Global Medium Voltage Industrial Transmission Substation Market - Key Trends & Growth Drivers Summarized

Why Are Medium Voltage Industrial Transmission Substations Critical for Power Distribution?

Medium voltage (MV) industrial transmission substations are an essential component of modern electrical infrastructure, acting as intermediary nodes that regulate and distribute electricity between high-voltage transmission networks and medium-voltage industrial consumers. Typically operating within a voltage range of 1 kV to 72 kV, these substations play a crucial role in stepping down high-voltage electricity from transmission lines to more manageable levels suitable for industrial operations, manufacturing plants, and commercial facilities. Unlike traditional distribution substations that primarily serve residential and small commercial areas, MV industrial transmission substations are designed to handle high-power loads, ensuring stability and reliability in energy-intensive industries such as oil and gas, mining, steel production, and automotive manufacturing. The increasing complexity of industrial power demand, coupled with the growing integration of renewable energy sources, has made MV substations indispensable in managing grid stability, improving power factor correction, and ensuring operational continuity. As industries continue to electrify and adopt smart grid technologies, the role of MV industrial transmission substations in enhancing energy efficiency and supporting large-scale industrial applications is becoming even more critical.How Are Technological Advancements Transforming MV Industrial Transmission Substations?

The medium voltage industrial transmission substation market is witnessing rapid technological advancements that are enhancing efficiency, reliability, and operational flexibility. One of the most significant innovations is the adoption of digital substations, which integrate intelligent electronic devices (IEDs), real-time monitoring systems, and automated control mechanisms to optimize power distribution. These smart substations enable remote diagnostics, predictive maintenance, and faster fault isolation, minimizing downtime and improving operational efficiency. Another key development is the shift toward gas-insulated switchgear (GIS) technology, which replaces conventional air-insulated switchgear (AIS) with compact, high-performance gas-insulated solutions that reduce footprint requirements and enhance system reliability. Additionally, the use of eco-friendly insulation gases, as alternatives to sulfur hexafluoride (SF6), is gaining traction, helping industries meet stringent environmental regulations while maintaining high-voltage insulation performance. The integration of energy storage solutions, particularly battery energy storage systems (BESS), within MV transmission substations is also becoming increasingly important for load balancing, peak shaving, and improving grid stability.What Is Driving the Growing Demand for MV Industrial Transmission Substations?

The rising demand for medium voltage industrial transmission substations is being fueled by several key factors, including industrial expansion, increasing electrification of manufacturing processes, and the integration of renewable energy into the grid. Industries such as petrochemicals, heavy manufacturing, and mining require robust and reliable power distribution networks, making MV substations essential for ensuring uninterrupted operations. The ongoing transition toward renewable energy sources, particularly wind and solar power, has also accelerated the need for flexible and adaptive MV substations that can manage fluctuating energy inputs and maintain grid stability. Additionally, the rapid expansion of electric vehicle (EV) charging infrastructure and data centers is driving demand for high-capacity substations capable of handling increasing power loads efficiently. The rise of smart cities and digital infrastructure projects has further contributed to market growth, as MV industrial transmission substations play a key role in powering urban energy networks, commercial hubs, and critical infrastructure. Moreover, government initiatives focused on grid modernization, energy security, and sustainability are encouraging investments in advanced substation technologies, promoting the adoption of energy-efficient and resilient power distribution systems.What Factors Are Fueling the Growth of the Global MV Industrial Transmission Substation Market?

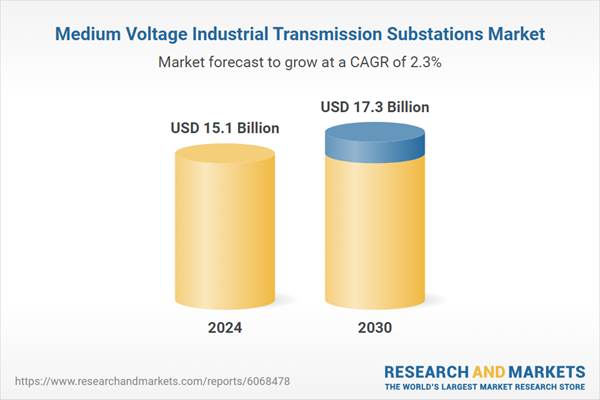

The growth in the medium voltage industrial transmission substation market is driven by several factors, including industrial automation, grid modernization initiatives, renewable energy integration, and advancements in digital power management. One of the primary growth drivers is the increasing industrial reliance on automated and digital manufacturing systems, which require stable and high-quality power supply, making MV substations crucial for operational efficiency. The push toward renewable energy transition has also been a major factor, as substations must be equipped with advanced power management systems to handle distributed energy resources (DERs) while maintaining grid stability. The expansion of high-power electric transportation infrastructure, including rail electrification and EV charging networks, is further contributing to market growth, as these applications demand robust and reliable medium voltage distribution solutions. Additionally, regulatory mandates for improving power efficiency and reducing transmission losses are prompting utilities and industrial players to invest in next-generation substations that incorporate digital controls, real-time monitoring, and automated fault detection. Another key factor is the increasing emphasis on resilient energy infrastructure in response to climate change-related disruptions, driving demand for substations with self-healing grid capabilities and enhanced disaster recovery mechanisms. With these trends shaping the industry, the global MV industrial transmission substation market is poised for substantial growth, driven by technological innovation, sustainability goals, and the continued expansion of industrial and commercial energy infrastructure worldwide.Report Scope

The report analyzes the Medium Voltage Industrial Transmission Substations market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Conventional, Digital); Component (Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, Others); Category (New, Refurbished).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventional Technology segment, which is expected to reach US$11.3 Billion by 2030 with a CAGR of a 2.3%. The Digital Technology segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.1 Billion in 2024, and China, forecasted to grow at an impressive 4.5% CAGR to reach $3.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medium Voltage Industrial Transmission Substations Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medium Voltage Industrial Transmission Substations Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medium Voltage Industrial Transmission Substations Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACME Engineering Products Ltd., AERCO International, Inc., Ariston Holding NV, Babcock Wanson, Bosch Industriekessel GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Medium Voltage Industrial Transmission Substations market report include:

- ABB Ltd.

- Alstom SA

- Burns & McDonnell

- Caverion Corporation

- CEPCO (Civil & Electrical Projects Contracting Company)

- CG Power and Industrial Solutions

- Chint Group

- Cooper Power Systems (Eaton)

- Eaton Corporation plc

- Efacec Power Solutions

- General Electric Company

- Hartigan Power Equipment

- Hitachi Energy Ltd.

- Larsen & Toubro Limited

- Locamation BV

- MasTec, Inc.

- Michels Corporation

- Mitsubishi Electric Power Products, Inc. (MEPPI)

- MYR Group Inc.

- Open Systems International, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alstom SA

- Burns & McDonnell

- Caverion Corporation

- CEPCO (Civil & Electrical Projects Contracting Company)

- CG Power and Industrial Solutions

- Chint Group

- Cooper Power Systems (Eaton)

- Eaton Corporation plc

- Efacec Power Solutions

- General Electric Company

- Hartigan Power Equipment

- Hitachi Energy Ltd.

- Larsen & Toubro Limited

- Locamation BV

- MasTec, Inc.

- Michels Corporation

- Mitsubishi Electric Power Products, Inc. (MEPPI)

- MYR Group Inc.

- Open Systems International, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.1 Billion |

| Forecasted Market Value ( USD | $ 17.3 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |