Global High-Speed Engine Market - Key Trends & Drivers Summarized

Why Are High-Speed Engines Gaining Momentum Across Power-Dense Applications?

High-speed engines - typically operating above 1,000 rpm - are witnessing rising demand in mission-critical sectors that require compact, responsive, and power-dense energy solutions. These engines, whether diesel- or gas-powered, are favored for their quick start-up capabilities, high power-to-weight ratios, and adaptability across mobile and stationary applications. Industries such as marine, rail, construction, oil & gas, and data center backup power increasingly rely on high-speed engines to meet rigorous performance requirements in limited space and time-critical environments. In backup power systems, particularly for healthcare facilities and IT infrastructure, high-speed engines offer fast load acceptance, supporting operational continuity during outages. The expanding use of high-speed engines in decentralized power generation, particularly in off-grid or weak-grid scenarios, is driving further adoption in emerging markets. In transportation and defense, their lightweight design and rapid acceleration capabilities make them ideal for high-performance vessels, locomotives, and tactical ground vehicles. Moreover, as global infrastructure development intensifies, the demand for mobile construction and mining equipment powered by high-speed engines is accelerating. These engines are also being increasingly integrated into hybrid powertrains and energy storage systems as part of broader fuel efficiency and emissions compliance strategies. Their modular design, ease of maintenance, and scalability make them a preferred choice in applications that require both flexibility and resilience under variable load conditions.How Are Technology Shifts Enhancing the Efficiency and Environmental Profile of High-Speed Engines?

The high-speed engine landscape is evolving rapidly as manufacturers incorporate advanced technologies to boost fuel efficiency, reduce emissions, and improve operational lifespan. Turbocharging, electronic fuel injection, and high-pressure common rail systems are becoming standard features to enhance combustion efficiency and minimize fuel wastage. Dual-fuel and flex-fuel capabilities are being introduced to allow engines to switch between diesel, natural gas, and biofuels depending on availability and regulatory requirements. Emissions control systems such as exhaust gas recirculation (EGR), diesel oxidation catalysts (DOC), and selective catalytic reduction (SCR) are enabling compliance with stringent emission norms including EPA Tier 4, Euro Stage V, and IMO Tier III. Advanced control units (ECUs) with real-time diagnostics and remote monitoring capabilities are transforming high-speed engines into digitally managed assets, enabling proactive maintenance and minimizing downtime. Engine manufacturers are also leveraging lightweight materials and friction-reducing coatings to enhance thermal efficiency and durability. Integration with hybrid systems, particularly in marine propulsion and mobile power platforms, is gaining traction as it helps optimize fuel use and cut down emissions during variable load conditions. Digital twin models and AI-based engine performance optimization are being explored to simulate usage cycles and fine-tune operating parameters for specific mission profiles. These innovations are not only making high-speed engines cleaner and smarter but also strengthening their competitive positioning in increasingly regulated and cost-sensitive markets.Which End-Use Applications Are Shaping the Demand for High-Speed Engines Worldwide?

Demand for high-speed engines is being driven by a diverse and evolving set of end-use applications, each with unique performance, mobility, and reliability needs. In the power generation sector, high-speed engines serve as standby and prime movers for data centers, hospitals, industrial plants, and commercial buildings, where uninterrupted power is critical. The growing frequency of grid outages and demand for decentralized generation in Africa, South Asia, and parts of Latin America is expanding the generator set market reliant on high-speed engines. In transportation, their usage spans small to medium marine vessels, commuter railcars, and specialty vehicles such as airport ground support equipment and military logistics vehicles. Construction and mining continue to be high-volume consumers due to the need for portable, durable engines in cranes, excavators, and drilling rigs, particularly in remote or rugged environments. The oil & gas sector depends on high-speed engines to power drilling rigs, mobile pumps, and well servicing equipment where mobility, rapid deployment, and high-load operation are essential. Moreover, with the rise in smart farming and precision agriculture, these engines are increasingly used in tractors and harvesters, supporting high operational uptime during peak seasons. In developed economies, high-speed engines are gaining relevance in CHP (combined heat and power) and peak-shaving applications, often integrated with smart grids. Across sectors, the demand for rapid start-up, scalability, and adaptable performance underpins their growing application footprint.The Growth In The High-Speed Engine Market Is Driven By Several Factors…

The global shift toward resilient, decentralized, and high-efficiency energy systems is a core driver of growth in the high-speed engine market. The rising need for backup and off-grid power in response to grid instability, especially in emerging economies and disaster-prone regions, is generating sustained demand for high-speed gensets. Infrastructure development, particularly in transportation, construction, and extractive industries, continues to fuel large-scale procurement of mobile power equipment powered by high-speed engines. Environmental regulations are prompting upgrades to compliant, fuel-efficient engine models, which is accelerating replacement cycles in both industrial and commercial segments. The growth of data centers, telecommunications infrastructure, and urban logistics hubs is further expanding the use of high-speed engines as emergency and supplementary power sources. Additionally, the global push for fuel flexibility and energy transition is opening up new opportunities for dual-fuel and hybrid-compatible high-speed engines, especially in marine and power generation applications. Rising defense budgets and investments in tactical mobility and homeland security are also contributing to demand in rugged, high-performance engine platforms. Digitization of fleet and asset management is enhancing lifecycle economics and encouraging enterprises to adopt smart, connected engine systems. Lastly, policy incentives for distributed energy systems and hybridized transport applications are reinforcing the strategic relevance of high-speed engines in the global energy and mobility ecosystem.Report Scope

The report analyzes the High-Speed Engine market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Speed (1000-1500 RPM, 1500-1800 RPM, Above 1800 RPM); Power Output (0.50-0.56 MW, 0.56-1 MW, 1-2 MW, 2-4 MW, Above 4 MW); End-User (Power Generation End-User, Marine End-User, Railway End-User, Mining and Oil & Gas End-User, Construction End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 1000-1500 RPM Engine segment, which is expected to reach US$17.5 Billion by 2030 with a CAGR of a 3.8%. The 1500-1800 RPM Engine segment is also set to grow at 1.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.7 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $5.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High-Speed Engine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High-Speed Engine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High-Speed Engine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Centrix Dental, Church & Dwight Co., Inc., Colgate-Palmolive Company, Dentsply Sirona and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this High-Speed Engine market report include:

- Caterpillar Inc.

- Cummins Inc.

- Daihatsu Diesel Mfg. Co., Ltd.

- Deutz AG

- Doosan Infracore

- Fairbanks Morse Defense

- GE Aerospace

- Ilmor Engineering Inc.

- Isotta Fraschini Motori S.p.A.

- MAN Energy Solutions

- Mitsubishi Heavy Industries, Ltd.

- MTU Friedrichshafen GmbH

- Perkins Engines Company Limited

- Power Solutions International, Inc. (PSI)

- Rolls-Royce Holdings plc

- Scania AB

- Volvo Penta

- Wärtsilä Corporation

- Weichai Power Co., Ltd.

- Yanmar Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Caterpillar Inc.

- Cummins Inc.

- Daihatsu Diesel Mfg. Co., Ltd.

- Deutz AG

- Doosan Infracore

- Fairbanks Morse Defense

- GE Aerospace

- Ilmor Engineering Inc.

- Isotta Fraschini Motori S.p.A.

- MAN Energy Solutions

- Mitsubishi Heavy Industries, Ltd.

- MTU Friedrichshafen GmbH

- Perkins Engines Company Limited

- Power Solutions International, Inc. (PSI)

- Rolls-Royce Holdings plc

- Scania AB

- Volvo Penta

- Wärtsilä Corporation

- Weichai Power Co., Ltd.

- Yanmar Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 396 |

| Published | January 2026 |

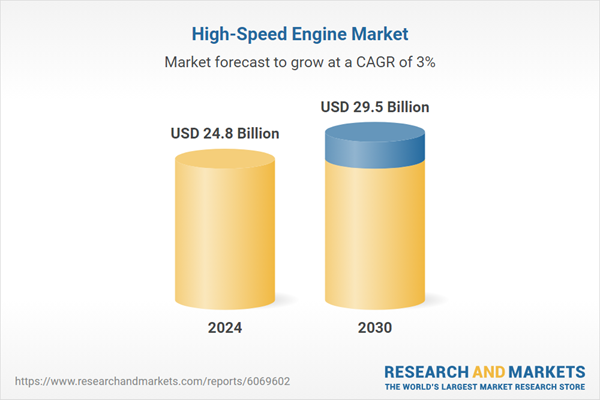

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.8 Billion |

| Forecasted Market Value ( USD | $ 29.5 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |