Global Leak Detection and Repair Market - Key Trends & Drivers Summarized

How Is Leak Detection and Repair Transforming Industrial Safety and Environmental Compliance?

The increasing emphasis on industrial safety, operational efficiency, and regulatory compliance has driven significant advancements in leak detection and repair (LDAR) technologies. Industries such as oil and gas, chemicals, pharmaceuticals, and power generation are under constant pressure to minimize emissions, reduce hazardous leaks, and improve asset integrity. LDAR systems have become an essential component of facility maintenance and environmental management programs, allowing companies to detect and mitigate gas leaks before they escalate into critical safety hazards or regulatory violations. Traditional methods of leak detection relied heavily on manual inspections, which were time-consuming, labor-intensive, and often prone to inaccuracies. However, recent technological innovations, including infrared (IR) imaging, ultrasonic leak detection, and laser-based gas sensors, have dramatically improved detection accuracy and response times. Automated leak detection solutions integrated with artificial intelligence (AI) and the Internet of Things (IoT) are now revolutionizing the industry by enabling real-time monitoring and predictive maintenance. With these advancements, industries can proactively address leaks before they lead to costly shutdowns, environmental fines, or safety incidents. Moreover, the adoption of drone-based leak detection, particularly in large-scale industrial facilities and pipeline networks, has further enhanced the efficiency of LDAR programs. These aerial systems equipped with optical gas imaging cameras can rapidly scan vast areas, providing precise leak localization while minimizing human exposure to hazardous environments. As sustainability and emission reduction targets become more stringent, industries are increasingly investing in robust LDAR solutions to ensure compliance with evolving environmental regulations. The market is witnessing a growing shift towards cloud-based monitoring systems that provide centralized control and data analytics, allowing facility operators to make informed decisions in real time. This shift is driving the transition from reactive leak management to proactive and predictive leak prevention strategies, setting new benchmarks for industrial safety and environmental stewardship.What Are the Emerging Trends in Leak Detection and Repair Technologies?

Several key trends are shaping the evolution of LDAR technologies, transforming the way industries manage leak prevention and regulatory compliance. One of the most significant trends is the increasing integration of AI-powered analytics and machine learning algorithms into leak detection systems. These advanced analytics tools enhance pattern recognition and anomaly detection, allowing for more accurate identification of leaks based on historical data and real-time monitoring. AI-driven LDAR solutions can differentiate between false alarms and genuine leaks, reducing unnecessary maintenance efforts and improving overall efficiency. Another notable trend is the rapid adoption of remote sensing technologies, including satellite-based leak detection systems. With the capability to monitor large geographical areas from space, these systems are particularly beneficial for industries with extensive pipeline networks, such as oil and gas transportation. Additionally, the rise of wireless sensor networks and IoT-enabled devices has revolutionized data collection and reporting in LDAR programs. These smart sensors continuously transmit real-time leak data to cloud-based dashboards, providing instant notifications and actionable insights to maintenance teams. The adoption of these advanced technologies has significantly reduced response times and improved asset reliability. Furthermore, regulatory agencies worldwide are tightening emission monitoring and leak detection requirements, leading to an increased demand for automated LDAR solutions. Governments and environmental bodies are imposing stricter penalties for non-compliance, compelling industries to upgrade their leak detection capabilities. The growing emphasis on environmental, social, and governance (ESG) initiatives is also pushing companies to invest in sustainable leak detection solutions that minimize greenhouse gas emissions. Moreover, advancements in portable gas detection devices have made leak identification more accessible for small-scale facilities and municipal utilities. These handheld devices equipped with multi-gas sensors offer cost-effective solutions for industries looking to enhance their safety protocols without significant capital investments. The industry is also witnessing an increasing demand for third-party LDAR service providers, as companies seek expert solutions to navigate complex compliance requirements and optimize their maintenance strategies.What Challenges Are Hindering the Widespread Adoption of LDAR Solutions?

Despite the growing adoption of LDAR technologies, several challenges continue to hinder their widespread implementation across industries. One of the primary obstacles is the high initial cost associated with deploying advanced leak detection systems. Automated LDAR solutions, including drone-based and satellite-based systems, require substantial capital investments, making it difficult for small and medium-sized enterprises (SMEs) to adopt these technologies. Additionally, integrating new LDAR solutions with existing industrial infrastructure can be complex, requiring extensive retrofitting and technical expertise. Another critical challenge is the lack of standardized regulations across different regions and industries. While developed countries have well-established emission monitoring frameworks, many developing regions lack uniform regulatory guidelines, leading to inconsistent adoption rates. The complexity of data interpretation and analysis is another concern, as LDAR programs generate vast amounts of data that require skilled personnel to assess and act upon effectively. Without proper training and expertise, industries may struggle to extract actionable insights from their LDAR systems, limiting their overall effectiveness. Furthermore, certain leak detection methods, such as infrared thermography, may have limitations in detecting leaks in adverse weather conditions or highly dynamic industrial environments. The need for periodic calibration and maintenance of sensor-based leak detection devices also adds to operational costs, posing an additional challenge for industries with budget constraints. Moreover, false positives and detection inefficiencies in some LDAR solutions can lead to unnecessary maintenance actions, increasing downtime and operational costs. Addressing these challenges requires ongoing research and development efforts to make LDAR technologies more cost-effective, user-friendly, and adaptable to diverse industrial applications. Additionally, regulatory bodies must work towards harmonizing global leak detection standards to create a more consistent compliance landscape.What Is Driving the Growth of the Leak Detection and Repair Market?

The growth in the leak detection and repair market is driven by several factors, including advancements in sensor technology, increasing regulatory scrutiny, and the rising focus on environmental sustainability. The continuous development of highly sensitive gas detection sensors has significantly improved the accuracy and reliability of LDAR systems, making them more effective in identifying even minor leaks. The tightening of global environmental regulations, particularly concerning volatile organic compounds (VOCs) and methane emissions, has accelerated the demand for automated LDAR solutions across multiple industries. The growing adoption of digitalization and Industry 4.0 principles has further propelled market growth, as industries shift towards>Report Scope

The report analyzes the Leak Detection and Repair market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Equipment Component, Services Component); Product (Handheld Gas Detectors, UAV-based Detectors, Vehicle-based Detectors, Manned Aircraft Detectors); Technology (Volatile Organic Compounds Analyzer Technology, Optical Gas Imaging Technology, Laser Absorption Spectroscopy Technology, Ambient / Mobile Leak Monitoring Technology, Acoustic Leak Detection Technology, Audio-Visual-Olfactory Inspection Technology).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Equipment Component segment, which is expected to reach US$14.3 Billion by 2030 with a CAGR of a 2.2%. The Services Component segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 5.6% CAGR to reach $4.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Leak Detection and Repair Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Leak Detection and Repair Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Leak Detection and Repair Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, AtriCure, Inc., Biotronik SE & Co. KG, Boston Scientific Corporation, Cardiac Rhythm Management (CRM) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Leak Detection and Repair market report include:

- ABB Ltd.

- AECOM

- Aeris Technologies, Inc.

- Atmos International

- Baker Hughes Company

- Ball Corporation

- Bridger Photonics, Inc.

- ClampOn AS

- Emerson Electric Co.

- FLIR Systems, Inc.

- Honeywell International Inc.

- IBM Corporation

- KROHNE Messtechnik GmbH

- Picarro Inc.

- Schneider Electric SE

- Siemens Energy Global GmbH & Co. KG

- Team, Inc.

- Teledyne Technologies

- WorleyParsons Limited

- Yokogawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- AECOM

- Aeris Technologies, Inc.

- Atmos International

- Baker Hughes Company

- Ball Corporation

- Bridger Photonics, Inc.

- ClampOn AS

- Emerson Electric Co.

- FLIR Systems, Inc.

- Honeywell International Inc.

- IBM Corporation

- KROHNE Messtechnik GmbH

- Picarro Inc.

- Schneider Electric SE

- Siemens Energy Global GmbH & Co. KG

- Team, Inc.

- Teledyne Technologies

- WorleyParsons Limited

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

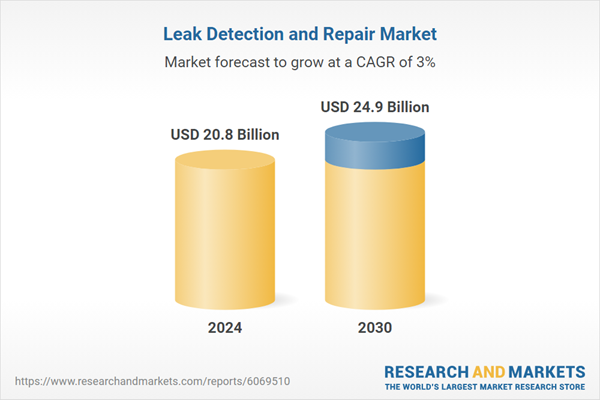

| Estimated Market Value ( USD | $ 20.8 Billion |

| Forecasted Market Value ( USD | $ 24.9 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |