Global AMI Smart Water Meters Market - Key Trends & Drivers Summarized

How Are AMI Smart Water Meters Redefining Utility Management?

Advanced Metering Infrastructure (AMI) smart water meters are transforming the global water management landscape by enabling utilities to automate meter readings, detect leaks in real time, and optimize water distribution. Unlike traditional water meters, AMI smart meters leverage wireless communication networks, IoT integration, and cloud-based analytics to provide real-time data transmission and remote monitoring capabilities. These meters eliminate the inefficiencies of manual readings, reducing labor costs while improving billing accuracy and customer transparency. Governments and municipal authorities worldwide are increasingly mandating the adoption of smart metering solutions to enhance water conservation efforts amid rising concerns over water scarcity and wastage. Developed regions such as North America and Europe have already embarked on large-scale AMI smart water meter deployments, with utility providers leveraging the technology to streamline operations and minimize non-revenue water (NRW) losses. Meanwhile, emerging economies in Asia-Pacific and Latin America are gradually adopting AMI smart water meters to modernize aging water distribution networks and address the challenges posed by rapid urbanization. In addition to government mandates, growing consumer awareness of water conservation and the need for accurate billing are also accelerating the adoption of AMI technology in the residential, commercial, and industrial sectors.What Role Do IoT and AI Play in Enhancing AMI Smart Water Metering?

The integration of Internet of Things (IoT) and artificial intelligence (AI) has been a game-changer for AMI smart water metering, enabling utility providers to leverage predictive analytics and>How Are Regulatory Policies and Consumer Preferences Shaping the Market?

Stringent regulatory mandates and evolving consumer expectations are key factors influencing the AMI smart water meter market, driving large-scale deployments across multiple regions. Governments worldwide are enacting policies that require utility providers to transition from conventional metering systems to advanced smart metering infrastructures as part of broader sustainability and resource management goals. In Europe, for example, the European Water Framework Directive is pushing for enhanced water monitoring and conservation efforts, leading to increased investments in AMI smart water meters. Similarly, in the U.S., the Environmental Protection Agency (EPA) and local water authorities are incentivizing smart meter installations to tackle water losses and improve distribution efficiency. In addition to regulatory drivers, consumer behavior is also playing a pivotal role in shaping market trends. Growing environmental consciousness is encouraging consumers to demand greater transparency in water usage, prompting utilities to adopt smart metering solutions that offer real-time consumption tracking and personalized usage reports. The proliferation of smart homes and connected devices has further accelerated the demand for AMI smart water meters, as homeowners seek seamless integration of water monitoring solutions into their existing smart home ecosystems. Additionally, industries with high water consumption, such as manufacturing and agriculture, are increasingly deploying AMI smart meters to optimize resource utilization and comply with stringent water conservation regulations. As environmental concerns and sustainability goals continue to gain prominence, the market for AMI smart water meters is expected to witness sustained growth.What Are the Key Growth Drivers Fueling the Expansion of AMI Smart Water Meters?

The growth in the AMI smart water meter market is driven by several factors, including technological advancements, increasing regulatory enforcement, rising consumer demand for real-time monitoring, and the rapid expansion of smart city initiatives. The continuous evolution of wireless communication technologies, such as 5G, LPWAN, and NB-IoT, has significantly enhanced the efficiency and reliability of AMI smart meters, enabling faster data transmission and reducing latency in remote monitoring applications. Additionally, regulatory frameworks that mandate improved water conservation strategies are compelling utilities to invest in AMI infrastructure, particularly in regions facing severe water scarcity challenges.The report analyzes the AMI Smart Water Meters market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.

- Segments: Product (Hot Water Meters, Cold Water Meters); Application (Residential Application, Commercial Application, Utility Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hot Water Meters segment, which is expected to reach US$6.2 Billion by 2030 with a CAGR of a 36.6%. The Cold Water Meters segment is also set to grow at 22.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $456.7 Million in 2024, and China, forecasted to grow at an impressive 41.8% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global AMI Smart Water Meters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global AMI Smart Water Meters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global AMI Smart Water Meters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apator S.A., Azbil Kimmon Co., Ltd, EDMI Limited, FortisBC Energy Inc., Holley Technology Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this AMI Smart Water Meters market report include:

- Arad Group

- Arqiva Limited

- Eaton Corporation

- EDMI Limited

- Iskraemeco d.d.

- Kamstrup A/S

- Landis+Gyr AG

- Peltek India

- Pietro Fiorentini SpA

- Sagemcom SAS

- Trilliant Holdings, Inc

- Wasion Holdings International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arad Group

- Arqiva Limited

- Eaton Corporation

- EDMI Limited

- Iskraemeco d.d.

- Kamstrup A/S

- Landis+Gyr AG

- Peltek India

- Pietro Fiorentini SpA

- Sagemcom SAS

- Trilliant Holdings, Inc

- Wasion Holdings International

Table Information

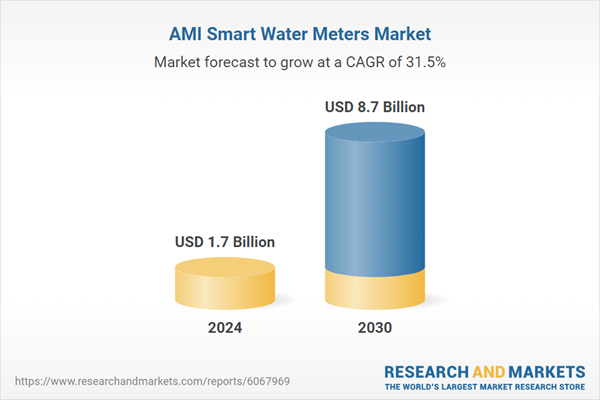

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 8.7 Billion |

| Compound Annual Growth Rate | 31.5% |

| Regions Covered | Global |