Global LED Mobile Light Tower Market - Key Trends & Drivers Summarized

Why Are LED Mobile Light Towers Becoming the Preferred Choice for Portable Illumination?

The increasing demand for energy-efficient and reliable portable lighting solutions has driven the rapid adoption of LED mobile light towers across multiple industries. These mobile lighting systems, equipped with high-intensity LED lamps, offer superior illumination, durability, and fuel efficiency compared to traditional metal halide or halogen-based towers. They are extensively used in construction sites, mining operations, emergency response efforts, outdoor events, and military applications, where consistent lighting is essential for safety and productivity. The superior energy efficiency of LED technology allows these light towers to operate longer on a single fuel tank or battery charge, reducing operational costs and environmental impact. Additionally, LED lights offer better illumination coverage, higher lumen output, and improved color rendering, making them an ideal solution for nighttime operations. The reduction in maintenance requirements due to the long lifespan of LED fixtures further enhances their appeal. Innovations in mobile light tower design, such as hybrid power sources, solar-powered units, and remote monitoring capabilities, have also contributed to their growing popularity. With stricter regulations on emissions and noise pollution, manufacturers are developing eco-friendly LED light towers that minimize fuel consumption and noise levels, aligning with global sustainability goals.What Are the Emerging Trends Shaping the LED Mobile Light Tower Industry?

Several transformative trends are influencing the LED mobile light tower market, making them more efficient, sustainable, and technologically advanced. One of the most notable trends is the rising adoption of solar-powered and hybrid LED light towers, driven by the growing emphasis on reducing carbon footprints and fuel dependency. These hybrid models, which combine battery storage with renewable energy sources, provide extended operation time and lower emissions, making them suitable for remote and off-grid locations. Another major trend is the integration of smart control systems, including IoT connectivity and remote operation capabilities. Fleet managers can now monitor multiple light towers remotely, adjust lighting intensity, and track fuel consumption in real-time using cloud-based platforms. The shift toward modular and compact designs has also improved mobility and ease of deployment, allowing light towers to be transported and set up quickly in different locations. Furthermore, the use of lithium-ion battery technology in LED mobile light towers is gaining traction due to its longer lifespan and fast-charging capabilities, reducing downtime and maintenance costs. The increasing demand for mobile lighting solutions in disaster relief operations and humanitarian missions has further expanded market opportunities. Additionally, advancements in LED technology, such as high-output chip-on-board (COB) LEDs and tunable white lighting, are improving the performance and versatility of these towers.What Challenges Are Hindering the Adoption of LED Mobile Light Towers?

Despite their numerous advantages, several challenges impact the widespread adoption of LED mobile light towers. One of the primary obstacles is the high initial investment required for LED-based models compared to conventional diesel-powered light towers. Although LED technology offers long-term cost savings, budget-conscious industries may hesitate to make the switch due to upfront costs. Additionally, the limited availability of solar-powered and hybrid models in some regions can slow adoption, particularly in areas with inconsistent access to renewable energy infrastructure. Another challenge is the operational limitations in extreme weather conditions, as solar-powered light towers may struggle to function efficiently in areas with limited sunlight or harsh environments. Maintenance of hybrid power systems also presents technical challenges, requiring specialized knowledge and training for proper upkeep. The presence of alternative lighting solutions, such as standalone floodlights and portable generator-powered lights, poses competition for LED mobile light towers in certain applications. Furthermore, regulatory barriers and varying standards across regions make it challenging for manufacturers to streamline production and compliance processes. Addressing these challenges requires ongoing innovation in cost reduction, battery technology, and hybrid energy integration to make LED mobile light towers more accessible and efficient.What Is Driving the Growth of the LED Mobile Light Tower Market?

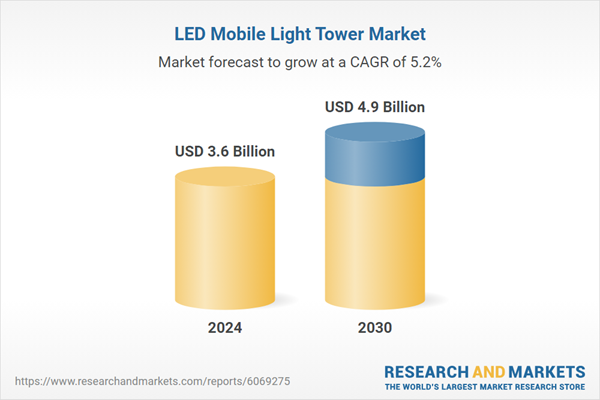

The growth in the LED mobile light tower market is driven by several key factors, including the increasing demand for energy-efficient lighting, stringent emission regulations, and the expansion of construction and infrastructure projects worldwide. The construction and mining industries are among the largest consumers of mobile light towers, requiring reliable illumination for nighttime operations and underground work environments. The rising adoption of smart and automated lighting solutions in industrial sectors has also contributed to market expansion. Governments and organizations promoting green energy initiatives have fueled the demand for solar and hybrid-powered light towers, encouraging manufacturers to develop sustainable solutions. The growing number of outdoor events, film productions, and emergency response operations has further increased the need for high-performance portable lighting. Additionally, advancements in LED efficiency and battery storage technology have improved the reliability and cost-effectiveness of LED mobile light towers. The increasing deployment of these towers in oil and gas refineries, railway maintenance, and military applications is also expanding their market potential. The trend toward rental services for LED light towers has created new business opportunities, as companies prefer cost-effective and flexible solutions rather than purchasing units outright. With continuous technological innovation and expanding applications, the LED mobile light tower market is poised for steady growth in the coming years.Report Scope

The report analyzes the LED Mobile Light Tower market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Power Source (Diesel Power Source, Solar Power Source, Direct Power Source, Other Power Sources); Technology (Manual Lifting System Technology, Hydraulic Lifting System Technology); Application (Construction Application, Infrastructure Development Application, Oil & Gas Application, Mining Application, Military & Defense Application, Emergency & Disaster Relief Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Diesel Power Source segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 3.6%. The Solar Power Source segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $978.0 Million in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $958.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LED Mobile Light Tower Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LED Mobile Light Tower Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LED Mobile Light Tower Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Angela Caglia Skincare, BeautyBio, Celluma by BioPhotas, Corona Elite Technology Co., Ltd., CurrentBody and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this LED Mobile Light Tower market report include:

- Allmand Bros Inc.

- Atlas Copco

- BossLTR

- Briggs & Stratton Corporation

- Chicago Pneumatic

- Doosan Portable Power

- Generac Mobile Products

- Himoinsa S.L.

- Inmesol S.L.U.

- JCB Power Products

- Kubota Corporation

- Lind Equipment

- Magnum Power Products LLC

- Pramac S.p.A.

- Progress Solar Solutions

- Terex Corporation

- Trime S.r.l.

- Wacker Neuson SE

- Wanco Inc.

- Yanmar Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allmand Bros Inc.

- Atlas Copco

- BossLTR

- Briggs & Stratton Corporation

- Chicago Pneumatic

- Doosan Portable Power

- Generac Mobile Products

- Himoinsa S.L.

- Inmesol S.L.U.

- JCB Power Products

- Kubota Corporation

- Lind Equipment

- Magnum Power Products LLC

- Pramac S.p.A.

- Progress Solar Solutions

- Terex Corporation

- Trime S.r.l.

- Wacker Neuson SE

- Wanco Inc.

- Yanmar Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |