Based on the mode of transportation, the Australia freight logistics market share is led by road freight

They are flexible in transporting the products as they can easily provide door-to-door services to the consumers and act as an accessible option to locations where airports are not available. Road freights are comparatively less dependent on the specific infrastructure which makes them a better option for transportation, and they are also less affected by the weather conditions which makes them more reliable. Moreover, they can transport heavy and bulky goods with ease.The Australia freight logistics market growth is being driven by various trends including the rise in e-commerce which has increased the demands for storage, warehousing and transportation due to the fastest delivery needs of the consumers. Moreover, the incorporation of sustainable packaging materials and the practice of lowering the emission of carbon is also growing.

As per the Department of Infrastructure, Transport, Regional Development, Communications and Arts, total freight is expected to increase by 26% from 756 billion tonne-kilometres in 2020 to 964 billion tonne-kilometres in 2050.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Function

- Freight Forwarding

- Warehousing and Storage

- Courier, Express and Parcel

- Freight Transport

- Others

Market Breakup by Mode of Transport

- Airways

- Waterways

- Roadways

- Railways

Market Breakup by End Use

- Consumer Goods

- Manufacturing

- Automotive

- Food and Beverage

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Table of Contents

Companies Mentioned

- FedEx Logistics (Australia) Pty Ltd

- Schenker Australia Pty Ltd.

- DHL Express (Australia) Pty Ltd.

- Yusen Logistics (Australia) Pty Ltd.

- Freight Logistics Pty Ltd.

- Linfox Australia Pty Ltd.

- DTDC Australia Pty Ltd

- Henning Harders Pty Ltd.

- Mainfreight Distribution Pty Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | October 2025 |

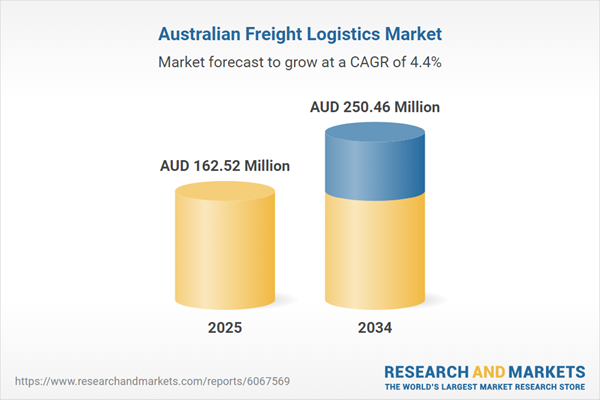

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 162.52 Million |

| Forecasted Market Value ( AUD | $ 250.46 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 9 |