Global Alternative Fuel Injection Systems Market - Key Trends & Drivers Summarized

Why Are Alternative Fuel Injection Systems Gaining Traction in the Automotive Industry?

Alternative fuel injection systems are emerging as a key technology in the transition toward cleaner and more efficient transportation. As governments and industries push for lower emissions, improved fuel efficiency, and reduced dependency on fossil fuels, the demand for alternative fuel-powered vehicles - including electric, hybrid, hydrogen, and biofuel-based systems - has surged. Fuel injection systems play a crucial role in optimizing the combustion process, enhancing engine efficiency, and reducing harmful emissions, making them essential in the development of next-generation vehicles.One of the primary drivers behind the rise of alternative fuel injection systems is the global push for decarbonization and stricter emission regulations. Governments worldwide are enforcing stringent fuel efficiency standards and emission norms, such as Euro 7 (Europe), CAFE (U.S.), and China VI emission standards, compelling automakers to adopt advanced fuel injection solutions. Technologies such as direct injection, port-fuel injection, and electronic fuel injection (EFI) are being optimized for biofuels, compressed natural gas (CNG), liquefied petroleum gas (LPG), and hydrogen-based fuel systems.

Additionally, the rising adoption of hybrid and alternative fuel vehicles has driven the need for specialized injection systems that can accommodate dual-fuel and multi-fuel engines. Modern flex-fuel vehicles (FFVs) are designed to run on ethanol blends, biodiesel, or synthetic fuels, requiring adaptive and high-precision injection systems. As the automotive industry moves toward sustainable and eco-friendly fuel options, advanced fuel metering, atomization, and combustion control technologies are becoming integral to improving engine performance and reducing fuel consumption.

What Are the Key Trends Shaping the Alternative Fuel Injection Systems Market?

The alternative fuel injection systems market is undergoing rapid transformation, driven by technological advancements, electrification trends, and the increasing adoption of hydrogen and biofuels. One of the most significant trends shaping the industry is the development of high-pressure direct injection (HPDI) technology for gaseous fuels. Unlike traditional injection systems, HPDI enables efficient combustion of CNG, LNG (Liquefied Natural Gas), and hydrogen, making it a viable solution for heavy-duty trucks, buses, and industrial vehicles.Another key trend is the integration of smart and electronically controlled fuel injection systems. Electronic Fuel Injection (EFI) and Gasoline Direct Injection (GDI) technologies are now equipped with real-time sensors, AI-driven controls, and adaptive fuel mapping, ensuring optimal fuel-air mixture and precise combustion control. These innovations help improve fuel efficiency, reduce unburned hydrocarbons, and enhance overall vehicle performance. The demand for engine control units (ECUs) and intelligent fuel management systems is rising as automakers shift toward digitized and automated fuel regulation technologies.

The rise of hydrogen fuel cell technology is also reshaping the fuel injection systems market. Hydrogen-powered vehicles require specialized direct injection systems that operate at extremely high pressures, ensuring efficient combustion and controlled ignition. Companies developing hydrogen internal combustion engines (H2-ICE) are focusing on high-precision fuel injection solutions that maximize energy output while minimizing NOx emissions. This trend is particularly gaining momentum in the commercial vehicle segment, where hydrogen-based transportation is emerging as a viable alternative to diesel engines.

Additionally, biofuel-compatible injection systems are seeing increasing adoption, particularly in the agriculture, marine, and off-highway vehicle sectors. The ability to blend biofuels with conventional gasoline or diesel has led to the development of adaptive injection technologies that optimize fuel delivery based on fuel composition, temperature, and engine load conditions. This innovation ensures seamless operation of vehicles running on ethanol, biodiesel, or synthetic fuels, helping decarbonize internal combustion engines (ICEs) without completely phasing them out.

Which Industries Are Driving the Demand for Alternative Fuel Injection Systems?

The automotive industry is the largest consumer of alternative fuel injection systems, with growing investments in hybrid, hydrogen, and biofuel-powered vehicles. Automakers are rapidly deploying flex-fuel injection systems, dual-fuel engines, and advanced GDI technology to meet emission compliance and fuel efficiency targets. The shift toward carbon-neutral transportation has also driven interest in LPG and CNG injection systems, particularly in markets such as India, Brazil, and Southeast Asia, where natural gas-powered vehicles are gaining momentum.The commercial transportation and heavy-duty vehicle sector is another major driver of market growth. Fleet operators and logistics companies are increasingly adopting LNG, CNG, and hydrogen-powered trucks to reduce fuel costs and comply with environmental regulations. The demand for high-performance injection systems capable of handling gaseous and synthetic fuels is rising, particularly in the long-haul trucking, public transit, and construction equipment industries. Companies investing in zero-emission freight solutions are exploring hydrogen and renewable natural gas (RNG) injection technologies as long-term sustainable fuel options.

The agriculture and off-road vehicle segment is also contributing to market expansion. Tractors, harvesters, and industrial machines are increasingly being retrofitted with biofuel-compatible fuel injection systems to enhance fuel efficiency and reduce carbon emissions. With government incentives promoting biofuel adoption, many rural and developing regions are shifting toward biodiesel and ethanol-blended fuels, necessitating customized injection solutions for agricultural machinery.

The marine and aviation industries are emerging as new frontiers for alternative fuel injection systems. The shipping sector is exploring liquefied biofuels, ammonia, and LNG-powered marine engines, requiring specialized high-pressure injection systems for cleaner combustion. Similarly, the aviation industry is investing in Sustainable Aviation Fuels (SAF), which demand optimized fuel atomization and combustion control technologies. The development of synthetic e-fuels and hydrogen-powered aircraft engines is further expanding the scope of advanced fuel injection technologies in aerospace applications.

What Is Driving the Growth of the Global Alternative Fuel Injection Systems Market?

The growth in the alternative fuel injection systems market is driven by stringent emission regulations, technological advancements, and increasing investment in sustainable fuel solutions. One of the most critical drivers is the global push for low-carbon transportation, as countries implement carbon neutrality goals and fossil fuel reduction strategies. Governments are offering subsidies, tax incentives, and R&D grants to accelerate the adoption of biofuels, hydrogen fuel cells, and clean combustion technologies, creating strong demand for next-generation fuel injection systems.The rise of hybrid and alternative fuel vehicles is another major factor fueling market expansion. As internal combustion engines (ICEs) evolve to support cleaner fuel options, manufacturers are developing fuel-flexible injection technologies that enable vehicles to seamlessly switch between gasoline, ethanol, natural gas, or hydrogen. The increasing penetration of hybrid-electric and plug-in hybrid vehicles (PHEVs) is further driving demand for precision-controlled, electronically regulated fuel injection systems.

Technological advancements in fuel injection precision and efficiency have played a crucial role in market growth. Innovations such as variable fuel injection timing, direct fuel metering, and AI-driven combustion control have significantly improved engine efficiency and reduced unburned fuel emissions. The integration of IoT-enabled fuel management systems is also helping fleet operators and logistics companies optimize fuel consumption and reduce operational costs.

The expansion of alternative fuel infrastructure, including hydrogen refueling stations, biofuel production plants, and LNG fueling networks, is another factor driving market growth. As governments and private entities invest in fuel diversification and renewable energy integration, the demand for advanced injection systems capable of handling multiple fuel types continues to rise.

With continuous innovation in fuel injection technologies, growing emphasis on carbon-neutral mobility, and expanding applications across multiple industries, the global alternative fuel injection systems market is poised for significant growth in the coming years.

Report Scope

The report analyzes the Alternative Fuel Injection Systems market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Fuel Type (Natural Gas, Hydrogen, LPG, Biofuels, Other Fuel Types); Component Type (Fuel Injectors, Fuel Rails, Electronic Control Unit (ECU), Pressure Regulators).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Gas Fuel segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 5.5%. The Hydrogen Fuel segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.8 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $2.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alternative Fuel Injection Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alternative Fuel Injection Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alternative Fuel Injection Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbnb, Inc., Couchsurfing International, Inc., Expedia, Inc., Holidu GmbH, HomeToGo GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Alternative Fuel Injection Systems market report include:

- Ballard Power Systems, Inc.

- BorgWarner, Inc.

- Bosch Mobility Solutions

- Continental Automotive Technologies GmbH

- Cummins, Inc.

- Denso Corporation

- Heinzmann GmbH & Co. KG

- HPDI Technology (Cespira)

- Marelli Holdings Co., Ltd.

- PHINIA Inc.

- Power Systems Mfg., LLC

- Woodward, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ballard Power Systems, Inc.

- BorgWarner, Inc.

- Bosch Mobility Solutions

- Continental Automotive Technologies GmbH

- Cummins, Inc.

- Denso Corporation

- Heinzmann GmbH & Co. KG

- HPDI Technology (Cespira)

- Marelli Holdings Co., Ltd.

- PHINIA Inc.

- Power Systems Mfg., LLC

- Woodward, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

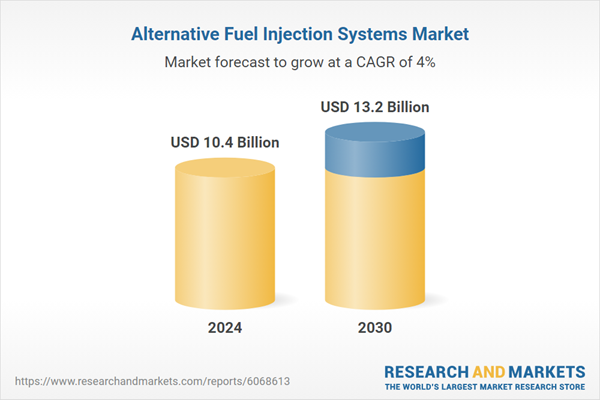

| Estimated Market Value ( USD | $ 10.4 Billion |

| Forecasted Market Value ( USD | $ 13.2 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |