Global Specimen Containers Market - Key Trends & Drivers Summarized

Why Are Specimen Containers Foundational to Modern Diagnostic and Healthcare Workflows?

Specimen containers play a vital role in global healthcare systems by enabling the safe, sterile, and traceable collection, storage, and transport of biological samples for diagnostic testing, research, and therapeutic monitoring. These containers, which include urine cups, stool sample jars, sputum collection bottles, and histology specimen vials, form the first point of contact between a patient and a diagnostic process. They ensure the integrity of the collected sample, prevent contamination, and support standardized workflows across hospitals, laboratories, and research facilities. With the global increase in diagnostic testing - driven by chronic disease surveillance, infectious disease monitoring, and the expansion of clinical laboratory services - the demand for high-quality, regulation-compliant specimen containers is on the rise. Their significance became even more apparent during the COVID-19 pandemic, where high-volume testing required scalable and reliable sample collection systems. As diagnostics move increasingly toward decentralization and home based testing, specimen containers are becoming critical not just in centralized labs but in point-of-care settings, mobile units, and even direct-to-consumer health kits. The growing emphasis on sample traceability, patient safety, and biohazard containment continues to reinforce the central role of specimen containers in clinical diagnostics.How Are Design Innovations and Regulatory Standards Enhancing Product Functionality and Safety?

Advancements in material science, container ergonomics, and labeling systems are driving continuous improvements in specimen container design. Manufacturers are increasingly focusing on leak-proof, tamper-evident closures and chemically resistant plastics such as polypropylene and polyethylene to enhance the durability and safety of containers used for a wide variety of biological specimens. For microbiology and molecular diagnostics, containers with integrated preservatives or transport media are enabling longer sample stability and accurate pathogen detection. Pre-labeled or barcode-ready containers are now widely adopted to support traceability and automation, reducing the risk of labeling errors and facilitating faster laboratory processing. Specialized designs for pediatric use, wide-mouth jars for fecal sample collection, and dual-compartment containers for histopathology are examples of niche innovations aimed at enhancing patient comfort and sample viability. The use of sterile, pre-packaged formats is growing, particularly for procedures conducted outside traditional clinical settings. Globally, adherence to regulatory standards such as CE marking in Europe, FDA clearance in the U.S., and ISO certifications is ensuring consistency in quality and interoperability across labs. These product enhancements are helping healthcare providers meet rising standards for biosafety, efficiency, and diagnostic accuracy.Where Is Demand for Specimen Containers Accelerating and Which Segments Are Driving Market Expansion?

The demand for specimen containers is expanding rapidly across hospital laboratories, diagnostic centers, research institutions, and home-testing services, with growth being especially pronounced in infectious disease testing, oncology diagnostics, and chronic disease monitoring. Hospitals remain the largest end-users, utilizing containers across departments for urinalysis, blood culture collection, tissue biopsies, and other routine investigations. Independent clinical labs and pathology centers are adopting advanced specimen containers to handle high-volume workflows while ensuring compliance with biosafety protocols. The direct-to-consumer (DTC) diagnostics space is emerging as a high-growth segment, where specimen containers are incorporated into home collection kits for genetic testing, microbiome analysis, fertility tracking, and at-home screenings for conditions like colorectal cancer. In public health and epidemiological surveillance, particularly in low- and middle-income countries, specimen containers are key enablers of mass testing and disease tracking initiatives. Biopharmaceutical companies and clinical research organizations (CROs) also rely heavily on specialized containers for biological sample collection during clinical trials. Geographically, the Asia-Pacific region is witnessing the fastest growth, driven by expanding healthcare infrastructure, increased access to diagnostics, and rising awareness of hygiene and disease prevention. These trends collectively contribute to a sustained and diversified demand base for specimen containers.What's Driving the Long-term Growth of the Specimen Containers Market Worldwide?

The growth in the specimen containers market is driven by a combination of global healthcare expansion, diagnostic innovation, regulatory compliance, and demand for operational efficiency. A major driver is the sharp rise in diagnostic testing due to aging populations, the prevalence of chronic diseases, and heightened infectious disease surveillance post-pandemic. As diagnostic methodologies become more advanced, the need for contamination-free, tamper-evident, and clearly labeled specimen containers has grown, particularly to ensure sample integrity for molecular, cytology, and histology analysis. Additionally, the decentralization of diagnostics - through mobile health units, telemedicine platforms, and home-testing kits - is fueling demand for compact, user-friendly container formats designed for non-clinical environments. Environmental considerations are also gaining traction, with manufacturers exploring biodegradable plastics and reusable container systems to reduce medical waste. Furthermore, the integration of smart labels, RFID tags, and QR-coded lids is transforming how samples are tracked and managed across digital lab ecosystems. Investments in laboratory automation and sample handling robotics are also influencing container design, favoring automation-compatible formats. As global health systems continue to expand access to diagnostics and personalized care, specimen containers will remain a critical, evolving component at the interface of patients, clinicians, and laboratories.Report Scope

The report analyzes the Specimen Containers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Raw Material (Polypropylene, High Density Polyethylene, PVC, Others); Type (Collection Cups, Graduated Bottles, Airtight Containers, Jars, Vials); End-User (Healthcare Facilities, Diagnostic Laboratories, Academic & Research Institutes, Biopharmaceutical Companies, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polypropylene Raw Material segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of a 2.4%. The High Density Polyethylene Raw Material segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $609.4 Million in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $535.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Specimen Containers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Specimen Containers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Specimen Containers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ahlstrom-Munksjö, ARCHIMEDlife, Becton, Dickinson and Company (BD), Capitainer AB, Cardinal Health and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Specimen Containers market report include:

- Becton, Dickinson and Company (BD)

- Bio Plas Inc.

- BRAND GMBH + CO KG

- Cardinal Health

- CELLTREAT Scientific Products

- Copan Diagnostics Inc.

- Corning Incorporated

- Desjardin

- Dynarex Corporation

- Eppendorf AG

- Fisher Scientific

- FL Medical

- Globe Scientific Inc.

- Greiner Bio-One International GmbH

- Heathrow Scientific LLC

- International Scientific Supplies Ltd.

- Kartell Labware

- Kimble Chase Life Science and Research Products LLC

- Kopac Industries, Inc.

- Labcon North America

- Medline Industries, LP

- MTC Bio

- Nalgene (Thermo Fisher Scientific)

- NEST Biotechnology Co., Ltd.

- SARSTEDT AG & Co. KG

- SPL Life Sciences Co., Ltd.

- Thermo Fisher Scientific

- TPP Techno Plastic Products AG

- VWR International, LLC

- WHEATON Industries

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Becton, Dickinson and Company (BD)

- Bio Plas Inc.

- BRAND GMBH + CO KG

- Cardinal Health

- CELLTREAT Scientific Products

- Copan Diagnostics Inc.

- Corning Incorporated

- Desjardin

- Dynarex Corporation

- Eppendorf AG

- Fisher Scientific

- FL Medical

- Globe Scientific Inc.

- Greiner Bio-One International GmbH

- Heathrow Scientific LLC

- International Scientific Supplies Ltd.

- Kartell Labware

- Kimble Chase Life Science and Research Products LLC

- Kopac Industries, Inc.

- Labcon North America

- Medline Industries, LP

- MTC Bio

- Nalgene (Thermo Fisher Scientific)

- NEST Biotechnology Co., Ltd.

- SARSTEDT AG & Co. KG

- SPL Life Sciences Co., Ltd.

- Thermo Fisher Scientific

- TPP Techno Plastic Products AG

- VWR International, LLC

- WHEATON Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

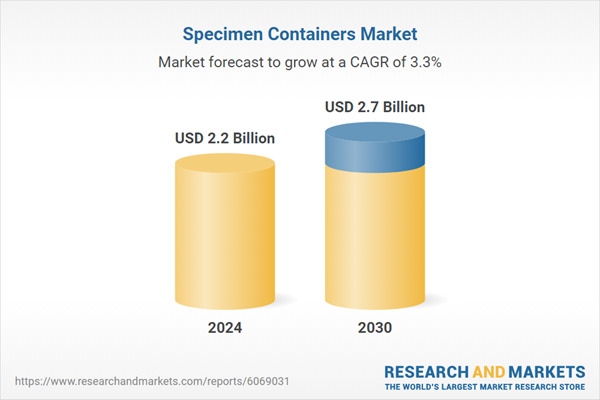

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |