Global Electric Coolant Pump Market - Key Trends & Drivers Summarized

Why Are Electric Coolant Pumps Becoming Critical in Modern Thermal Management?

Electric coolant pumps are becoming an essential component in today’ s automotive and industrial thermal management systems, largely driven by the electrification of vehicles and advancements in power electronics. Unlike conventional mechanical pumps that rely on engine power for operation, electric coolant pumps are independently powered and electronically controlled, allowing for precise and efficient coolant flow regulation. This shift is crucial for modern internal combustion engines (ICEs), hybrid electric vehicles (HEVs), plug-in hybrids (PHEVs), and especially battery electric vehicles (BEVs), all of which require tightly regulated thermal environments for optimal performance. In electric vehicles, these pumps cool battery packs, inverters, electric motors, and charging systems - ensuring longevity, safety, and consistent power output. Additionally, as vehicles incorporate more electronic components, the need for localized and responsive cooling solutions has surged. Electric coolant pumps respond instantly to thermal demands, operate across a wide range of voltages, and offer variable speed control, resulting in better energy efficiency and reduced emissions. Their decoupling from engine speed also allows for operation even when the engine is off, which is vital for stop-start systems and electric-only driving modes. Beyond automotive applications, these pumps are also making inroads into industrial automation, data centers, and renewable energy systems where efficient heat dissipation is critical. The rising global focus on fuel economy standards, reduced maintenance, and longer system lifespans is pushing OEMs to replace outdated mechanical pumps with smarter, programmable electric variants that deliver superior control and performance.How Are Regulations and Electrification Trends Accelerating Market Growth Worldwide?

Stringent environmental regulations and aggressive electrification mandates are significantly influencing the demand for electric coolant pumps across key global markets. In the automotive sector, governments in Europe, North America, and Asia are enforcing stricter emissions standards and fuel efficiency targets that are pushing manufacturers to adopt energy-saving thermal management systems. Electric coolant pumps play a pivotal role in reducing parasitic losses and enhancing the efficiency of powertrains in both traditional and electrified vehicles. The European Union’ s CO2 emission targets, along with the Euro 7 emission standard rollout, are accelerating the transition to electric pumps in both light and heavy vehicles. In the United States, the EPA’ s Clean Car Standards and California’ s zero-emission vehicle mandates are fostering widespread adoption across electric and hybrid platforms. Meanwhile, China’ s New Energy Vehicle (NEV) program, which includes subsidies and production quotas, is boosting local demand for electric pumps in EV and HEV models. These policies are also influencing global supply chains and compelling Tier 1 suppliers to localize production and innovate more efficient, compact, and reliable electric coolant pump designs. Beyond automotive, regulatory trends in the industrial sector are contributing to demand, particularly in applications requiring enhanced cooling for electronics, renewable energy components, and server infrastructure. Across regions, national investments in EV infrastructure, incentives for EV buyers, and stricter compliance guidelines for OEMs are reinforcing electric coolant pumps as standard equipment in modern thermal systems. These policy-driven trends are not only stimulating product innovation but also creating long-term demand visibility, encouraging deeper investments in R&D and manufacturing capacity worldwide.Are Innovations in Design and Functionality Enhancing Pump Efficiency and Versatility?

Rapid advancements in electric coolant pump design and technology are dramatically enhancing performance, efficiency, and operational versatility. Manufacturers are focusing on integrating brushless DC motors, which offer higher reliability, longer service life, and lower energy consumption compared to brushed alternatives. Compact and lightweight construction is a key trend, especially for electric vehicles, where space and weight savings translate directly into range and performance gains. Innovations in control systems are enabling dynamic response to real-time temperature data, optimizing coolant flow precisely where and when it’ s needed. Pumps are now capable of variable flow rates, multi-zone cooling, and operation across wide temperature and voltage ranges, making them suitable for everything from electric vehicles to high-performance industrial electronics. Advanced sealing and bearing materials are improving durability under high-load and high-temperature conditions, reducing the frequency of maintenance and extending service intervals. The incorporation of CAN bus and LIN bus communication protocols allows electric pumps to seamlessly integrate into larger vehicle or system control networks, enabling predictive diagnostics and remote monitoring. In the EV segment, high-voltage coolant pumps designed to manage rapid charging heat spikes are also gaining traction. Additionally, dual-pump systems and decentralized cooling loops are being developed for multi-component platforms such as EVs with dual motors and fast-charging capabilities. Thermal modeling and simulation tools are being used to optimize pump placement and performance at the system level, improving overall efficiency. These technological advancements are not only enhancing pump functionality but are also expanding their role in complex thermal architectures, transforming them into intelligent nodes within the broader energy management ecosystem.What’ s Driving the Expanding Demand in the Global Electric Coolant Pump Market?

The growth in the global electric coolant pump market is driven by several factors rooted in the expansion of electric and hybrid vehicle platforms, rising demand for intelligent thermal systems, and the broader electrification of industrial equipment. A major driver is the global acceleration of electric mobility, which demands precise and scalable thermal management solutions to support high-performance batteries, power electronics, and fast-charging components. As EV adoption grows in both passenger and commercial segments, the need for efficient and durable electric coolant pumps becomes critical to ensure system reliability and safety. Another key growth driver is the shift among OEMs toward modular vehicle architectures that require distributed and decentralized cooling capabilities, where electric pumps offer unmatched flexibility. On the industrial front, sectors like data centers, renewable energy, and automation are increasingly relying on electric pumps for active cooling, as systems become more compact, energy-intensive, and sensitive to overheating. The trend toward smart manufacturing and Industry 4.0 is also spurring demand for connected and programmable pumps that offer real-time diagnostics and remote operability. Additionally, consumers’ growing expectations for quieter, low-maintenance, and fuel-efficient vehicles are leading automakers to replace conventional mechanical pumps with electric variants. The rise in advanced driver assistance systems (ADAS) and onboard computing in modern vehicles is further intensifying the need for localized thermal management. Supply chain improvements and increased localization of pump manufacturing are also helping reduce costs and improve availability, particularly in price-sensitive markets. Lastly, growing investments in electric vehicle R&D, coupled with government incentives and regulatory alignment across regions, are reinforcing the position of electric coolant pumps as an indispensable component in the next generation of mobility and industrial efficiency.Report Scope

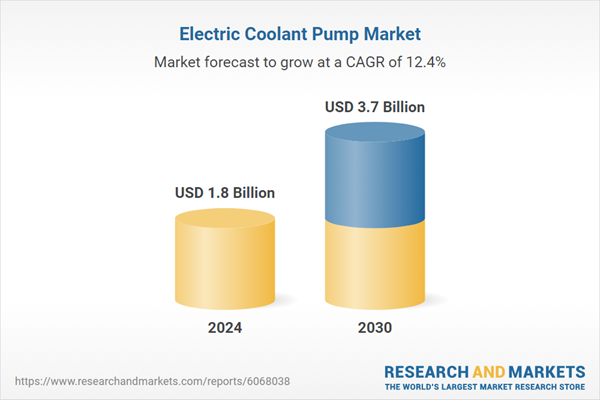

The report analyzes the Electric Coolant Pump market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Sealed Electric Coolant Pumps, Sealless Electric Coolant Pumps); Application (Powertrain & HVAC Application, Battery & Power Electronics Application, Gearbox Cooling Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sealed Electric Coolant Pumps segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of a 14%. The Sealless Electric Coolant Pumps segment is also set to grow at 9.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $502.2 Million in 2024, and China, forecasted to grow at an impressive 17% CAGR to reach $792.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Coolant Pump Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Coolant Pump Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Coolant Pump Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Volvo (Volvo Trucks), Hitachi Construction Machinery (China) Co., Ltd., Hydrema Group, KNOW-HOW Group, Komatsu Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Electric Coolant Pump market report include:

- Aisin Corporation

- BorgWarner, Inc.

- Continental AG

- Denso Corporation

- Eberspacher Climate Control Systems International GmbH

- Four Seasons

- Grayson Thermal Systems

- Hanon Systems

- Johnson Electric Holdings Limited

- MAHLE GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Corporation

- BorgWarner, Inc.

- Continental AG

- Denso Corporation

- Eberspacher Climate Control Systems International GmbH

- Four Seasons

- Grayson Thermal Systems

- Hanon Systems

- Johnson Electric Holdings Limited

- MAHLE GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |