Forklifts play a critical role in material handling operations, enhancing efficiency and productivity in supply chain management. As per the Australia forklift market analysis, the rising emphasis on automation and mechanization in industrial processes has further propelled the demand for advanced forklifts equipped with modern technologies such as telematics, IoT integration, and electric powertrains. As businesses seek to optimize operational efficiency and reduce labor-intensive tasks, the adoption of forklifts has become an essential component of industrial growth in the region.

The expanding e-commerce sector is a key driver of the Australia forklift market growth, as the increasing volume of online orders has necessitated the development of large-scale warehousing and distribution centers. Companies involved in retail, logistics, and third-party warehousing are investing in high-performance forklifts to streamline inventory management and accelerate goods movement.

Additionally, the growing preference for electric forklifts over conventional diesel or LPG-powered models is shaping the market landscape. Electric forklifts offer numerous advantages, including lower operational costs, reduced emissions, and compliance with stringent environmental regulations, making them a preferred choice for businesses prioritizing sustainability.

The construction industry has also contributed significantly to the Australia forklift market expansion. With ongoing infrastructure projects and urban development initiatives, the demand for forklifts in material handling and site logistics continues to rise. Forklifts are widely used in transporting heavy materials such as cement, steel, and timber, ensuring smooth and efficient construction operations. The introduction of rough-terrain forklifts has further enhanced operational capabilities in challenging environments, allowing construction companies to improve productivity in off-road and uneven surface conditions.

The adoption of automation and smart technology has revolutionized the Australia forklift market dynamics, leading to the integration of advanced safety features, GPS tracking, and remote monitoring systems. The use of telematics in forklifts enables real-time data analysis, helping fleet managers optimize vehicle utilization, monitor performance, and ensure preventive maintenance. The increasing implementation of artificial intelligence and machine learning in forklift operations has also enhanced efficiency, reducing the risk of accidents and improving overall workplace safety. As businesses continue to embrace digital transformation, the demand for technologically advanced forklifts is expected to grow significantly.

Moreover, the rental and leasing segment has added to the Australia forklift market value, providing businesses with cost-effective solutions to meet fluctuating demand. Many companies prefer renting forklifts instead of purchasing them outright, as it allows for greater flexibility in fleet management and reduces capital expenditure. Forklift rental services offer a wide range of models, from counterbalance forklifts to reach trucks and pallet jacks, catering to diverse industry requirements. The growing popularity of short-term and long-term rental agreements has contributed to the overall market expansion, enabling businesses to scale operations efficiently.

Sustainability trends and environmental considerations are expected to shape the future Australia forklift market outlook. With the shift towards green logistics and eco-friendly industrial practices, the demand for electric and hydrogen-powered forklifts is set to rise. Manufacturers are focusing on developing energy-efficient forklifts with longer battery life and reduced carbon footprints to align with corporate sustainability goals. The increasing emphasis on circular economy principles, including the recycling and refurbishing of forklift components, is also contributing to the market’s long-term growth.

Government regulations and workplace safety standards play a crucial role in shaping the Australia forklift market trends. Compliance with occupational health and safety (OHS) regulations has led to increased adoption of forklifts equipped with enhanced safety features, including collision detection systems, automatic braking, and operator-assist technologies.

The emphasis on reducing workplace injuries and improving employee well-being has encouraged companies to invest in high-quality forklifts with ergonomic designs and user-friendly controls. Additionally, training programs and certification requirements for forklift operators have reinforced the importance of safe and efficient equipment usage in industrial settings.

Despite its strong growth trajectory, the Australia forklift market faces challenges related to supply chain disruptions, fluctuating raw material costs, and skilled labor shortages. The impact of global economic uncertainties and geopolitical factors can influence the availability of forklift components and lead to price volatility. Additionally, the increasing demand for skilled forklift operators has prompted businesses to invest in workforce training and upskilling programs. Addressing these challenges through strategic planning and technological advancements will be crucial in sustaining market growth.

Looking ahead, the Australia forklift market is poised for continued expansion, driven by advancements in technology, increasing industrial automation, and evolving business needs. The integration of smart forklifts, enhanced safety features, and sustainable energy solutions will redefine the industry landscape, offering businesses more efficient and environmentally friendly material handling solutions. As industries continue to prioritize productivity and operational efficiency, forklifts will remain a vital asset in the region's logistics and supply chain infrastructure, ensuring seamless movement of goods and materials in a rapidly evolving economic environment.

Market Segmentation

The market can be divided based on power source, tonnage capacity, class, product type, application, and regionMarket Breakup by Power Source

- Internal Combustion Engine (ICE)

- Electric

Market Breakup by Tonnage Capacity

- Below 5 Ton

- 6-30 Ton

- Above 30 Ton

Market Breakup by Class

- Class 1

- Class 2

- Class 3

- Class 4/5

Market Breakup by Product Type

- Counterbalance

- Warehouse

Market Breakup by Application

- Food and Beverage

- Third-Party Logistics (3PL)

- Automotive

- Healthcare

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Australia'forklift market. Some of the major players explored in the report are as follows:- Caterpillar Inc.

- Komatsu Forklift Australia Pty Ltd.

- Clark Equipment Australia Pty Ltd.

- Toyota Material Handling Australia Pty Limited

- Linde Material Handling Pty Limited

- HC Forklift Australia Pty Ltd.

- Crown Equipment Pty Ltd.

- Adaptalift Group

- Manitou BF S.A.

- Others

Table of Contents

Companies Mentioned

- Caterpillar Inc.

- Komatsu Forklift Australia Pty Ltd.

- Clark Equipment Australia Pty Ltd.

- Toyota Material Handling Australia Pty Limited

- Linde Material Handling Pty Limited

- HC Forklift Australia Pty Ltd.

- Crown Equipment Pty Ltd.

- Adaptalift Group

- Manitou BF S.A.

Table Information

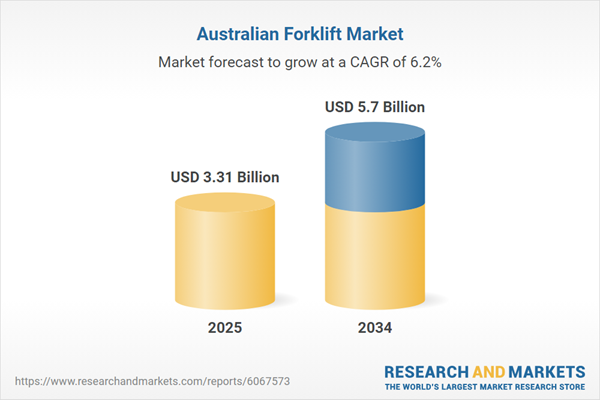

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | March 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.31 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 9 |