Isobutyraldehyde - Key Trends & Market Drivers Summarized

Isobutyraldehyde (IBA) is an important chemical intermediate widely used in the production of various industrial and consumer products, including agrochemicals, pharmaceuticals, plasticizers, and specialty chemicals. It is a four-carbon branched-chain aldehyde (C4H8O) primarily manufactured through the hydroformylation (oxo process) of propylene. The chemical's high reactivity and versatility make it essential for downstream applications such as isobutanol, neopentyl glycol (NPG), methacrylate esters, and rubber additives.As industries increasingly focus on sustainable chemical processes and bio-based alternatives, manufacturers are exploring bio-derived isobutyraldehyde production pathways to reduce reliance on fossil feedstocks. Additionally, regulatory trends, advancements in catalytic synthesis, and the growing demand for high-performance coatings, lubricants, and fuel additives are shaping the global isobutyraldehyde market.

How Are Technological Advancements Enhancing Isobutyraldehyde Production?

The production of isobutyraldehyde has seen significant technological improvements, particularly in catalyst efficiency, process sustainability, and raw material optimization. The most widely used industrial process for IBA synthesis is the hydroformylation of propylene, where a cobalt or rhodium catalyst facilitates the addition of carbon monoxide and hydrogen to produce a mixture of normal butyraldehyde (n-butyraldehyde) and isobutyraldehyde. Innovations in rhodium-based catalyst systems have improved selectivity, reduced by-product formation, and enhanced reaction efficiency, making modern production methods more cost-effective.Another major advancement is the shift toward bio-based isobutyraldehyde synthesis. Research into microbial fermentation and enzymatic conversion of renewable feedstocks, such as lignocellulosic biomass, sugar-derived isobutanol, and engineered microorganisms, is gaining traction. Biocatalytic oxidation of isobutanol presents a promising alternative to traditional petrochemical routes, offering a more sustainable pathway for IBA production while reducing greenhouse gas emissions.

Furthermore, process integration and energy efficiency improvements in reactor design, gas-liquid mixing, and continuous production systems are optimizing industrial-scale isobutyraldehyde synthesis. These advancements are helping manufacturers lower production costs, improve yield, and reduce waste generation, making IBA more competitive in high-demand applications.

What Market Trends Are Driving the Growth of Isobutyraldehyde?

Several key trends are influencing the demand and market dynamics of isobutyraldehyde, shaping its growth across multiple industries. One of the most significant trends is the rising demand for high-performance coatings and polymers. Isobutyraldehyde serves as a crucial precursor in the production of neopentyl glycol (NPG) and methacrylate esters, both of which are widely used in automotive coatings, industrial paints, and high-durability resins. The growing emphasis on corrosion resistance, UV stability, and long-lasting finishes in the coatings sector is driving the consumption of IBA-derived intermediates.Another critical trend is the expansion of the agrochemicals and specialty chemicals industries. Isobutyraldehyde is a key raw material in the synthesis of herbicides, insecticides, and fungicides, particularly in the production of isobutylamine and other alkylated amines used in crop protection formulations. As global food demand rises and agricultural efficiency becomes a priority, the need for advanced agrochemical solutions continues to grow, fueling IBA market expansion.

Additionally, the increasing use of isobutyraldehyde in lubricants and fuel additives is shaping industry trends. IBA-derived polyvinyl acetate resins and ester derivatives improve the viscosity, thermal stability, and oxidative resistance of lubricants and fuels, making them essential in high-performance automotive and industrial applications. With fuel efficiency regulations tightening and the shift toward biofuels accelerating, demand for high-quality fuel additives and synthetic lubricants derived from IBA is expected to rise.

The growth of bio-based chemical production and green chemistry initiatives is also playing a crucial role in shaping the IBA market. Regulatory bodies worldwide are encouraging sustainable alternatives to traditional petrochemicals, prompting manufacturers to explore renewable feedstock options and environmentally friendly synthesis pathways. This trend is leading to increased R&D investments in bio-based isobutyraldehyde production, opening new market opportunities for sustainable chemical applications.

What Is Driving the Growth of the Isobutyraldehyde Market?

The growth in the isobutyraldehyde market is driven by multiple factors, including industrial demand for specialty chemicals, sustainability initiatives, and advancements in production technology. One of the key drivers is the expanding coatings and polymers industry, where isobutyraldehyde-derived compounds are essential for high-performance resins, adhesives, and surface coatings. The rise in infrastructure development, automotive manufacturing, and consumer electronics is further fueling demand for IBA-based specialty materials.Another major growth driver is the increasing application of IBA in agrochemicals and pharmaceuticals. The demand for crop protection chemicals is rising due to population growth, climate change, and the need for higher agricultural yields, leading to greater consumption of IBA-based amines and precursors. Additionally, IBA is being utilized in pharmaceutical synthesis, particularly in the production of active pharmaceutical ingredients (APIs) and intermediates used in drug formulations.

The global focus on sustainable and bio-based chemicals is also accelerating market growth. Government regulations promoting environmentally friendly chemical production and corporate sustainability initiatives are encouraging the development of bio-derived isobutyraldehyde. Companies investing in bio-catalytic and fermentation-based production routes are expected to benefit from market expansion and regulatory incentives in the coming years.

Finally, the increasing demand for high-performance lubricants and fuel additives is propelling the isobutyraldehyde market forward. With the global automotive industry shifting toward advanced lubricants, synthetic fuels, and improved engine efficiency, IBA-derived compounds are becoming integral components in next-generation fuel formulations and synthetic oils. As industrial machinery, transportation, and energy sectors continue to expand, demand for high-stability lubricant additives and fuel enhancers will further support IBA market growth.

In summary, isobutyraldehyde is poised for significant market expansion, driven by technological advancements, growing industrial applications, and the increasing push toward sustainable chemical production. As industries seek high-performance and eco-friendly alternatives, IBA's role as a versatile chemical intermediate will continue to strengthen across diverse sectors.

Report Scope

The report analyzes the Isobutyraldehyde market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Liquid Form, Solid Form); Synthesis Method (Hydroformylation of propene Method, Oxidation of isobutene Method); Application (Production of isobutanol, Methacrylate esters, Pharmaceutical intermediates, Pesticides, Flavors & fragrances, Manufacturing, Agriculture, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Liquid Form segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 2%. The Solid Form segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $546.4 Million in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $451.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Isobutyraldehyde Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Isobutyraldehyde Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

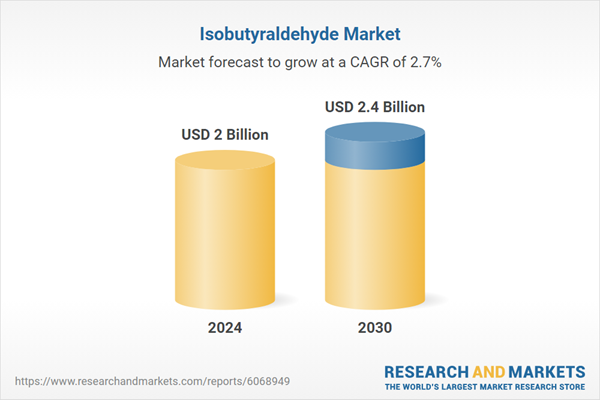

- How is the Global Isobutyraldehyde Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as B. Braun Medical Inc., BeamOne LLC, BGS Beta-Gamma-Service, Centurion Sterilization Services, E-BEAM Services, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Isobutyraldehyde market report include:

- Aceto Corporation

- Airgas Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Dairen Chemical Corporation

- Dow Inc.

- Eastman Chemical Company

- Formosa Plastics Corporation

- Grupa Azoty S.A.

- Hangzhou DayangChem Co., Ltd.

- JNC Group

- Kanto Chemical Co., Inc.

- KH Neochem Co., Ltd.

- Luxi Chemical Group Co., Ltd.

- Merck & Co., Inc.

- Mitsubishi Chemical Corporation

- Mubychem Group

- Sumitomo Chemical Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aceto Corporation

- Airgas Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Dairen Chemical Corporation

- Dow Inc.

- Eastman Chemical Company

- Formosa Plastics Corporation

- Grupa Azoty S.A.

- Hangzhou DayangChem Co., Ltd.

- JNC Group

- Kanto Chemical Co., Inc.

- KH Neochem Co., Ltd.

- Luxi Chemical Group Co., Ltd.

- Merck & Co., Inc.

- Mitsubishi Chemical Corporation

- Mubychem Group

- Sumitomo Chemical Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 374 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |