Global Digital Twin in Finance Market - Key Trends & Drivers Summarized

Can Digital Twins Revolutionize Financial Modeling and Risk Assessment?

The adoption of digital twin technology in finance is transforming risk modeling, scenario analysis, and predictive forecasting, allowing financial institutions to create real-time virtual replicas of markets, portfolios, and customer behaviors. Unlike traditional financial models that rely on static datasets, digital twins continuously update with live market data, economic indicators, and customer transactions, enabling dynamic simulations for risk assessment and investment strategies. AI-powered digital twins are enhancing fraud detection by identifying anomalies in financial transactions, predicting credit risk, and optimizing investment portfolios. Moreover, banks and fintech companies are using digital twins to simulate the impact of interest rate fluctuations, regulatory changes, and economic downturns before implementing financial policies. However, while digital twin technology offers unparalleled insights, challenges such as data privacy concerns, high computational costs, and regulatory uncertainties still hinder widespread adoption. Despite these barriers, as financial institutions prioritize>How Is AI and Machine Learning Enhancing Digital Twin Applications in Finance?

Artificial intelligence (AI) and machine learning (ML) are key enablers of digital twins in finance, allowing financial institutions to analyze vast datasets, automate complex risk assessments, and personalize customer interactions. AI-driven digital twins simulate customer behavior, optimizing financial products, credit scoring models, and fraud detection systems. Machine learning algorithms continuously refine financial models based on real-time data, enhancing decision-making accuracy. In capital markets, digital twins assist traders and asset managers in modeling price fluctuations, portfolio performance, and market trends in real-time. The integration of AI-powered sentiment analysis also allows financial firms to gauge investor behavior by analyzing social media, news trends, and economic reports. However, ensuring data integrity and addressing biases in AI models remain critical challenges. As AI technologies advance, their integration with digital twins is expected to further refine financial predictions, improve risk mitigation strategies, and enhance overall financial stability.Can Digital Twins Improve Compliance and Regulatory Reporting?

Regulatory compliance and reporting are becoming increasingly complex due to evolving financial regulations and global oversight. Digital twin technology is streamlining compliance by providing financial institutions with real-time simulations of regulatory scenarios, ensuring adherence to legal frameworks. Automated compliance monitoring systems powered by digital twins reduce the risk of non-compliance by continuously analyzing financial transactions, identifying suspicious activities, and flagging anomalies for further review. Additionally, central banks and regulatory bodies are exploring digital twins to model economic policies, assess systemic risks, and improve transparency in financial operations. Despite its advantages, challenges such as ensuring data security, achieving cross-border regulatory alignment, and managing the high costs of deploying digital twin solutions remain significant hurdles. However, as regulatory technology (RegTech) continues to evolve, digital twins are expected to become a vital tool in financial governance, improving efficiency, accuracy, and regulatory adherence.What Is Driving the Growth of the Digital Twin in Finance Market?

The growth in the digital twin in finance market is driven by several factors, including advancements in AI-powered financial analytics, increasing demand for real-time risk assessment, and rising regulatory compliance requirements. The acceleration of digital banking and fintech innovations is pushing financial institutions to adopt predictive modeling tools to enhance decision-making and risk management. The growing adoption of blockchain and decentralized finance (DeFi) is creating new use cases for digital twins in fraud prevention and transaction monitoring. Additionally, the expansion of cloud-based computing and high-performance analytics is enabling financial firms to simulate complex financial environments with greater efficiency. The increasing focus on cybersecurity and digital fraud prevention is also fueling the demand for AI-driven financial digital twins. Despite challenges such as data security concerns and high implementation costs, the market for digital twins in finance is expected to witness significant expansion, reshaping the financial landscape with advanced predictive and analytical capabilities.Report Scope

The report analyzes the Digital Twin in Finance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Offering (Platforms & Solutions, Professional Services, Managed Services); Application (Risk Assessment & Compliance Application, Process Optimization Application, Insurance Claims Management Application, Testing & Simulation Application, Other Applications); End-Use (Banking End-Use, Financial Services End-Use, Insurance End-Use, Manufacturing End-Use, Transportation & Logistics End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Platforms & Solutions segment, which is expected to reach US$412.1 Million by 2030 with a CAGR of a 29.3%. The Professional Services segment is also set to grow at 39.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $38.3 Million in 2024, and China, forecasted to grow at an impressive 31.7% CAGR to reach $123.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Twin in Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Twin in Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Twin in Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACI Worldwide, Adobe Inc., airSlate Inc., Citrix Systems Inc., DocuSign Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Digital Twin in Finance market report include:

- Accenture

- Altair Engineering Inc.

- Atos SE

- Capgemini

- Cognizant

- Deloitte

- Ernst & Young (EY)

- FIS Global

- IBM

- Infosys

- KPMG

- Microsoft Corporation

- Multiverse Computing

- Oracle Corporation

- PwC

- SAP SE

- Tata Consultancy Services

- Wipro Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- Altair Engineering Inc.

- Atos SE

- Capgemini

- Cognizant

- Deloitte

- Ernst & Young (EY)

- FIS Global

- IBM

- Infosys

- KPMG

- Microsoft Corporation

- Multiverse Computing

- Oracle Corporation

- PwC

- SAP SE

- Tata Consultancy Services

- Wipro Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

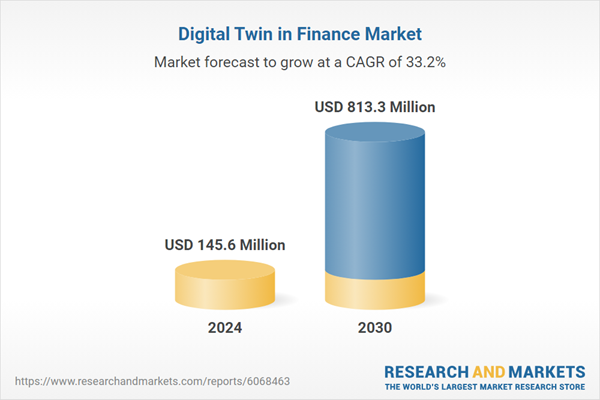

| Estimated Market Value ( USD | $ 145.6 Million |

| Forecasted Market Value ( USD | $ 813.3 Million |

| Compound Annual Growth Rate | 33.2% |

| Regions Covered | Global |