Global Fipronil Pyrazole Market - Key Trends & Drivers Summarized

What Makes Fipronil Pyrazole a Preferred Choice in Pest Management Today?

Fipronil pyrazole has emerged as one of the most widely used and effective insecticides in modern pest management, primarily due to its broad-spectrum efficacy and unique mode of action. Belonging to the phenylpyrazole chemical family, fipronil functions by disrupting the central nervous system of insects, offering high toxicity to pests while maintaining relatively low toxicity in mammals and humans when used correctly. It has proven to be a game-changer in agricultural practices, particularly in controlling insects that have developed resistance to conventional pesticides such as organophosphates and carbamates. Fipronil is extensively applied in crops like rice, corn, potatoes, and cotton, where it provides prolonged protection against harmful pests like stem borers, rootworms, and leafhoppers. Its popularity is also bolstered by its use in veterinary medicine and pet care, particularly in flea and tick treatments for dogs and cats. Moreover, it finds applications in structural pest control, including termite and cockroach management in residential and commercial buildings. As global agricultural practices evolve and pest resistance becomes a more pressing concern, fipronil pyrazole continues to stand out for its potency, versatility, and adaptability across different use cases and geographies.How Are Regulatory and Safety Concerns Shaping Market Dynamics?

The use of fipronil pyrazole, while widespread, is increasingly coming under regulatory scrutiny due to concerns over its environmental impact, particularly on pollinators like bees and aquatic ecosystems. In several regions including the European Union, restrictions or bans have been imposed on certain formulations or applications of fipronil due to studies linking it to ecological imbalances. These regulatory pressures are forcing manufacturers and end-users to reassess application methods, develop safer delivery mechanisms, and invest in formulations that minimize non-target exposure. In parallel, countries with emerging agricultural sectors in Asia-Pacific, Latin America, and Africa continue to expand their use of fipronil, driven by its effectiveness and cost-efficiency in pest control. This geographic dichotomy is reshaping global supply chains, with leading producers focusing on meeting both stringent regulatory compliance in developed markets and volume demand in developing ones. Companies are investing heavily in research to create biodegradable or encapsulated versions of fipronil that offer enhanced safety profiles without compromising efficacy. These efforts reflect a broader industry trend towards responsible pesticide use and integrated pest management (IPM) strategies, where fipronil’ s role is being fine-tuned to balance effectiveness with environmental responsibility.Is Innovation Keeping Pace With Resistance and Sustainability Demands?

Yes, innovation in the fipronil pyrazole market is steadily advancing to meet the twin challenges of insect resistance and sustainability. With pests increasingly adapting to conventional insecticides, chemical companies are investing in synergistic formulations where fipronil is combined with other active ingredients to enhance efficacy and delay resistance buildup. Controlled-release technologies are also gaining traction, allowing for slower degradation and reduced frequency of application, thereby lowering environmental load. Advances in nanotechnology are enabling more precise delivery of fipronil to target organisms, minimizing collateral damage to non-target species and ecosystems. In veterinary medicine, the development of long-acting spot-on and injectable treatments has improved compliance and treatment outcomes, contributing to fipronil’ s continued popularity in pet care. Furthermore, digitization in agriculture - through drones, smart sprayers, and GIS mapping - is enabling precision application of fipronil, ensuring targeted treatment and minimal waste. These innovations are not only enhancing the value proposition of fipronil pyrazole but also aligning it with the broader objectives of sustainable agriculture, responsible chemical use, and effective resistance management. As competition intensifies, innovation remains the cornerstone of maintaining fipronil’ s market relevance amid evolving regulatory and environmental expectations.What’ s Fueling the Expanding Global Demand for Fipronil Pyrazole?

The growth in the fipronil pyrazole market is driven by several factors related to its performance capabilities, diversified applications, and shifting global pest control demands. The increasing need for high-efficiency insecticides in large-scale commercial agriculture - particularly in high-value crops like rice, maize, sugarcane, and horticultural produce - is a primary growth driver. The ongoing expansion of the veterinary parasiticide sector, particularly pet healthcare, is also significantly contributing to market growth, with rising pet ownership and awareness about flea and tick management. Additionally, fipronil’ s role in structural pest control is gaining ground in urban and suburban markets where the demand for reliable, long-lasting solutions to termite and cockroach infestations is on the rise. In emerging economies, favorable agricultural subsidies and expanding farmlands are encouraging the adoption of advanced crop protection products, with fipronil being a top choice due to its proven efficacy and economic feasibility. Technological integration, such as precision farming and drone-based pesticide application, is further promoting the adoption of fipronil by making applications more efficient and cost-effective. Lastly, the continuous R&D efforts by agrochemical companies to introduce improved, eco-friendly formulations are helping to address regulatory challenges while keeping the product competitive in the market. Collectively, these drivers are positioning fipronil pyrazole as a resilient and adaptable solution in the global pest management arsenal.Report Scope

The report analyzes the Fipronil Pyrazole market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Gel Form, Particle Form, Liquid Form); End-Use (Chemical Synthesis End-Use, Agriculture End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gel Form segment, which is expected to reach US$179.3 Million by 2030 with a CAGR of a 2.2%. The Particle Form segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $79.1 Million in 2024, and China, forecasted to grow at an impressive 4.5% CAGR to reach $63.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fipronil Pyrazole Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fipronil Pyrazole Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fipronil Pyrazole Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adyen, Dwolla, Inc., EFT Corporation Limited, Finastra, Fiserv, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Fipronil Pyrazole market report include:

- BASF SE

- Bayer AG

- Dhanuka Agritech Limited

- Gharda Chemicals Ltd.

- Hubei Sanonda Co., Ltd.

- Jiangsu Changqing Agrochemical Co., Ltd.

- Jiangsu Fengshan Group Co., Ltd.

- Jiangsu Flag Chemical Industry Co., Ltd.

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

- Jiangsu Huangma Agrochemicals Co., Ltd.

- Jiangsu Kwin Group Co., Ltd.

- Jiangsu Lanfeng Bio-Chemical Co., Ltd.

- Jiangsu Repont Pesticide Factory Co., Ltd.

- Jiangsu Sevencontinent Green Chemical Co., Ltd.

- Jiangsu Tuoqiu Agrochemical Co., Ltd.

- Jiangsu Yangnong Chemical Group Co., Ltd.

- Meghmani Organics Ltd.

- Shandong Sino-Agri United Biotechnology Co., Ltd.

- Syngenta AG

- Zhejiang Yongnong Chem. Ind. Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Bayer AG

- Dhanuka Agritech Limited

- Gharda Chemicals Ltd.

- Hubei Sanonda Co., Ltd.

- Jiangsu Changqing Agrochemical Co., Ltd.

- Jiangsu Fengshan Group Co., Ltd.

- Jiangsu Flag Chemical Industry Co., Ltd.

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

- Jiangsu Huangma Agrochemicals Co., Ltd.

- Jiangsu Kwin Group Co., Ltd.

- Jiangsu Lanfeng Bio-Chemical Co., Ltd.

- Jiangsu Repont Pesticide Factory Co., Ltd.

- Jiangsu Sevencontinent Green Chemical Co., Ltd.

- Jiangsu Tuoqiu Agrochemical Co., Ltd.

- Jiangsu Yangnong Chemical Group Co., Ltd.

- Meghmani Organics Ltd.

- Shandong Sino-Agri United Biotechnology Co., Ltd.

- Syngenta AG

- Zhejiang Yongnong Chem. Ind. Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

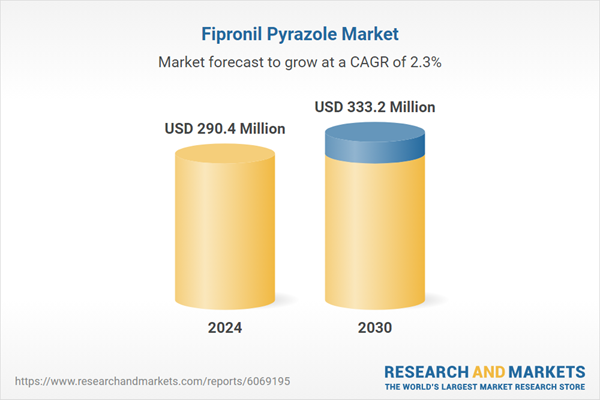

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 290.4 Million |

| Forecasted Market Value ( USD | $ 333.2 Million |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |