Global Clinical Trial Equipment and Ancillary Solutions Market - Key Trends & Drivers Summarized

How Are Equipment and Ancillary Solutions Streamlining Clinical Trials?

The efficiency and success of clinical trials depend heavily on the availability of high-quality equipment and ancillary solutions that support the smooth execution of study protocols. Clinical trial equipment, ranging from diagnostic imaging systems to infusion pumps, plays a critical role in patient monitoring and therapeutic interventions. Meanwhile, ancillary supplies, including lab kits, sample collection devices, and cold chain logistics, ensure the seamless conduct of trials across multiple sites. The growing shift toward decentralized clinical trials (DCTs) has increased the demand for portable and patient-centric equipment, such as wearable biosensors and remote monitoring devices. Additionally, the adoption of eClinical solutions, including cloud-based inventory management systems, is optimizing the procurement and distribution of trial supplies. Standardization of trial equipment across global study sites is also enhancing compliance with regulatory requirements, ensuring data integrity and consistency. As clinical research becomes increasingly complex, the need for sophisticated trial equipment and well-coordinated supply chain logistics is more pronounced than ever.What Are the Emerging Innovations in Clinical Trial Equipment?

Advancements in clinical trial equipment are reshaping the way studies are conducted, enhancing data accuracy, patient safety, and operational efficiency. The rise of wearable biosensors and remote monitoring devices is enabling real-time tracking of patient vitals, reducing the need for frequent site visits and improving patient compliance. AI-powered imaging systems are revolutionizing clinical endpoints assessment, offering high-precision radiological analysis for oncology and neurology trials. The integration of automated sample processing equipment is accelerating laboratory workflows, minimizing variability in specimen analysis. Additionally, the deployment of smart infusion systems in clinical trials is ensuring accurate drug dosing, reducing human errors in investigational drug administration. The increasing use of blockchain technology in clinical supply chain management is enhancing traceability, preventing counterfeit medical devices from entering the research ecosystem. As digital transformation continues to influence clinical research, innovative trial equipment is becoming an essential component in accelerating drug development and regulatory approvals.How Is Logistics and Supply Chain Management Evolving in Clinical Trials?

The management of clinical trial equipment and ancillary supplies is becoming more sophisticated, driven by technological advancements and regulatory requirements. Cold chain logistics is witnessing significant innovation, with real-time temperature monitoring sensors ensuring the integrity of temperature-sensitive biologics, vaccines, and investigational drugs. AI-driven demand forecasting is optimizing trial supply chain logistics, reducing wastage and ensuring timely delivery of critical equipment to trial sites. The increasing reliance on direct-to-patient (DTP) supply models is streamlining drug delivery in decentralized clinical trials, improving patient retention and adherence. Additionally, digital twin technology is being employed to simulate trial supply chain scenarios, allowing sponsors to predict bottlenecks and optimize resource allocation. The use of RFID (Radio Frequency Identification) and IoT (Internet of Things) in equipment tracking is enhancing visibility and efficiency in clinical trial logistics. As regulatory scrutiny over supply chain management intensifies, clinical trial sponsors are prioritizing compliance-driven logistics solutions to mitigate risks and maintain data integrity.What’ s Driving the Growth of the Clinical Trial Equipment and Ancillary Solutions Market?

The growth in the clinical trial equipment and ancillary solutions market is driven by several factors, including the increasing complexity of clinical trials, technological advancements in trial equipment, and the shift toward decentralized and hybrid trial models. The rising demand for real-time patient monitoring solutions is fueling the adoption of wearable biosensors and remote diagnostic devices. The proliferation of biologics and cell and gene therapies (CGTs) is intensifying the need for specialized cold chain logistics and ultra-low temperature storage solutions. Additionally, the growing trend of outsourcing clinical trial services to contract research organizations (CROs) is driving investments in advanced trial equipment and ancillary solutions. The increasing emphasis on digital transformation in clinical research is propelling the adoption of AI-driven imaging technologies, automated laboratory equipment, and blockchain-powered supply chain management systems. Furthermore, regulatory agencies are mandating stricter compliance standards for trial equipment and logistics, encouraging sponsors to invest in high-quality, validated solutions. As clinical trial designs continue to evolve, the demand for innovative, efficient, and technology-driven equipment and ancillary solutions will remain a key driver of market expansion.Report Scope

The report analyzes the Clinical Trial Equipment and Ancillary Solutions market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Sourcing, Supply/Logistics, Service, Other Types); Phase Type (Phase I, Phase II, Phase III, Phase IV).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sourcing segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 8%. The Supply / Logistics segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $848.0 Million in 2024, and China, forecasted to grow at an impressive 11.1% CAGR to reach $983.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clinical Trial Equipment and Ancillary Solutions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clinical Trial Equipment and Ancillary Solutions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clinical Trial Equipment and Ancillary Solutions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Type Culture Collection (ATCC), Azenta U.S., Inc., BioStorage Technologies (Brooks), Celerion, Cell&Co BioServices (Cryoport) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Clinical Trial Equipment and Ancillary Solutions market report include:

- Ancillare, LP

- Bionical Emas

- Bio-Rad Laboratories, Inc.

- Caligor Coghlan

- ClientPharma

- Emsere (Medicapital Rent)

- Imperial Clinical Research Services

- Integrated Research Management (IRM)

- Marken

- MedFlow Clinical

- MediCapital Rent

- Myonex

- Pacific Science

- PAREXEL International Corporation

- PPD, Inc.

- Quipment SAS

- Sharp Services

- Thermo Fisher Scientific Inc.

- Woodley Equipment Company Ltd.

- Yourway

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ancillare, LP

- Bionical Emas

- Bio-Rad Laboratories, Inc.

- Caligor Coghlan

- ClientPharma

- Emsere (Medicapital Rent)

- Imperial Clinical Research Services

- Integrated Research Management (IRM)

- Marken

- MedFlow Clinical

- MediCapital Rent

- Myonex

- Pacific Science

- PAREXEL International Corporation

- PPD, Inc.

- Quipment SAS

- Sharp Services

- Thermo Fisher Scientific Inc.

- Woodley Equipment Company Ltd.

- Yourway

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

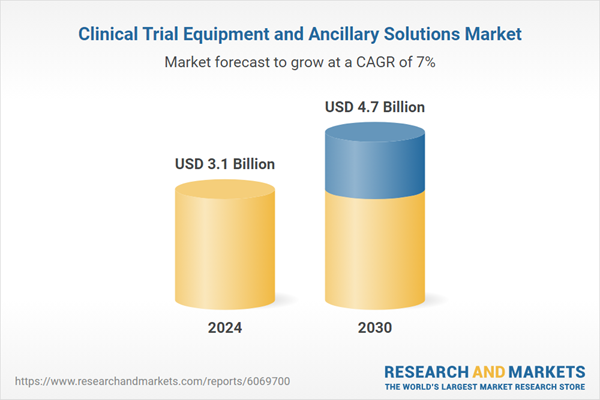

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |