Global Security and Vulnerability Management Market - Key Trends & Drivers Summarized

Why Is Security And Vulnerability Management A Top Priority For Enterprises?

With cyber threats becoming more sophisticated, security and vulnerability management (SVM) is a critical aspect of enterprise cybersecurity strategies. Businesses are facing increasing risks from ransomware attacks, phishing campaigns, and zero-day vulnerabilities, necessitating robust security frameworks. Regulatory compliance mandates such as GDPR, HIPAA, and SOC 2 are also driving organizations to adopt proactive security and vulnerability management solutions. The shift toward cloud computing, IoT expansion, and remote work environments is further increasing the need for continuous threat monitoring and vulnerability assessments. As cyber risks evolve, organizations are prioritizing SVM solutions to safeguard sensitive data and prevent financial and reputational losses.What Innovations Are Enhancing Security And Vulnerability Management?

AI-driven threat intelligence, automated vulnerability scanning, and real-time risk assessment tools are transforming the SVM landscape. AI-powered cybersecurity platforms are improving anomaly detection and predictive threat modeling. Continuous security monitoring integrated with machine learning is enabling proactive vulnerability identification and patch management. Additionally, blockchain technology is being explored for tamper-proof security audits and identity management. The convergence of cybersecurity frameworks with cloud-based security orchestration and response (SOAR) is enhancing incident response capabilities. These innovations are strengthening enterprise resilience against emerging cyber threats.Which Industries Are Driving The Growth Of Security And Vulnerability Management Solutions?

The financial services, healthcare, and government sectors are leading adopters of SVM solutions due to stringent regulatory requirements and high-value data protection needs. Enterprises in e-commerce, telecommunications, and cloud service providers are also heavily investing in security frameworks to mitigate cyber risks. Additionally, critical infrastructure sectors such as energy, transportation, and defense are implementing SVM to safeguard against cyber-physical threats. As cyberattacks continue to escalate, demand for advanced security and vulnerability management solutions is increasing across all industries.What Factors Are Fueling The Growth Of The SVM Market?

The growth in the SVM market is driven by increasing cybersecurity regulations, rising cybercrime incidents, and the shift toward automated security solutions. The expansion of digital transformation initiatives, coupled with the proliferation of IoT and cloud computing, is creating new security vulnerabilities, necessitating continuous risk management. Enterprises are prioritizing investments in AI-driven cybersecurity and managed security services to enhance threat detection and response. Additionally, the rising adoption of security frameworks such as Zero Trust Architecture (ZTA) and Security Information and Event Management (SIEM) is further propelling market demand. As cybersecurity threats continue to evolve, the SVM market is expected to witness rapid expansion.Report Scope

The report analyzes the Security and Vulnerability Management market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Security & Vulnerability Management Software, Security & Vulnerability Management Services); Security Type (Network Security, Application Security, Endpoint Security, Cloud Security); Vertical (BFSI Vertical, Healthcare Vertical, Government Vertical, Manufacturing Vertical, Energy & Utilities Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Security & Vulnerability Management Software segment, which is expected to reach US$13.9 Billion by 2030 with a CAGR of a 6.3%. The Security & Vulnerability Management Services segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.4 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Security and Vulnerability Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Security and Vulnerability Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Security and Vulnerability Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aridhia Informatics, ARPA, Blockdaemon, Chainlink, Cube.Exchange and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Security and Vulnerability Management market report include:

- Arctic Wolf Networks

- AT&T Cybersecurity (AlienVault)

- Broadcom Inc. (Symantec)

- Check Point Software Technologies

- Cisco Systems, Inc.

- CrowdStrike Holdings, Inc.

- Dell EMC

- Hewlett Packard Enterprise Company

- IBM Corporation

- Ivanti

- McAfee, LLC

- Micro Focus International plc

- Microsoft Corporation

- Palo Alto Networks

- Qualys Inc.

- Qualys VMDR

- Rapid7 Inc.

- Skybox Security, Inc.

- Tenable Inc.

- Tripwire, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arctic Wolf Networks

- AT&T Cybersecurity (AlienVault)

- Broadcom Inc. (Symantec)

- Check Point Software Technologies

- Cisco Systems, Inc.

- CrowdStrike Holdings, Inc.

- Dell EMC

- Hewlett Packard Enterprise Company

- IBM Corporation

- Ivanti

- McAfee, LLC

- Micro Focus International plc

- Microsoft Corporation

- Palo Alto Networks

- Qualys Inc.

- Qualys VMDR

- Rapid7 Inc.

- Skybox Security, Inc.

- Tenable Inc.

- Tripwire, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

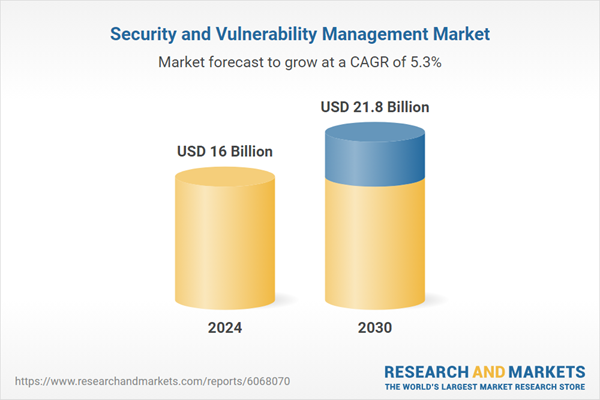

| Estimated Market Value ( USD | $ 16 Billion |

| Forecasted Market Value ( USD | $ 21.8 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |