Global Forestry Lubricants Market - Key Trends & Drivers Summarized

Why Are Forestry Lubricants Essential for the Logging and Wood Processing Industry?

Forestry lubricants play a critical role in maintaining the efficiency, longevity, and performance of heavy machinery used in logging, sawmilling, wood processing, and paper production. The forestry industry relies on a wide range of high-performance lubricants, including hydraulic fluids, gear oils, chain oils, and greases, to ensure smooth operation of equipment such as chainsaws, harvesters, skidders, feller bunchers, and sawmill machinery. Given the demanding environmental conditions - such as extreme temperatures, heavy loads, moisture, and contamination from dirt and wood particles - lubricants must be specifically formulated to withstand harsh forestry operations.One of the key reasons forestry lubricants are in high demand is the need for equipment reliability and reduced downtime. Unscheduled maintenance and equipment failure can lead to significant financial losses in forestry operations. Specialized lubricants enhance wear protection, corrosion resistance, and friction reduction, thereby extending equipment lifespan and improving overall operational efficiency. Additionally, as the industry shifts toward sustainable and eco-friendly practices, there is a growing demand for biodegradable lubricants that minimize environmental impact without compromising performance.

How Are Technological Advancements Enhancing Forestry Lubricants?

The forestry lubricants industry is evolving with technological advancements in lubricant formulation, additive technology, and eco-friendly alternatives. One of the most significant developments is the introduction of bio-based and biodegradable lubricants, which are derived from plant-based oils, synthetic esters, and renewable resources. These lubricants offer low toxicity, high biodegradability, and reduced environmental pollution, making them ideal for forestry applications where lubricant spillage and leakage can impact soil and water quality.Another key innovation is the development of high-performance synthetic lubricants that offer better temperature stability, oxidation resistance, and extended drain intervals compared to conventional mineral-based lubricants. Synthetic hydraulic fluids and gear oils provide superior lubrication in extreme weather conditions, ensuring optimal performance even in sub-zero temperatures or high-heat environments. These advancements have significantly improved equipment efficiency, reduced maintenance costs, and enhanced fuel economy.

The incorporation of nanotechnology and smart lubrication systems is also transforming the forestry lubricants market. Nano-additives in lubricants enhance anti-wear and anti-friction properties, improving machinery efficiency and durability. Additionally, smart lubrication systems equipped with IoT sensors enable real-time monitoring of lubricant condition, wear levels, and equipment performance. This predictive maintenance technology helps forestry operators reduce unplanned downtime and optimize lubricant usage, leading to cost savings and improved productivity.

What Are the Emerging Trends in the Forestry Lubricants Market?

Several key trends are shaping the forestry lubricants market, driven by environmental regulations, technological advancements, and the growing demand for efficient and sustainable logging operations. One of the most prominent trends is the shift toward environmentally friendly lubricants, particularly biodegradable chain oils, hydraulic fluids, and greases. Forestry companies and equipment manufacturers are increasingly adopting EU Ecolabel-certified and USDA BioPreferred lubricants to comply with sustainability regulations and reduce their environmental footprint.Another emerging trend is the rise of high-viscosity, long-lasting lubricants designed to withstand intense mechanical stress and extreme operating conditions. Forestry machines operate under continuous heavy loads, high-impact forces, and exposure to water and dust, making high-performance lubricants with superior adhesion and film strength essential for preventing wear and tear. Lubricants with high tackiness and anti-fling properties are particularly crucial for chainsaws and harvesting equipment, as they ensure continuous lubrication in high-speed cutting operations.

The increasing adoption of automated lubrication systems in forestry machinery is also influencing the market. These systems provide precise lubricant delivery, reducing waste and ensuring consistent lubrication across critical machine components. Automated lubrication enhances efficiency, extends service life, and minimizes manual maintenance efforts, making it an attractive option for large-scale logging and wood processing companies.

Additionally, bio-based lubricants with enhanced thermal stability and oxidation resistance are gaining popularity, particularly in regions with strict environmental regulations such as Europe and North America. Forestry companies are investing in sustainable forestry management by utilizing low-carbon, non-toxic lubricants that comply with environmental standards while maintaining high performance.

What Factors Are Driving the Growth of the Forestry Lubricants Market?

The growth of the forestry lubricants market is driven by several factors, including rising global demand for wood products, advancements in forestry machinery, and increasing environmental awareness. The expansion of timber, paper, and biomass industries has led to higher demand for heavy-duty forestry equipment, which in turn drives the need for specialized lubricants to enhance performance and minimize wear-related breakdowns.Regulatory policies aimed at reducing carbon emissions and environmental pollution are also shaping the market. Governments and forestry organizations are enforcing sustainable logging practices, leading to a surge in demand for biodegradable and eco-friendly lubricants. Companies that integrate green lubrication solutions are gaining a competitive advantage by demonstrating compliance with environmental sustainability initiatives.

Technological advancements in forestry machinery are another key driver. Modern logging equipment features high-speed, high-torque engines, advanced hydraulic systems, and automated processing capabilities, requiring high-performance lubricants that can withstand intense mechanical and thermal stress. The growing adoption of high-efficiency lubricants with extended service intervals is helping forestry companies reduce operational costs and improve overall efficiency.

Additionally, the rising trend of mechanized forestry operations in emerging economies is boosting market growth. Countries in Asia-Pacific, Latin America, and Africa are rapidly expanding their commercial forestry and timber industries, increasing the demand for lubricants that enhance machine durability and performance in challenging environments. As more forestry operators transition to fully mechanized logging and processing, the market for specialized lubricants tailored for extreme conditions is expected to grow.

The future of the forestry lubricants market will be shaped by continued innovation in bio-based formulations, smart lubrication technologies, and stricter environmental regulations. Companies that focus on developing high-performance, eco-friendly lubricants and integrating predictive maintenance solutions will lead the industry.

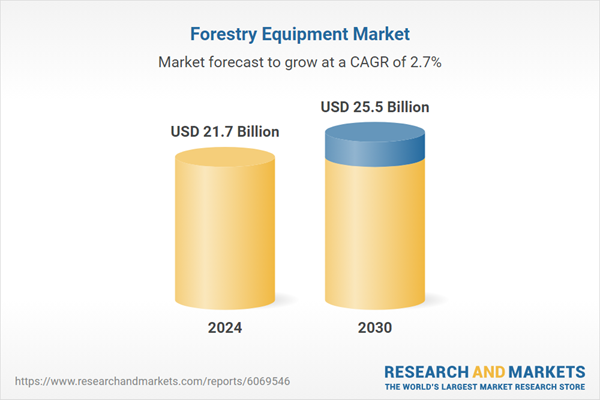

The report analyzes the Forestry Equipment market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.

- Segments: Equipment (Felling Equipment, Extracting Equipment, On-Site Processing Equipment, Other Equipment).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Felling Equipment segment, which is expected to reach US$10.9 Billion by 2030 with a CAGR of a 2.7%. The Extracting Equipment segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.9 Billion in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Forestry Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Forestry Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Forestry Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Agilent Technologies Inc., Aware, Inc., Axon Enterprise, Bruker Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Forestry Equipment market report include:

- Altendorf GmbH

- Barko Hydraulics, LLC

- Bell Equipment

- Caterpillar Inc.

- Deere & Company

- Doosan Infracore Co., Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Heavy Industries Co., Ltd.

- J.C. Bamford Excavators Limited (JCB)

- J.D. Irving, Limited

- Komatsu Ltd.

- Kubota Corporation

- Morbark, LLC

- Nortrax, Inc.

- Ponsse Plc

- Rottne Industri AB

- Stihl

- Sumitomo Heavy Industries

- Tigercat International Inc.

- Volvo Construction Equipment

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Altendorf GmbH

- Barko Hydraulics, LLC

- Bell Equipment

- Caterpillar Inc.

- Deere & Company

- Doosan Infracore Co., Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Heavy Industries Co., Ltd.

- J.C. Bamford Excavators Limited (JCB)

- J.D. Irving, Limited

- Komatsu Ltd.

- Kubota Corporation

- Morbark, LLC

- Nortrax, Inc.

- Ponsse Plc

- Rottne Industri AB

- Stihl

- Sumitomo Heavy Industries

- Tigercat International Inc.

- Volvo Construction Equipment

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.7 Billion |

| Forecasted Market Value ( USD | $ 25.5 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |