Global Healthcare Creditor Insurance Market - Key Trends & Drivers Summarized

Why Is Healthcare Creditor Insurance Gaining Momentum?

Healthcare creditor insurance has become an essential financial tool in mitigating risks associated with unpaid medical debts, offering a safety net for both healthcare providers and patients. As healthcare costs continue to rise globally, individuals and families struggle with medical expenses, leading to increased cases of non-payment and bad debt for hospitals and clinics. Creditor insurance ensures that healthcare providers receive timely payments while shielding patients from financial burdens in times of illness, disability, or job loss. With the growing prevalence of chronic diseases and unexpected medical emergencies, the need for financial products that secure medical payments is increasing. Additionally, insurance companies are partnering with healthcare institutions to integrate creditor insurance solutions directly into patient billing systems, ensuring seamless access to coverage. The COVID-19 pandemic further underscored the importance of healthcare financing mechanisms, as job losses and economic instability led to a surge in unpaid medical bills. Governments and regulatory bodies are also encouraging the adoption of creditor insurance as part of broader healthcare affordability and financial inclusion initiatives. As healthcare expenditure rises and financial risks become more pronounced, the demand for robust creditor insurance policies is expected to accelerate, providing critical support to both patients and healthcare organizations.How Are Digital Innovations Transforming Healthcare Creditor Insurance?

The rapid digitization of financial services and insurance products is reshaping the healthcare creditor insurance market, making policies more accessible and efficient. Insurtech companies are leveraging artificial intelligence (AI), big data, and blockchain technology to streamline underwriting, risk assessment, and claims processing. AI-driven risk analytics enable insurers to assess an individual's financial and medical history in real time, allowing for more accurate premium pricing and faster approvals. The integration of digital payment platforms and automated billing systems has also facilitated seamless premium collection, reducing administrative delays for both insurers and healthcare providers. Additionally, blockchain technology is being utilized to enhance data security, ensuring transparency and reducing fraud in insurance transactions. The use of machine learning algorithms helps detect potential defaults early, allowing insurers to intervene with payment restructuring options. Mobile applications and self-service portals are further improving customer engagement, enabling policyholders to manage their insurance coverage, file claims, and receive instant approvals without the need for manual intervention. As digital innovations continue to enhance efficiency and accessibility, technology-driven creditor insurance solutions are expected to dominate the market, offering greater convenience for policyholders and healthcare institutions alike.What Regulatory and Market Challenges Impact Healthcare Creditor Insurance?

Despite its growing importance, the healthcare creditor insurance market faces several challenges, including regulatory complexities, affordability issues, and consumer awareness. Regulatory frameworks governing creditor insurance vary across regions, requiring insurers to navigate compliance requirements related to credit protections, consumer rights, and healthcare financing policies. In some countries, stringent regulations on credit-based insurance policies make it difficult for insurers to expand their offerings. Additionally, affordability remains a significant barrier, as low-income populations may struggle to pay for insurance premiums, even if the benefits outweigh the costs. The perception of insurance as an additional financial burden rather than a safety net further limits adoption. Another challenge is the lack of awareness and financial literacy among patients, many of whom are unaware of the availability of creditor insurance policies that could ease their healthcare expenses. Moreover, the dynamic nature of healthcare costs makes it difficult for insurers to predict long-term risks, leading to conservative underwriting practices that may exclude high-risk individuals. Addressing these challenges requires increased consumer education, policy reforms that promote accessibility, and innovative pricing models that cater to diverse patient demographics.What Is Driving the Growth of the Healthcare Creditor Insurance Market?

The growth in the healthcare creditor insurance market is driven by several factors, including rising healthcare costs, increasing medical debt, and the expansion of digital insurance services. The growing burden of out-of-pocket medical expenses is pushing more individuals and businesses to seek creditor insurance as a financial safety measure. Additionally, the rise of flexible insurance plans and pay-as-you-go models is making creditor insurance more attractive to a wider range of consumers. The expansion of microinsurance solutions targeted at low-income populations is also contributing to market growth, as insurers develop affordable coverage options that align with varying financial capacities. The increasing collaboration between insurance companies and healthcare providers is streamlining the integration of creditor insurance into hospital billing systems, ensuring broader accessibility. Moreover, the proliferation of embedded insurance solutions - where creditor insurance is automatically bundled with healthcare loans, credit cards, or employer benefits - has expanded market penetration. With advancements in AI-driven risk modeling and blockchain-based claims management, the efficiency of creditor insurance services is improving, making them more reliable and scalable. As financial security becomes a priority in healthcare planning, the demand for comprehensive and technology-driven creditor insurance solutions is expected to rise, reshaping the landscape of medical financing worldwide.Report Scope

The report analyzes the Healthcare Creditor Insurance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (Direct Sales Distribution Channel, Brokers & Individual Agents Distribution Channel, Bankers Distribution Channel, Other Distribution Channels); Age Group (Pediatric, Adult, Geriatric).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Direct Sales Distribution Channel segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 7.7%. The Brokers & Individual Agents Distribution Channel segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $524.8 Million in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $620.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Healthcare Creditor Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Healthcare Creditor Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Healthcare Creditor Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Health Media (AHM), Alphanumeric Systems, Inc., AmerisourceBergen Corporation, Ashfield Healthcare Communications, Axxelus and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Healthcare Creditor Insurance market report include:

- Aflac Incorporated

- Allianz SE

- American International Group (AIG)

- Assurant, Inc.

- Aviva plc

- AXA S.A.

- Canada Life Assurance Company

- CareCredit (Synchrony Financial)

- Cigna Corporation

- Generali Group

- Legal & General Group plc

- Manulife Financial Corporation

- MetLife, Inc.

- Munich Re Group

- Prudential Financial, Inc.

- Securian Financial Group, Inc.

- Sun Life Financial Inc.

- Swiss Re Group

- UnitedHealth Group Incorporated

- Zurich Insurance Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aflac Incorporated

- Allianz SE

- American International Group (AIG)

- Assurant, Inc.

- Aviva plc

- AXA S.A.

- Canada Life Assurance Company

- CareCredit (Synchrony Financial)

- Cigna Corporation

- Generali Group

- Legal & General Group plc

- Manulife Financial Corporation

- MetLife, Inc.

- Munich Re Group

- Prudential Financial, Inc.

- Securian Financial Group, Inc.

- Sun Life Financial Inc.

- Swiss Re Group

- UnitedHealth Group Incorporated

- Zurich Insurance Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

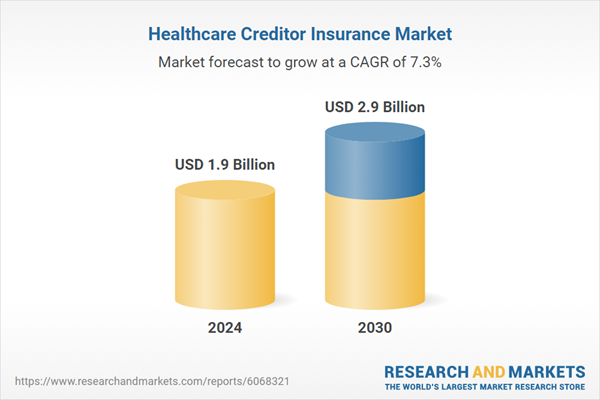

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.9 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |