Global Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services Market - Key Trends & Drivers Summarized

Why Is Hybrid Cloud Deployment Transforming the Satellite Remote Sensing and Imagery Ecosystem?

Hybrid cloud deployment is emerging as a critical enabler of efficiency, scalability, and security in the satellite remote sensing, imagery, and data services market. As demand for Earth observation (EO) data intensifies across defense, agriculture, energy, urban planning, disaster management, and environmental monitoring, the sheer volume and variety of satellite-derived data have outpaced the capabilities of traditional on-premise or public cloud-only infrastructures. Hybrid cloud models offer a balanced solution - enabling seamless integration of on-site processing for latency-sensitive or mission-critical applications with the scalable, high-performance computing and storage capabilities of public clouds for data analytics, long-term archiving, and multi-user access.The hybrid approach is especially valuable in scenarios where data sovereignty, regulatory compliance, and operational security must be preserved, such as military surveillance, critical infrastructure monitoring, and strategic governmental applications. Satellite operators, EO platforms, and analytics providers are increasingly leveraging hybrid architectures to perform initial image pre-processing and AI-driven object detection at edge or private cloud nodes, while offloading advanced analytics, visualization, and distribution tasks to hyperscale cloud environments. This architecture ensures data agility, improves operational responsiveness, and enhances user flexibility across geographies, thereby establishing hybrid cloud as the foundational IT backbone for next-generation satellite data services.

How Are Analytics, Edge Computing, and AI Enhancing the Value of Satellite Imagery in Hybrid Environments?

The convergence of hybrid cloud infrastructure with edge computing and AI/ML technologies is radically accelerating the processing-to-decision cycle in satellite imagery workflows. Real-time or near-real-time analytics - previously constrained by bandwidth and latency limitations - are now feasible through localized compute nodes co-located with ground stations or even embedded within satellite payloads. These nodes perform rapid data triage, event detection, image fusion, and classification, reducing the volume of raw data that must be transmitted and enabling prioritized data delivery. Hybrid cloud environments then serve as the orchestration layer, facilitating collaboration between ground-based control centers, regional data users, and global analytic hubs.AI algorithms trained on satellite image datasets are being deployed across cloud-native platforms to automate complex tasks such as land cover classification, maritime vessel tracking, infrastructure mapping, and crop health monitoring. Hybrid deployments allow users to dynamically allocate workloads - performing sensitive or region-specific processing on-premises while tapping into cloud-based GPU clusters for computationally intensive model training or global pattern recognition. This architecture not only lowers data egress costs but also enables modular, scalable service delivery, particularly for analytics-as-a-service models offered by EO startups and geospatial intelligence providers. These capabilities are transforming satellite imagery from a static product into an on-demand, insight-driven solution, tailored to real-time decision-making across industries.

What Market Trends, Regulatory Forces, and Sectoral Demands Are Fueling Hybrid Cloud Adoption in EO Data Services?

Market demand for high-resolution, high-frequency, and multi-sensor EO data is growing exponentially, driven by climate change monitoring, infrastructure development, and strategic intelligence applications. Government agencies and commercial users alike are seeking more accessible, interoperable, and analysis-ready data formats that can be delivered with minimal latency. Hybrid cloud models are supporting this shift by enabling end-to-end orchestration of satellite tasking, image ingestion, metadata tagging, API-based delivery, and downstream analytics. In defense and intelligence, where data confidentiality and operational sovereignty are paramount, hybrid cloud configurations allow air-gapped processing environments to coexist with collaborative mission planning tools hosted in secure public clouds.The regulatory landscape is also reinforcing hybrid architectures. Data localization mandates, cybersecurity protocols, and interoperability frameworks in regions such as the EU, North America, and Asia-Pacific require EO service providers to architect solutions that satisfy both national compliance and global scalability. Furthermore, the trend toward public-private partnerships in satellite infrastructure - spanning shared downlink stations, cloud-native EO platforms, and mission-as-a-service business models - is creating demand for interoperable data environments where hybrid cloud is not just a technical preference but a strategic imperative. These dynamics are transforming the EO value chain and establishing hybrid cloud as a vital enabler of distributed, compliant, and commercially viable satellite data ecosystems.

What Is Driving the Growth of the Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services Market Across Regions and Applications?

The growth in the hybrid cloud deployment satellite remote sensing, imagery, and data services market is driven by a confluence of factors including rapid proliferation of small satellite constellations, surging demand for near-real-time analytics, and increasing digitization of earth observation platforms. In North America, the market is being propelled by strong investments in defense, environmental monitoring, and precision agriculture, combined with robust public-private collaborations involving cloud giants, geospatial analytics firms, and satellite operators. The U.S. government’ s push toward cloud-forward modernization of its geospatial intelligence infrastructure is accelerating adoption of hybrid cloud in both civilian and military EO operations.In Europe, hybrid cloud deployment is gaining traction due to the European Space Agency’ s (ESA) Earth observation programs and Copernicus data services, which are increasingly integrated with regional cloud infrastructures to ensure data compliance under GDPR and EU data strategy frameworks. In Asia-Pacific, countries like China, India, and Japan are deploying hybrid architectures to manage their growing satellite fleets and support regional disaster response, border surveillance, and agricultural intelligence. Meanwhile, emerging space nations in the Middle East, Africa, and Latin America are leveraging cloud-based EO platforms and hybrid cloud service partnerships to leapfrog infrastructure limitations and enable rapid scaling of satellite data services.

Across applications - from urban planning and resource management to autonomous logistics and ESG compliance - hybrid cloud models offer the flexibility, security, and scalability required to unlock actionable insights from satellite data. As satellite networks grow in volume and variety, and as analytics shift from post-event review to proactive intervention, the hybrid cloud deployment model will remain central to the EO industry’ s ability to deliver timely, targeted, and transformative geospatial intelligence at global scale.

Report Scope

The report analyzes the Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Service Type (Imagery Data, Data analytics services); Application (Agriculture/ forestry / fishing, Mining, Engineering & infrastructure, Energy & power, Environment & weather monitoring, Maritime, Transport & logistics, Aerospace & Defense, Others); End-Use (Government, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Imagery Data Services segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 23.2%. The Data Analytics services segment is also set to grow at 17.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $609.5 Million in 2024, and China, forecasted to grow at an impressive 20.3% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anheuser-Busch InBev, Arizona Beverages USA, Carlsberg Group, Constellation Brands, Inc., Danone S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Hybrid Cloud Deployment Satellite Remote Sensing, Imagery & Data Services market report include:

- Airbus Group SE

- Earth-i Ltd.

- East View Geospatial

- Iceye OY

- L3Harris Technologies, Inc.

- LandInfo Worldwide Mapping

- Maxar Technologies Ltd.

- Planet Labs PBC

- RMSI Pvt. Ltd.,

- Satellite Imaging Corporation (SIC)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Group SE

- Earth-i Ltd.

- East View Geospatial

- Iceye OY

- L3Harris Technologies, Inc.

- LandInfo Worldwide Mapping

- Maxar Technologies Ltd.

- Planet Labs PBC

- RMSI Pvt. Ltd.,

- Satellite Imaging Corporation (SIC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

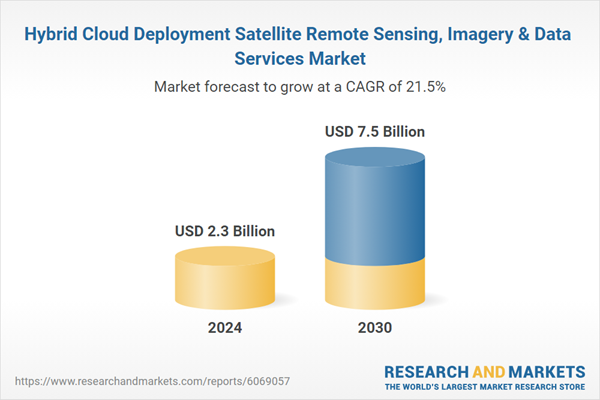

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 7.5 Billion |

| Compound Annual Growth Rate | 21.5% |

| Regions Covered | Global |