Global On-Demand Warehousing Market - Key Trends & Drivers Summarized

Why Is On-Demand Warehousing Gaining Traction in the Modern Supply Chain?

On-demand warehousing is reshaping the logistics landscape by offering flexible, scalable, and technology-driven storage solutions tailored to dynamic inventory needs. Unlike traditional warehousing, which often requires long-term contracts and large upfront commitments, on-demand models allow businesses to access storage space and fulfillment services on a short-term, pay-as-you-go basis. This is particularly valuable for e-commerce retailers, seasonal businesses, and brands experiencing unpredictable sales patterns or rapid growth. The ability to quickly scale storage capacity up or down based on real-time demand helps businesses reduce overhead costs, avoid stockouts, and minimize excess inventory. Digital platforms serve as the backbone of on-demand warehousing, connecting businesses with third-party warehouses that have excess capacity. These platforms also manage inventory tracking, order fulfillment, shipping, and analytics through centralized dashboards. As omnichannel commerce grows, and last-mile delivery becomes a competitive differentiator, businesses are strategically using on-demand warehousing to position inventory closer to end customers. This geographic flexibility reduces delivery times, enhances customer experience, and improves supply chain responsiveness. With the need for agility and speed at an all-time high, on-demand warehousing is becoming a critical lever for meeting the demands of a fast-moving, consumer-driven market.How Are Technology Platforms and Data Integration Powering the On-Demand Warehousing Model?

Technology is the key enabler of on-demand warehousing, making real-time inventory access and operational transparency possible across geographically dispersed locations. Cloud-based warehousing platforms use APIs to connect seamlessly with e-commerce stores, inventory management systems, and shipping carriers, enabling end-to-end automation from order receipt to delivery. AI and machine learning algorithms are used to forecast demand, allocate inventory, and suggest optimal warehouse placement based on order history, shipping zones, and customer density. These intelligent systems enhance efficiency, reduce shipping costs, and prevent stock imbalances. Warehouse management systems (WMS) embedded within on-demand platforms allow real-time visibility into inventory levels, movement, and fulfillment accuracy. Robotics, barcode scanning, and IoT-enabled tracking tools are also increasingly integrated to support same-day and next-day delivery operations. For warehouse providers, the model transforms unused space into a monetizable asset, while for brands and retailers, it provides access to fulfillment capabilities without the burden of infrastructure ownership. Furthermore, real-time dashboards and data analytics give businesses actionable insights into shipping performance, order accuracy, and inventory turnover. This level of digital sophistication not only boosts operational performance but also makes the on-demand warehousing model more accessible to small and medium enterprises seeking enterprise-grade logistics capabilities.Can Consumer Expectations and E-Commerce Growth Sustain Long-Term Adoption of On-Demand Warehousing?

Yes - shifting consumer expectations and the explosive growth of e-commerce are foundational to the continued expansion of on-demand warehousing. Today’ s customers expect fast, affordable, and reliable delivery - often within 24 to 48 hours - which places immense pressure on retailers to hold inventory closer to consumption points. On-demand warehousing supports this need by enabling brands to maintain micro-fulfillment centers across multiple locations without building their own infrastructure. The rise of D2C (direct-to-consumer) brands, flash sales, influencer-driven product drops, and crowdfunding campaigns has increased the frequency of short-term, high-volume inventory needs. For these brands, the ability to scale fulfillment operations quickly and efficiently without committing to long leases is a game-changer. Consumer expectations around sustainability are also influencing fulfillment strategies, as on-demand warehousing can reduce emissions by shortening last-mile delivery routes. Additionally, the post-COVID supply chain landscape has driven companies to prioritize flexibility, redundancy, and resilience, encouraging the adoption of distributed warehousing models. This shift is particularly evident in industries such as fashion, electronics, health & wellness, and perishables, where order variability and speed-to-customer are critical. With customer satisfaction now directly tied to fulfillment performance, businesses are turning to on-demand warehousing as a long-term logistics solution rather than a temporary fix.What’ s Driving the Accelerated Growth of the Global On-Demand Warehousing Market?

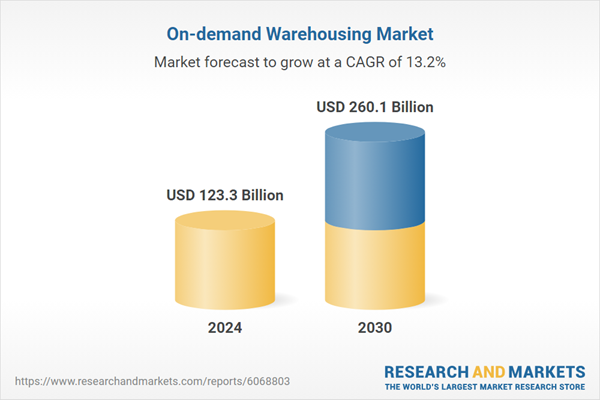

The growth in the on-demand warehousing market is driven by several interlinked factors rooted in digital transformation, evolving retail models, and supply chain decentralization. A major catalyst is the rapid growth of e-commerce and omnichannel retailing, which demands highly agile and scalable logistics networks. Retailers, brands, and marketplaces are increasingly looking for solutions that can adapt to fluctuating sales cycles, rapid product launches, and unexpected demand spikes without incurring the high costs of fixed warehousing. At the same time, the proliferation of digital warehousing marketplaces and fulfillment networks is making it easier for companies to discover, contract, and manage third-party storage space. Technological advances in WMS, cloud connectivity, and real-time tracking are making distributed inventory management more precise and efficient. The growing preference for localized fulfillment and micro-warehousing - especially in urban centers - has opened new markets and applications for on-demand services. Logistics providers and 3PLs are also joining the ecosystem, monetizing excess space and expanding value-added services to attract demand. Furthermore, global supply chain disruptions and inventory strategy shifts (from “ just-in-time” to “ just-in-case”) are prompting companies to build more resilient and distributed warehousing footprints. These evolving dynamics, supported by digital innovation and changing consumer behavior, are collectively fueling the sustained and rapid growth of the global on-demand warehousing market.Report Scope

The report analyzes the On-demand Warehousing market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Organization Size (Large Businesses, Small & Medium Businesses); Vertical (Manufacturing Vertical, Retail & E-commerce Vertical, Healthcare Vertical, Food & Beverage Vertical, Automotive Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Large Businesses segment, which is expected to reach US$182.8 Billion by 2030 with a CAGR of a 15%. The Small & Medium Businesses segment is also set to grow at 9.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $33.6 Billion in 2024, and China, forecasted to grow at an impressive 18% CAGR to reach $56.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global On-demand Warehousing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global On-demand Warehousing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global On-demand Warehousing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BlackBuck, Cargomatic, Convoy, Deliveree, DHL Supply Chain and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this On-demand Warehousing market report include:

- Amazon Logistics

- Clutter

- Extensiv

- FedEx Supply Chain

- Flexe, Inc.

- Flowspace

- GXO Logistics

- Lineage Logistics

- MakeSpace

- Neighbor

- Prologis

- ReadySpaces

- Red Stag Fulfillment

- ShipBob, Inc.

- Stord, Inc.

- Storebox

- Ware2Go Inc.

- Waredock Estonia LLC

- Wareflex

- ZhenHub Technologies Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon Logistics

- Clutter

- Extensiv

- FedEx Supply Chain

- Flexe, Inc.

- Flowspace

- GXO Logistics

- Lineage Logistics

- MakeSpace

- Neighbor

- Prologis

- ReadySpaces

- Red Stag Fulfillment

- ShipBob, Inc.

- Stord, Inc.

- Storebox

- Ware2Go Inc.

- Waredock Estonia LLC

- Wareflex

- ZhenHub Technologies Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 123.3 Billion |

| Forecasted Market Value ( USD | $ 260.1 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |