Global PFAS Filtration Market - Key Trends & Drivers Summarized

Why Is PFAS Filtration Emerging as a Critical Component in Global Water Safety Initiatives?

PFAS (Per- and polyfluoroalkyl substances), commonly referred to as “forever chemicals,” have become a focal point in global environmental and public health discussions due to their persistence, bioaccumulative nature, and links to various health conditions, including cancer and endocrine disruption. These synthetic compounds are commonly found in non-stick cookware, water-repellent fabrics, firefighting foams, and industrial applications. With rising concerns over contaminated groundwater, drinking water, and wastewater, the demand for efficient PFAS filtration solutions is accelerating across municipal, industrial, and residential sectors.Increasing awareness of the dangers posed by PFAS, along with stricter water quality standards and regulatory mandates, is driving investment in advanced filtration systems. Governments, utilities, and private entities are rapidly adopting PFAS remediation technologies to protect human health and meet compliance obligations. This shift is not only pushing the adoption of proven technologies like activated carbon filters but also fostering innovation in next-generation filtration systems designed for higher specificity and cost-effectiveness in PFAS removal.

How Are Technological Innovations Enhancing PFAS Filtration Efficiency?

Emerging technologies are significantly advancing the performance and scope of PFAS filtration systems. Traditional solutions such as granular activated carbon (GAC) remain widely used for removing longer-chain PFAS compounds, but newer techniques are offering enhanced effectiveness and operational flexibility. Ion exchange resins, for instance, are being engineered to selectively bind with PFAS molecules, improving removal rates and system lifespan. These resins are increasingly being used in municipal water systems and industrial facilities alike.In parallel, membrane filtration technologies like nanofiltration and reverse osmosis are proving highly effective in eliminating both long-chain and short-chain PFAS compounds. While more capital intensive, these systems offer high removal efficiency and are gaining traction in high-risk or heavily contaminated sites. Advanced oxidation processes (AOPs) and electrochemical degradation technologies are also being developed to not just filter, but break down PFAS compounds, thereby addressing long-term environmental persistence. Innovations in modular and scalable system design are further enabling flexible deployment across diverse treatment scenarios.

Which Sectors and Applications Are Driving the Demand for PFAS Filtration?

The largest and most immediate driver for PFAS filtration is in drinking water treatment, where public utilities are under increasing pressure to ensure compliance with new safety standards. Utilities are investing in large-scale filtration systems to address both surface water and groundwater contamination, particularly in regions where PFAS usage has historically been widespread. In addition to public water systems, private and rural well users are also adopting point-of-entry and point-of-use PFAS filtration units to ensure personal water safety.Other key applications include industrial wastewater treatment, where sectors such as textiles, electronics, and chemical manufacturing must manage PFAS emissions as part of sustainability and compliance strategies. Environmental remediation is another growing segment, with filtration systems deployed in former industrial and military sites to clean up legacy PFAS pollution. Additionally, food processing and packaging sectors are exploring filtration technologies to limit PFAS exposure from processing equipment and water inputs, in response to tightening food safety regulations and consumer scrutiny.

What Is Fueling Market Growth Across Regulations, Innovation, and Environmental Demand?

The growth in the PFAS filtration market is driven by several factors deeply rooted in regulatory mandates, environmental urgency, and technological progression. One of the most significant growth drivers is the tightening of national and international regulations around permissible PFAS levels in water supplies. Regulatory frameworks are increasingly being updated to mandate PFAS monitoring, enforce discharge limits, and require proactive treatment, prompting immediate investments in filtration infrastructure.Simultaneously, rising public awareness of PFAS exposure through drinking water and food chains is fostering consumer demand for filtration solutions at the household level. This demand is also pushing manufacturers to develop compact, cost-effective, and highly selective filtration products suited for residential and commercial users. Industrial facilities, facing reputational and legal risks, are preemptively adopting PFAS filtration systems to align with environmental standards and corporate responsibility commitments. Advancements in filter media, system design, and treatment integration are also making PFAS filtration more scalable and economically viable. Collectively, these drivers are establishing PFAS filtration as a vital technology in safeguarding public health and supporting environmental stewardship.

Report Scope

The report analyzes the PFAS Filtration market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Water Treatment Systems, Water Treatment Chemicals); Contaminant Type (PFOA & PFOS, Multiple PFAS Compounds); Remediation Technology (Membranes, Chemicals); End-Use (Industrial End-Use, Commercial End-Use, Municipal End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water Treatment Systems segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 7.2%. The Water Treatment Chemicals segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $525.2 Million in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $567 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global PFAS Filtration Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global PFAS Filtration Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global PFAS Filtration Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 374Water Inc., Aclarity LLC, AECOM, Aquarden Technologies, Calgon Carbon Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this PFAS Filtration market report include:

- 374Water Inc.

- Aclarity LLC

- AECOM

- Aquarden Technologies

- Calgon Carbon Corporation

- CDM Smith

- Clean Harbors

- Clear Creek Systems

- Crystal Clean

- ECT2 (Emerging Compounds Treatment Technologies)

- Gradiant

- GWTT (Ground/Water Treatment & Technology, LLC)

- Kinetico Incorporated

- Montrose Environmental Group

- Newterra

- Oxyle AG

- Pentair

- Regenesis

- Veolia

- Xylem Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 374Water Inc.

- Aclarity LLC

- AECOM

- Aquarden Technologies

- Calgon Carbon Corporation

- CDM Smith

- Clean Harbors

- Clear Creek Systems

- Crystal Clean

- ECT2 (Emerging Compounds Treatment Technologies)

- Gradiant

- GWTT (Ground/Water Treatment & Technology, LLC)

- Kinetico Incorporated

- Montrose Environmental Group

- Newterra

- Oxyle AG

- Pentair

- Regenesis

- Veolia

- Xylem Inc.

Table Information

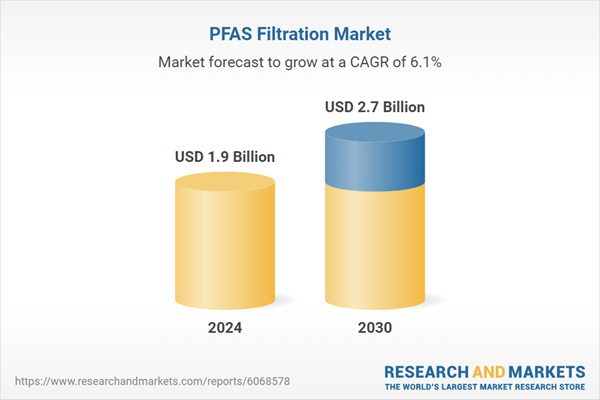

| Report Attribute | Details |

|---|---|

| No. of Pages | 457 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |