringing innovative solutions to enhance transmission efficiency and system performance.

Strategic partnerships between industry players and research institutions are fostering technological advancements in HVDC components, such as converters, cables, and insulation materials, improving the overall efficiency and cost-effectiveness of HVDC systems. As market competition increases, technological innovation is expected to play a key role in shaping the future of HVDC transmission in Australia.

Despite the numerous growth drivers, the Australia high-voltage direct current transmission systems market faces challenges related to high initial investment costs and technical complexities. The implementation of HVDC projects requires significant capital investment in infrastructure, converter stations, and transmission lines, which can be a barrier for some stakeholders.

Additionally, the complexity of integrating HVDC technology with existing alternating current (AC) grids necessitates advanced engineering expertise and coordination between multiple entities. However, ongoing technological advancements and increasing government support for grid modernization initiatives are expected to mitigate these challenges, making HVDC solutions more accessible and cost-effective in the long run.

The future Australia high-voltage direct current transmission systems market oulook is closely linked to the broader trends in energy transition, smart grid development, and regional energy cooperation. With Australia’s commitment to achieving net-zero emissions and expanding its renewable energy capacity, the demand for HVDC solutions is expected to grow significantly. The increasing integration of artificial intelligence (AI) and digital monitoring systems in HVDC infrastructure will further enhance grid efficiency, enabling real-time monitoring and predictive maintenance for improved system reliability.

Market Segmentation

The market can be divided based on component, transmission type, technology, power rating, application, and region.Market Breakup by Component

- Transmission Medium (Cables)

- Converter Stations

- DC Lines

- AC & DC Harmonic Filters

- Circuit Breakers

- Others

Market Breakup by Transmission Type

- Overhead

- Underground

- Submarine

Market Breakup by Technology

- Line Commutated Converters (LCC)

- Capacitor Commutated Converter (CCC)

- Voltage Source Converters (VSC)

Market Breakup by Power Rating

- Below 1000 MW

- 1001 - 2000 MW

- Above 2000 MW

Market Breakup by Application

- Infeed Urban Areas

- Bulk Power Transmission

- Interconnecting Grids

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- Australian Capital Territory

- Others

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Australia high-voltage direct current (HVDC) transmission systems market. Some of the major players explored in the report are as follows:- Schneider Electric SE

- CBI Australia

- Toshiba International Corporation Pty. Ltd.

- NR Electric Co., Ltd.

- NKT A/S

- Others

Table of Contents

Companies Mentioned

- Schneider Electric SE

- CBI Australia

- Toshiba International Corporation Pty. Ltd.

- NR Electric Co., Ltd.

- NKT A/S

Table Information

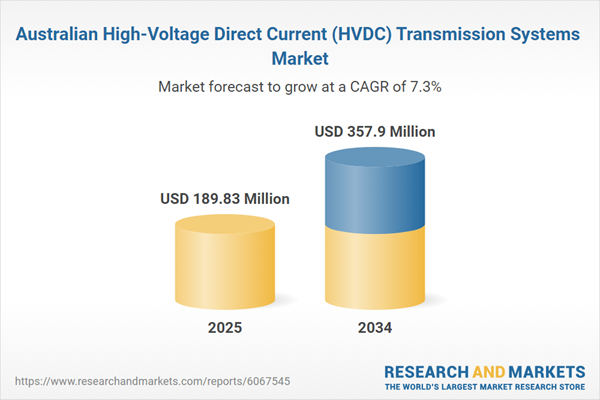

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | March 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 189.83 Million |

| Forecasted Market Value ( USD | $ 357.9 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 5 |