Global Chemical Merchant Hydrogen Generation Market - Key Trends & Drivers Summarized

Why is Merchant Hydrogen Generation Becoming a Key Industry Trend?

The demand for merchant hydrogen generation is experiencing a sharp rise, driven by the global push towards clean energy and industrial decarbonization. Merchant hydrogen, produced at central facilities and distributed to end-users, is increasingly becoming a vital part of the hydrogen supply chain. With growing concerns over climate change and carbon emissions, industries are seeking cleaner alternatives to traditional fossil fuels, positioning hydrogen as a key energy carrier. The expansion of the hydrogen economy is primarily fueled by its use in industrial applications, transportation, and power generation. Hydrogen’ s potential as a zero-emission fuel source is being actively explored by governments and industries looking to meet sustainability goals. Key players in the chemical, refining, and manufacturing sectors are investing in merchant hydrogen supply chains to ensure a steady, cost-effective supply of hydrogen for various applications. The emergence of hydrogen refueling infrastructure, coupled with advancements in production and distribution technologies, is expected to further accelerate market growth.How is Technology Enhancing Hydrogen Generation Efficiency?

Innovations in hydrogen production technologies are significantly improving the efficiency and cost-effectiveness of merchant hydrogen generation. Traditional hydrogen production methods, such as steam methane reforming (SMR), are being optimized with carbon capture and storage (CCS) solutions, reducing emissions while maintaining economic feasibility. Moreover, the increasing investment in electrolysis-based hydrogen production is enabling the development of green hydrogen, which utilizes renewable energy sources such as solar and wind power to generate hydrogen without carbon emissions. The integration of artificial intelligence (AI) and digital twin technology is further enhancing the efficiency of hydrogen production plants, optimizing energy consumption, monitoring equipment performance, and reducing operational downtime. Additionally, the development of modular and decentralized hydrogen generation systems is making on-site production more accessible for industrial end-users, reducing reliance on long-distance transportation and enhancing supply chain resilience.Which Industries Are Driving Demand for Merchant Hydrogen?

Several industries are at the forefront of merchant hydrogen adoption, primarily driven by its diverse applications in energy, transportation, and industrial processes. The petrochemical and refining sectors are some of the largest consumers of merchant hydrogen, using it for hydrotreating, hydrocracking, and desulfurization processes to produce cleaner fuels. However, with stringent carbon reduction targets, many refineries are shifting towards blue and green hydrogen solutions to minimize their environmental footprint. The transportation industry is another significant driver, with hydrogen fuel cell technology gaining traction in heavy-duty trucks, buses, trains, and even maritime vessels. Countries investing in hydrogen-powered public transportation and logistics fleets are creating substantial demand for merchant hydrogen supply chains. Additionally, power generation companies are integrating hydrogen-based energy storage solutions to balance intermittent renewable energy sources, further driving the market’ s expansion. The steel and cement industries, both major carbon emitters, are also exploring hydrogen-based production techniques to decarbonize their operations.What Factors Are Driving Market Growth?

The growth in the Chemical Merchant Hydrogen Generation market is driven by several factors, including technological advancements, regulatory policies, and shifting industry priorities. Governments worldwide are implementing hydrogen roadmaps, subsidies, and carbon pricing mechanisms to accelerate the adoption of low-carbon hydrogen solutions. The declining cost of renewable energy is also making green hydrogen production more competitive, encouraging industries to transition away from fossil-fuel-based hydrogen generation. Furthermore, the rising demand for hydrogen-based energy storage solutions is enhancing the market’ s scalability, particularly as nations expand their renewable energy capacity. The expansion of hydrogen refueling stations and distribution networks is also a critical factor, enabling broader adoption of hydrogen-powered vehicles and industrial applications. Additionally, evolving consumer preferences for sustainable products are pushing industries to incorporate low-carbon hydrogen solutions into their supply chains. With cross-sector collaboration and increased investment in hydrogen infrastructure, the merchant hydrogen market is poised for long-term growth, playing a central role in the future energy transition.Report Scope

The report analyzes the Chemical Merchant Hydrogen Generation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Process Type (Steam Reformer Process, Electrolysis Process, Other Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Steam Reformer Process segment, which is expected to reach US$9.9 Billion by 2030 with a CAGR of a 7.3%. The Electrolysis Process segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $4.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chemical Merchant Hydrogen Generation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chemical Merchant Hydrogen Generation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chemical Merchant Hydrogen Generation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Brenntag SE, Chemical Management Solutions, Chemours Company, Clean Harbors, Inc., Dow Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Chemical Merchant Hydrogen Generation market report include:

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Airgas, Inc.

- Bloom Energy Corporation

- BP plc

- Cummins Inc.

- ENGIE SA

- ExxonMobil Corporation

- Iberdrola

- ITM Power PLC

- Johnson Matthey

- Linde plc

- McPhy Energy

- Mitsubishi Power

- Nel ASA

- Plug Power Inc.

- Shell plc

- Siemens Energy AG

- Thyssenkrupp Nucera

- TotalEnergies SE

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Airgas, Inc.

- Bloom Energy Corporation

- BP plc

- Cummins Inc.

- ENGIE SA

- ExxonMobil Corporation

- Iberdrola

- ITM Power PLC

- Johnson Matthey

- Linde plc

- McPhy Energy

- Mitsubishi Power

- Nel ASA

- Plug Power Inc.

- Shell plc

- Siemens Energy AG

- Thyssenkrupp Nucera

- TotalEnergies SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

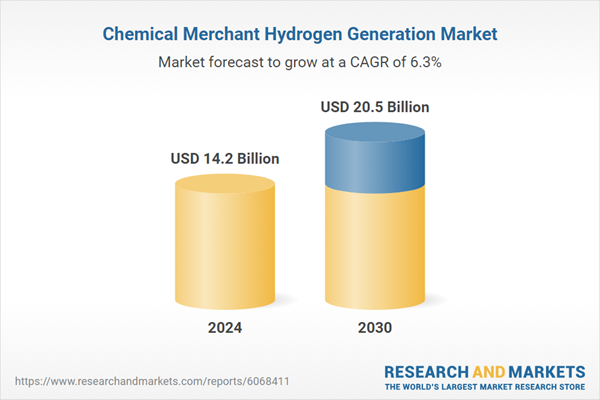

| Estimated Market Value ( USD | $ 14.2 Billion |

| Forecasted Market Value ( USD | $ 20.5 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |