Global Plant-Based Excipients Market - Key Trends & Drivers Summarized

The plant-based excipients market is experiencing significant growth, driven by increasing demand for clean-label pharmaceuticals, rising preference for natural ingredients, and advancements in sustainable drug formulation technologies. Excipients play a crucial role in pharmaceutical, nutraceutical, and cosmetic formulations, serving as binders, fillers, disintegrants, stabilizers, emulsifiers, and coating agents. As consumers and regulators push for eco-friendly, biocompatible, and non-toxic alternatives, pharmaceutical companies are shifting toward plant-derived excipients over their synthetic and animal-based counterparts.One of the most significant trends driving the market is the clean-label movement, where consumers are demanding natural, chemical-free, and plant-based alternatives in medicines and supplements. Conventional excipients, such as gelatin (from animal collagen) and synthetic polymers, are being replaced with cellulose, starches, pectin, and gum-based excipients that offer biodegradability, reduced toxicity, and sustainability benefits.

Another key driver is the increasing regulatory scrutiny on synthetic excipients, particularly petrochemical-derived binders and fillers that may pose health risks. Regulatory agencies, including the U.S. FDA, European Medicines Agency (EMA), and Indian Pharmacopeia Commission (IPC), are emphasizing natural and biocompatible excipients in drug formulations. This has led to increased R&D investments in plant-based excipient innovations, especially in orally disintegrating tablets (ODTs), extended-release formulations, and bioavailability-enhancing drug carriers.

Furthermore, sustainability and green chemistry initiatives are accelerating the shift toward plant-based excipients. The pharmaceutical industry is under pressure to reduce its carbon footprint, minimize reliance on petroleum-based materials, and adopt biodegradable formulation ingredients. Plant-derived excipients such as aloe vera gel, rice bran wax, and modified starches offer renewable, non-GMO, and environmentally friendly solutions, making them an attractive choice for pharmaceutical and nutraceutical manufacturers.

How Are Plant-Based Excipients Transforming Pharmaceutical and Nutraceutical Formulations?

The pharmaceutical and nutraceutical industries are increasingly adopting plant-based excipients due to their biocompatibility, stability, and ability to enhance drug delivery and bioavailability. These excipients are widely used in tablet formulations, capsules, suspensions, topical gels, and controlled-release drug systems.One of the most significant applications is in oral solid dosage forms (OSDs), where plant-based binders and disintegrants improve tablet cohesion, dissolution rates, and patient compliance. Natural excipients such as microcrystalline cellulose (MCC), starch derivatives, and pectin are replacing synthetic polyvinylpyrrolidone (PVP) and hydroxypropyl methylcellulose (HPMC) due to their better biodegradability and lower allergenic potential.

Another key area of innovation is in sustained-release and bioavailability-enhancing formulations. Plant-derived polysaccharides, such as xanthan gum, guar gum, and alginate, are being used to modify drug release kinetics, improve solubility, and optimize pharmacokinetics. These excipients enable better drug absorption, reducing the need for synthetic surfactants and chemical stabilizers.

In capsule manufacturing, plant-based excipients are replacing gelatin (derived from animal collagen) with hydroxypropyl methylcellulose (HPMC) and pullulan (from tapioca starch). These vegan and halal-friendly capsules are gaining traction in the nutraceutical and dietary supplement industries, where plant-based formulations are in high demand.

Furthermore, plant-based excipients are playing a crucial role in biologics and parenteral drug formulations. Plant-derived lecithins, soy phospholipids, and natural emulsifiers are being utilized in liposomal drug delivery, injectable formulations, and vaccine adjuvants, offering enhanced stability and reduced toxicity compared to synthetic alternatives.

What Innovations Are Driving the Growth of Plant-Based Excipients?

The plant-based excipients market is undergoing significant technological advancements, with green chemistry, nanotechnology, and biopolymer engineering enhancing their functionality and performance.One of the most notable innovations is the development of plant-based nanocarriers for drug delivery. Nanocellulose, derived from wood pulp, bacterial cellulose, and plant fibers, is emerging as a high-performance excipient for targeted drug release and nanoparticle stabilization. These biodegradable nanocarriers improve drug solubility, stability, and controlled release, making them ideal for oncology drugs, biologics, and mRNA-based therapies.

Another breakthrough is the use of plant-derived lipids and waxes in sustained-release formulations and bioadhesive drug carriers. Natural waxes, such as carnauba wax and rice bran wax, are being incorporated into matrix tablets and lipid-based drug formulations, enabling slow, controlled drug release while maintaining stability in acidic and enzymatic environments.

The advancement of modified plant starches and gums is also revolutionizing excipient technology. Scientists are engineering resistant starches, cross-linked pectins, and hydrocolloid gum blends to create high-performance disintegrants, emulsifiers, and viscosity enhancers. These excipients improve tablet integrity, enhance drug solubility, and provide better bioavailability without the need for artificial stabilizers or petroleum-based additives.

Additionally, fermentation-based plant excipient production is gaining momentum. Using microbial fermentation, researchers can produce high-purity plant-derived excipients such as fermented xanthan gum, pullulan, and plant-based lecithins. This approach enhances scalability, purity, and sustainability, ensuring consistent quality for pharmaceutical-grade applications.

What Are the Key Factors Driving the Growth of the Plant-Based Excipients Market?

The growth in the plant-based excipients market is driven by several factors, including regulatory support for natural ingredients, increasing consumer demand for clean-label pharmaceuticals, and advancements in green drug formulation technologies.One of the primary drivers is the increasing prevalence of chronic diseases and the need for safer, non-toxic drug formulations. As cancer, cardiovascular diseases, and metabolic disorders continue to rise, pharmaceutical companies are looking for biodegradable, non-immunogenic, and patient-friendly excipients that enhance drug delivery while minimizing side effects.

Another key factor is the shift toward plant-based and vegan-friendly nutraceuticals. The growing adoption of herbal supplements, functional foods, and botanical-based therapeutics is increasing demand for vegan excipients such as plant cellulose, gum arabic, and natural emulsifiers. Consumers are actively seeking plant-based alternatives to synthetic fillers, artificial coatings, and petroleum-derived stabilizers, accelerating market expansion.

The rise of sustainable and eco-friendly drug manufacturing practices is also fueling the demand for biodegradable and plant-derived excipients. With pharmaceutical companies striving to reduce carbon emissions, chemical waste, and reliance on fossil fuel-based ingredients, plant-based excipients offer a renewable and environmentally responsible alternative.

Additionally, regulatory policies supporting natural excipients are playing a crucial role in market growth. Agencies such as the European Medicines Agency (EMA) and U.S. FDA are promoting the use of non-toxic, naturally derived excipients in drug formulations. The expanding pharmacopoeia standards for botanical excipients are further encouraging their adoption in both traditional pharmaceuticals and novel drug delivery systems.

As plant-based pharmaceutical innovation, green chemistry advancements, and consumer demand for natural formulations continue to rise, the plant-based excipient market is poised for significant expansion. Companies that invest in high-performance natural excipients, eco-friendly extraction techniques, and biocompatible drug formulation technologies will be at the forefront of next-generation sustainable medicine and clean-label pharmaceutical solutions.

Report Scope

The report analyzes the Plant-based Excipients market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Chemical Nature (Carbohydrates, Proteins, Polymers, Minerals, Glycoside & Waxes, Esters, Ethers & Carboxylic Acids, Others); Applications & Function (Binders & Diluents, Glidants, Lubricants & Disintegrants, Film Forming & Coating Agents, Plasticizers, Suspending Agents, Preservatives & Antioxidants, Colorants & Flavoring Agents).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Carbohydrates segment, which is expected to reach US$625 Million by 2030 with a CAGR of a 2.6%. The Proteins segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $514.4 Million in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $437.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plant-based Excipients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plant-based Excipients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plant-based Excipients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADC, Asahi Kasei Corporation, Ashland Global Holdings, Azelis Group, BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Plant-based Excipients market report include:

- ADC

- Asahi Kasei Corporation

- Ashland Global Holdings

- Azelis Group

- BASF SE

- Biogrund GmbH

- Cargill, Incorporated

- DFE Pharma

- Evonik Industries

- Henan Fumei Bio-Technology

- IMCD N.V.

- Ingredion Incorporated

- JRS PHARMA

- Kerry Group plc

- Lonza Group

- MEGGLE GmbH & Co. KG

- Micro Powders, Inc.

- Roquette Frères

- Sensient Technologies

- Stepan Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADC

- Asahi Kasei Corporation

- Ashland Global Holdings

- Azelis Group

- BASF SE

- Biogrund GmbH

- Cargill, Incorporated

- DFE Pharma

- Evonik Industries

- Henan Fumei Bio-Technology

- IMCD N.V.

- Ingredion Incorporated

- JRS PHARMA

- Kerry Group plc

- Lonza Group

- MEGGLE GmbH & Co. KG

- Micro Powders, Inc.

- Roquette Frères

- Sensient Technologies

- Stepan Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 314 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

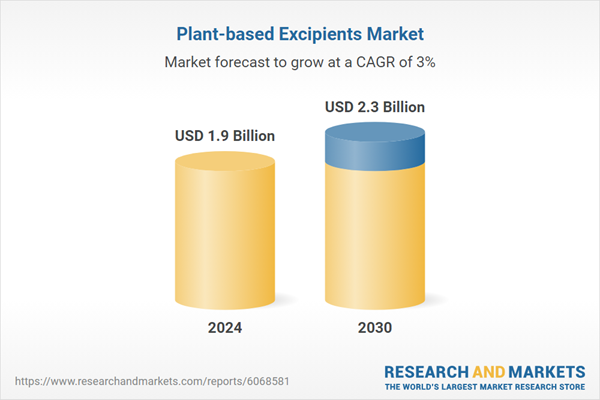

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.3 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |