Global Off-Highway Vehicle Lighting Market - Key Trends & Drivers Summarized

Why Is Lighting Technology Becoming Mission-Critical for Off-Highway Vehicles?

Off-highway vehicle lighting has become a crucial component in ensuring operational safety, productivity, and compliance across industries such as construction, agriculture, mining, and forestry. These rugged environments demand lighting systems that not only provide visibility in low-light or extreme weather conditions but also withstand high vibration, dust, and moisture. Modern off-highway lighting systems go beyond basic illumination; they are engineered for durability, efficiency, and integration with advanced vehicle systems. LED technology, in particular, has revolutionized the space with its longer lifespan, lower power consumption, and superior brightness compared to halogen or HID (High-Intensity Discharge) lights. The adoption of LED work lights, beacon lights, headlamps, and tail lights enhances operator awareness and reduces downtime related to equipment maintenance or visibility-related accidents. Furthermore, regulatory mandates in regions such as North America and the EU require vehicles to meet strict lighting performance and safety standards, pushing OEMs and fleet operators to upgrade from traditional lighting to smarter, compliant systems. As operations extend into night shifts and underground or remote settings, the demand for reliable and adaptive lighting solutions becomes even more pronounced. Thermal management, ingress protection, and resistance to electromagnetic interference are now standard considerations in lighting design. With lighting systems playing an integral role in visibility, signaling, and machine diagnostics, their value proposition in off-highway vehicles has never been more indispensable or technically advanced.How Are Sector-Specific Needs Shaping Lighting Innovation Across Off-Highway Applications?

The lighting needs of off-highway vehicles vary significantly across industry sectors, leading to highly specialized innovations in design and functionality. In the construction industry, where heavy machinery operates around-the-clock on rugged terrains, powerful floodlights and glare-free cabin lighting are essential for maintaining safety during night operations or in dim environments like tunnels. In mining, explosion-proof lighting and enhanced dust-proof housings are critical due to the hazardous, particulate-rich nature of the surroundings. Agricultural vehicles require lighting systems that provide uniform field illumination without disturbing wildlife or overexposing crops - adaptive beam patterns and selective wavelength lighting are emerging to meet these needs. Forestry machinery demands narrow-beam spotlights that can penetrate dense vegetation, helping operators navigate tight clearings with precision. Even within the same industry, lighting must be customized to suit the function of each vehicle - whether it’ s a bulldozer, harvester, grader, or wheel loader. OEMs are increasingly embedding smart lighting solutions that adjust brightness based on ambient conditions, integrate with telematics, and provide diagnostic feedback to vehicle control systems. Additionally, increased emphasis on operator comfort and visibility inside the cabin is influencing interior lighting design. As safety regulations and operational expectations evolve, sector-specific lighting requirements are playing a pivotal role in driving innovation, leading to a new generation of robust, intelligent, and energy-efficient lighting systems for every off-highway vehicle use case.Is Smart and Connected Lighting the Next Frontier for Off-Highway Vehicles?

The off-highway vehicle lighting market is at the cusp of a digital transformation, with smart and connected lighting systems emerging as key enablers of automation, efficiency, and predictive maintenance. Integration of lighting with IoT (Internet of Things) platforms and vehicle telematics is enabling real-time monitoring and remote control of lighting functions, especially useful in fleet management scenarios. Smart lighting systems equipped with sensors can automatically adjust brightness, beam angle, and activation based on environmental inputs like terrain type, proximity to other vehicles, or operator activity. This not only improves energy efficiency but also enhances situational awareness and reduces human error. Some advanced systems even offer geofencing capabilities, automatically activating specific lighting patterns in designated zones such as loading bays, hazardous areas, or high-traffic intersections within large worksites. AI and machine learning are also being applied to optimize lighting based on historical usage patterns, helping to prolong the life of the equipment and reduce overall maintenance costs. Furthermore, wireless control modules and Bluetooth connectivity are becoming standard features, allowing operators to adjust lighting configurations via mobile apps or integrated displays. These smart lighting solutions are especially relevant in autonomous or semi-autonomous vehicle platforms, where lighting can serve both operational and signaling functions without direct human intervention. As digitization becomes an operational priority in off-highway industries, the convergence of lighting with intelligent vehicle systems is redefining how visibility and safety are managed in the field.What Factors Are Driving the Rapid Expansion of the Off-Highway Vehicle Lighting Market?

The growth in the off-highway vehicle lighting market is driven by several factors related to technological evolution, industry safety norms, equipment modernization, and end-user expectations. One of the foremost drivers is the rising global demand for infrastructure development, mining output, mechanized agriculture, and sustainable forestry - all of which require reliable heavy-duty vehicles that operate in challenging conditions, often around the clock. This operational intensity amplifies the need for durable and high-performance lighting systems that enhance visibility, safety, and equipment uptime. Technological advancements, particularly the widespread adoption of LED lighting, are enabling manufacturers to offer long-lasting, vibration-resistant, and power-efficient solutions that outperform older halogen or HID systems. Additionally, government regulations and occupational safety standards are mandating better lighting on construction and agricultural equipment, prompting OEMs and aftermarket players to upgrade lighting systems to stay compliant. Consumer behavior and fleet operator preferences are also shifting toward intelligent, connected, and aesthetically refined lighting designs that align with broader trends in machine digitization and operator ergonomics. The growing popularity of autonomous and remotely operated off-highway vehicles is creating demand for lighting systems that serve as both functional tools and status indicators. Moreover, improvements in manufacturing processes, materials science, and modular design are making advanced lighting solutions more affordable and scalable, even for small and mid-sized equipment. Collectively, these factors are converging to fuel a robust and dynamic growth trajectory for the global off-highway vehicle lighting market, positioning it as a critical enabler of productivity and safety in tomorrow’ s heavy-duty industries.Report Scope

The report analyzes the Off-highway Vehicle Lighting market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Halogen Vehicle Lighting, LED Vehicle Lighting, HID Vehicle Lighting, Incandescent Vehicle Lighting); Vehicle (Tractor Vehicles, Excavator Vehicles, Loader Vehicles, Crane Vehicles, Dump Truck Vehicles, Other Vehicles); Application (Head Lamps Application, Tail Lamps Application, Work Lights Application, Other Applications); End-Use (Construction End-Use, Agriculture / Farming / Forestry End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Halogen Lighting segment, which is expected to reach US$707.4 Million by 2030 with a CAGR of a 4.8%. The LED Lighting segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $314.6 Million in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $311.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Off-highway Vehicle Lighting Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Off-highway Vehicle Lighting Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Off-highway Vehicle Lighting Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as B. Braun Melsungen AG, Bausch + Lomb Incorporated, Blink Medical Ltd, Bolton Surgical Ltd, BVI Medical and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Off-highway Vehicle Lighting market report include:

- ABL Lights Group

- APS Lighting and Safety

- ECCO Safety Group

- Flex-N-Gate Corporation

- Grote Industries

- Hamsar Diversco Inc.

- HELLA GmbH & Co. KGaA

- J.W. Speaker Corporation

- KC HiLiTES, Inc.

- Koito Manufacturing Co., Ltd.

- Magneti Marelli S.p.A.

- Marelli Holdings Co., Ltd.

- OSRAM GmbH

- Peterson Manufacturing Co.

- Phoenix Lamps Ltd.

- Robert Bosch GmbH

- Truck-Lite Co., LLC

- Valeo SA

- Vision X Lighting

- WESEM

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABL Lights Group

- APS Lighting and Safety

- ECCO Safety Group

- Flex-N-Gate Corporation

- Grote Industries

- Hamsar Diversco Inc.

- HELLA GmbH & Co. KGaA

- J.W. Speaker Corporation

- KC HiLiTES, Inc.

- Koito Manufacturing Co., Ltd.

- Magneti Marelli S.p.A.

- Marelli Holdings Co., Ltd.

- OSRAM GmbH

- Peterson Manufacturing Co.

- Phoenix Lamps Ltd.

- Robert Bosch GmbH

- Truck-Lite Co., LLC

- Valeo SA

- Vision X Lighting

- WESEM

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 489 |

| Published | January 2026 |

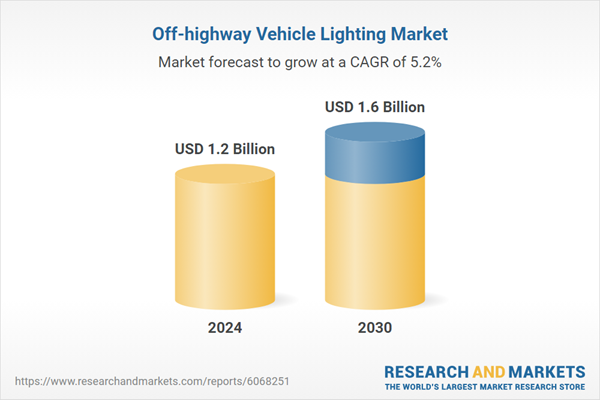

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |