Global Alternative Lending Platforms Market - Key Trends & Drivers Summarized

Why Are Alternative Lending Platforms Gaining Momentum in the Financial Sector?

Alternative lending platforms have emerged as a disruptive force in the financial industry, offering faster, more accessible, and technology-driven lending solutions compared to traditional banks. These platforms provide loans to individuals, small businesses, and enterprises through peer-to-peer (P2P) lending, crowdfunding, digital lending marketplaces, and AI-driven credit models. With the rise of fintech innovation, changing consumer preferences, and the need for faster credit approvals, alternative lending has become a viable financing option for borrowers who struggle with traditional lending requirements.One of the biggest drivers of this shift is the increasing demand for quick and flexible loan options, especially for small and medium-sized enterprises (SMEs), freelancers, and underbanked individuals. Traditional banks often require lengthy paperwork, high credit scores, and collateral, making it difficult for startups and self-employed individuals to secure funding. Alternative lenders leverage big data, AI, and blockchain technology to assess risk and approve loans within minutes or hours, creating a more inclusive financial ecosystem.

The post-pandemic economic recovery and global digitization trends have further accelerated the adoption of digital lending platforms. Many businesses and consumers are turning to non-bank lenders for emergency funds, business expansion, or personal financing, as interest rates remain competitive and loan disbursement is faster than ever. Additionally, the integration of decentralized finance (DeFi), cryptocurrencies, and blockchain-based lending solutions is reshaping the industry, providing borderless and transparent lending mechanisms outside of traditional banking systems.

What Are the Key Trends Shaping the Alternative Lending Market?

The alternative lending market is evolving rapidly, influenced by fintech innovation, AI-driven credit assessment models, and decentralized finance (DeFi). One of the biggest trends driving growth is the increased use of AI and machine learning in credit underwriting. Unlike traditional banks that rely on credit scores and historical financial data, alternative lenders use AI-powered algorithms to analyze real-time financial behavior, transaction history, and alternative credit indicators (such as social media activity and online spending habits). This enables lenders to offer loans to previously underserved borrowers while minimizing default risks.Another significant trend is the rise of buy-now-pay-later (BNPL) services, which are transforming consumer financing. BNPL platforms like Affirm, Klarna, and Afterpay allow consumers to split purchases into interest-free or low-interest installments, making alternative lending more integrated into e-commerce and retail transactions. As consumers shift away from traditional credit cards, BNPL solutions are gaining widespread adoption, particularly among millennials and Gen Z borrowers who prefer flexible, interest-free payment options.

The growth of blockchain-based lending and decentralized finance (DeFi) solutions is another game-changer in the alternative lending space. Platforms such as Aave, Compound, and MakerDAO are enabling peer-to-peer lending through smart contracts, eliminating the need for intermediaries. DeFi lending platforms allow users to collateralize cryptocurrency assets to secure loans, providing a decentralized and transparent lending mechanism. As crypto adoption increases, DeFi lending is expected to become a mainstream alternative to traditional financial institutions, offering borrowers borderless and censorship-resistant financing options.

Additionally, embedded finance and API-driven lending solutions are redefining how loans are offered. Tech companies, e-commerce platforms, and digital banks are integrating lending services directly into their ecosystems, enabling businesses and consumers to access financing at the point of transaction. For example, Amazon, Shopify, and PayPal now offer merchant cash advances and revenue-based financing to their sellers, allowing businesses to secure funding based on their sales performance rather than traditional credit scores. This trend is making alternative lending more seamless and widely accessible across different industries.

Which Industries Are Driving the Demand for Alternative Lending Platforms?

The small and medium-sized enterprise (SME) sector is the largest consumer of alternative lending services, as traditional banks often impose strict lending criteria on small businesses. Many SMEs lack the credit history or collateral required for bank loans, making P2P lending, revenue-based financing, and merchant cash advances attractive alternatives. Companies such as Funding Circle, OnDeck, and Kabbage provide fast, unsecured loans to small businesses, enabling them to scale operations, invest in inventory, and cover cash flow gaps.The e-commerce and retail sector is another major driver of alternative lending. With the rise of BNPL services, revenue-based financing, and embedded lending, online retailers and direct-to-consumer (DTC) brands are leveraging alternative financing models to increase customer spending and improve cash flow management. Platforms like Shopify Capital and Amazon Lending allow merchants to access flexible financing based on their sales performance, reducing their dependence on traditional bank loans.

The gig economy and freelancer workforce is also fueling the demand for alternative lending solutions. With millions of workers shifting to independent contracting and freelancing, traditional credit systems - designed for full-time salaried employees - fail to accommodate non-traditional income streams. Fintech companies like Earnin, Tala, and Brigit offer microloans, payday advances, and income-based financing to gig workers, providing them with on-demand cash flow solutions. This has become particularly relevant as remote work and self-employment continue to rise globally.

The real estate and property investment sector is another key contributor to alternative lending growth. Hard money lenders, crowdfunding platforms, and real estate-backed DeFi lending are enabling individuals and businesses to secure property loans without relying on traditional banks. Companies such as Fundrise, PeerStreet, and LendingHome allow investors to participate in real estate lending pools, making alternative lending a viable option for property developers, house flippers, and real estate investors.

What Is Driving the Growth of the Global Alternative Lending Market?

The growth of the alternative lending market is driven by increasing fintech adoption, evolving regulatory frameworks, and the growing demand for fast and flexible credit options. One of the primary drivers is the widespread use of mobile and digital banking platforms, which has made lending services more accessible to global consumers. With digital wallets, AI-driven risk assessment, and blockchain-based lending solutions, alternative lenders can process loans faster and serve a broader audience compared to traditional banks.The shift toward financial inclusion is another key factor fueling market expansion. Many individuals and businesses in emerging markets lack access to traditional banking services, making microfinance, mobile lending, and P2P lending essential for financial growth. Platforms like M-Pesa (Kenya), Tala (India), and Alipay (China) are pioneering mobile-based lending solutions that provide instant, low-cost credit to unbanked populations. As financial technology continues to expand in Africa, Latin America, and Southeast Asia, the demand for alternative lending platforms will continue to rise.

Additionally, regulatory advancements and open banking initiatives are creating a more transparent and competitive lending environment. Governments and financial regulators are implementing fintech-friendly policies that encourage data sharing, alternative credit scoring, and responsible lending practices. Open banking regulations, such as PSD2 in Europe and similar frameworks in North America and Asia, are enabling third-party lenders to access financial data, making it easier to offer personalized lending solutions.

The rise of AI-driven risk modeling and predictive analytics is also playing a crucial role in minimizing loan default risks and improving credit assessments. By analyzing alternative data sources, lenders can offer customized loan terms, automate loan approvals, and provide better borrower experiences. As machine learning and data analytics continue to improve, alternative lending platforms will become more efficient, scalable, and widely accepted.

With continuous innovation in fintech, rising demand for financial inclusivity, and expanding applications in multiple industries, the global alternative lending market is set for strong growth and long-term disruption of traditional banking systems.

Report Scope

The report analyzes the Alternative Lending Platforms market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Solution Type (Loan Origination, Loan Servicing, Lending Analytics, Other Solution Types); Service Type (Integration and Deployment Services, Support and Maintenance Services, Training and Consulting Services, Managed Services); Deployment (On-Premise Deployment, Cloud Deployment); End-Use (Crowdfunding End-Use, Peer-to-Peer Lending End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Loan Origination Solution segment, which is expected to reach US$6.6 Billion by 2030 with a CAGR of a 27.6%. The Loan Servicing Solution segment is also set to grow at 23.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.0 Billion in 2024, and China, forecasted to grow at an impressive 32.4% CAGR to reach $3.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alternative Lending Platforms Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alternative Lending Platforms Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alternative Lending Platforms Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ballard Power Systems, Inc., BorgWarner, Inc., Bosch Mobility Solutions, Continental Automotive Technologies GmbH, Cummins, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Alternative Lending Platforms market report include:

- Avant, LLC

- Fleximize Limited

- Funding Circle Ltd.

- GoFundMe Group, Inc.

- LendingClub Corporation

- Morgan Stanley

- National Funding, Inc.

- OnDeck Capital

- Prosper Funding, LLC

- Social Finance, Inc. (SoFi)

- Upstart Network, Inc.

- Zopa Bank Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Avant, LLC

- Fleximize Limited

- Funding Circle Ltd.

- GoFundMe Group, Inc.

- LendingClub Corporation

- Morgan Stanley

- National Funding, Inc.

- OnDeck Capital

- Prosper Funding, LLC

- Social Finance, Inc. (SoFi)

- Upstart Network, Inc.

- Zopa Bank Limited

Table Information

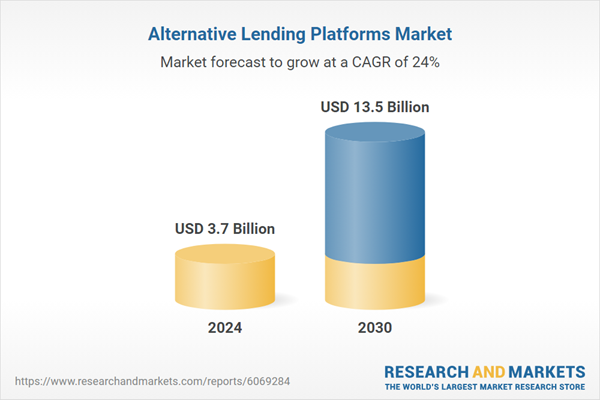

| Report Attribute | Details |

|---|---|

| No. of Pages | 465 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 13.5 Billion |

| Compound Annual Growth Rate | 24.0% |

| Regions Covered | Global |