ETFs are investment funds traded on stock exchanges, offering exposure to a wide range of asset classes, including equities, fixed income, commodities, and alternative investments. The Australia exchange traded funds market expansion has been fueled by growing awareness of the benefits associated with ETFs, including lower expense ratios, liquidity, and the ability to track major indices. The rising demand for passive investing strategies has further contributed to the popularity of ETFs, as investors seek efficient ways to build diversified portfolios with minimal management fees.

The increasing adoption of ETFs among both retail and institutional investors has played a crucial role in shaping the Australia exchange traded funds market dynamics. Retail investors are drawn to ETFs due to their transparency, ease of access, and ability to provide instant diversification across various sectors and geographies. At the same time, institutional investors utilize ETFs for tactical asset allocation, hedging strategies, and portfolio rebalancing. The shift towards self-directed investing and the rise of online brokerage platforms have also facilitated the growth of ETF investments, making them more accessible to a broader audience. As a result, the number of ETF products available in the market has expanded, catering to the diverse needs and risk appetites of investors.

The low-cost nature of ETFs remains a major driver of their adoption, boosting the overall Australia exchange traded funds market revenue growth. Compared to actively managed funds, ETFs offer lower expense ratios, making them an attractive option for cost-conscious investors. The ability to buy and sell ETFs throughout the trading day at market prices enhances their appeal, offering flexibility that traditional mutual funds do not provide.

Additionally, tax efficiency has contributed to the growing preference for ETFs, as they typically generate fewer capital gains distributions compared to actively managed funds, leading to potential tax advantages for investors. These factors have positioned ETFs as a preferred investment vehicle for long-term wealth accumulation and retirement planning.

The COVID-19 pandemic played a significant role in accelerating the demand in the Australia exchange traded funds market, as the industry volatility prompted investors to seek diversification and stability in their portfolios. During periods of economic uncertainty, ETFs provided investors with a transparent and liquid means of adjusting their exposure to different asset classes. The market rebound following the initial downturn saw a surge in ETF inflows, particularly in sectors such as technology, healthcare, and commodities. This trend underscored the resilience and adaptability of ETFs in responding to changing market conditions, further solidifying their role in investment portfolios.

Sustainability and thematic investing have emerged as key trends driving the Australia exchange traded funds market growth. Investors are increasingly seeking exposure to environmental, social, and governance (ESG)-focused ETFs, aligning their investment strategies with ethical and sustainable principles. The rising awareness of climate change, corporate governance, and social responsibility has led to an increase in ESG-themed ETFs, which focus on companies with strong sustainability practices. Thematic ETFs, which track specific industries or investment trends such as technology, clean energy, and artificial intelligence, have also gained traction, providing investors with targeted exposure to high-growth sectors. These trends reflect a broader shift in investor preferences towards values-based and future-focused investment strategies.

Regulatory developments and technological advancements have also contributed to the Australia exchange traded funds market development. The Australian Securities and Investments Commission (ASIC) and other regulatory bodies have supported the growth of ETFs by ensuring transparency, investor protection, and market stability. The introduction of innovative ETF structures, including actively managed ETFs and cryptocurrency-linked ETFs, has further diversified the product offerings available to investors. Additionally, the rise of robot-advisors and digital investment platforms has made it easier for investors to incorporate ETFs into their portfolios, offering automated, low-cost portfolio management solutions. These advancements have enhanced the accessibility and efficiency of ETF investing, attracting a new generation of investors.

The Australia exchange traded funds market faces several key challenges. Limited investor awareness and financial literacy hinder broader adoption. Market concentration among a few large providers restricts competition and innovation. Regulatory uncertainty, particularly around transparency and compliance, adds complexity. Liquidity concerns, especially in niche or thematic ETFs, can impact pricing and execution. Additionally, global economic volatility and currency fluctuations can affect investor confidence. These factors collectively pose barriers to sustained growth and diversification in the market.

Looking ahead, the Australia exchange traded funds market is poised for continued expansion, driven by increasing investor education, product innovation, and the growing acceptance of passive investing strategies. The demand for specialized ETFs, such as smart beta and factor-based ETFs, is expected to rise as investors seek customized strategies to enhance returns and manage risks.

The continued growth of ESG investing will likely drive further development of sustainable ETF products, reflecting the evolving priorities of both retail and institutional investors. Additionally, advancements in financial technology and digital trading platforms will further streamline ETF investing, making it more accessible and efficient for a wider audience.

Market Segmentation

The market can be divided based on type, investor type, distribution channel, and region.Market Breakup by Type

- Equity ETFs

- Currency ETFs

- Fixed Income/Bonds ETFs

- Specialty ETFs

- Commodity ETFs

- Others

Market Breakup by Investor Type

- Institutional Investor

- Individual Investor

Market Breakup by Distribution Channel

- Institutional

- Retail

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- Australian Capital Territory

- Others

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Australia exchange traded funds market. Some of the major players explored in the report are as follows:- Vanguard Investments Australia Ltd.

- State Street Corporation

- BlackRock Investment Management (Australia) Limited

- Vaneck Australia Pty Ltd.

- FIL Responsible Entity (Australia) Limited

- DFA Australia Limited

- Commonwealth Bank of Australia

- CMC Markets Asia Pacific Pty Ltd.

- Syfe Australia Pty Ltd.

- Others

Table of Contents

Companies Mentioned

- Vanguard Investments Australia Ltd.

- State Street Corporation

- BlackRock Investment Management (Australia) Limited

- Vaneck Australia Pty Ltd.

- FIL Responsible Entity (Australia) Limited

- DFA Australia Limited

- Commonwealth Bank of Australia

- CMC Markets Asia Pacific Pty Ltd.

- Syfe Australia Pty Ltd.

Table Information

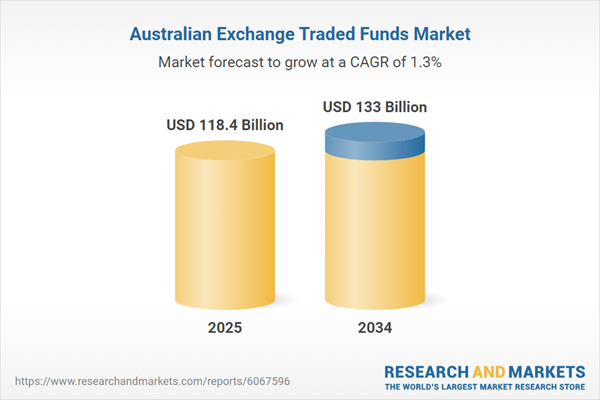

| Report Attribute | Details |

|---|---|

| No. of Pages | 162 |

| Published | March 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 118.4 Billion |

| Forecasted Market Value ( USD | $ 133 Billion |

| Compound Annual Growth Rate | 1.3% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 9 |