Global First Mile Logistics Delivery Software Market - Key Trends & Drivers Summarized

Why Is Software-Led Optimization Reshaping the First Mile of Logistics?

In the increasingly digitized logistics landscape, first mile delivery software has emerged as a mission-critical tool for orchestrating the seamless movement of goods from suppliers or production sites to distribution hubs. This software empowers manufacturers, retailers, 3PLs, and couriers to manage, track, and optimize the very beginning of the supply chain, which sets the foundation for delivery performance downstream. Traditionally manual and fragmented, first mile operations are now being transformed by platforms that integrate routing, shipment consolidation, inventory visibility, dispatch planning, and real-time communication into a single digital interface. The pressure to meet the expectations of a hyper-demanding e-commerce ecosystem - characterized by rapid order fulfillment, dynamic inventory locations, and a surge in small parcel volumes - has made first mile software indispensable.How Are Advanced Technologies Powering Innovation in First Mile Software Solutions?

Technological evolution is significantly enhancing the scope and sophistication of first mile logistics delivery software, enabling users to move from reactive to proactive logistics strategies. Artificial intelligence (AI) and machine learning (ML) algorithms are now embedded in many platforms to optimize vehicle loading, suggest predictive ETAs, and provide intelligent route sequencing based on historical trends and real-time variables. Integration with Internet of Things (IoT) sensors enables granular tracking of cargo temperature, humidity, and motion, which is especially valuable in perishables and pharma logistics. Cloud-based architecture ensures scalability and remote accessibility, making it easier for distributed teams to collaborate across geographies. APIs and plug-ins facilitate seamless integration with ERP, warehouse management systems (WMS), and transportation management systems (TMS), allowing businesses to create a connected logistics stack. Additionally, automation features such as digital documentation, smart label generation, and auto-dispatching are reducing manual workload while improving accuracy. With user-friendly dashboards, mobile apps for on-the-ground staff, and customizable alerts, first mile delivery software is moving from being a backend tool to a frontline enabler of logistics excellence, equipping businesses to handle greater complexity with fewer resources.What Industry and Regulatory Trends Are Accelerating Adoption of First Mile Software?

The adoption of first mile logistics delivery software is being accelerated by macro trends in supply chain management, regulatory frameworks, and customer expectations. The explosion of e-commerce and the shift to direct-to-consumer models have led to an increase in origin points and the frequency of first mile dispatches, requiring real-time coordination and systematization. Industries such as retail, FMCG, pharmaceuticals, and fresh produce are under immense pressure to shorten lead times, increase visibility, and eliminate inefficiencies in the early stages of delivery. Meanwhile, stricter compliance with labor laws, customs regulations, and data privacy standards is compelling logistics operators to digitize their first mile records and workflows. Sustainability goals are also playing a role, as shippers look for software solutions that support route optimization, load maximization, and emissions reporting to meet ESG objectives. Moreover, the COVID-19 pandemic exposed critical vulnerabilities in analog logistics operations, prompting businesses of all sizes to invest in digital platforms that offer resilience, remote operability, and business continuity. As the regulatory, operational, and commercial environments become more complex, first mile software is evolving from a nice-to-have to a strategic necessity across sectors and geographies.What Factors Are Fueling the Growth Trajectory of the First Mile Delivery Software Market?

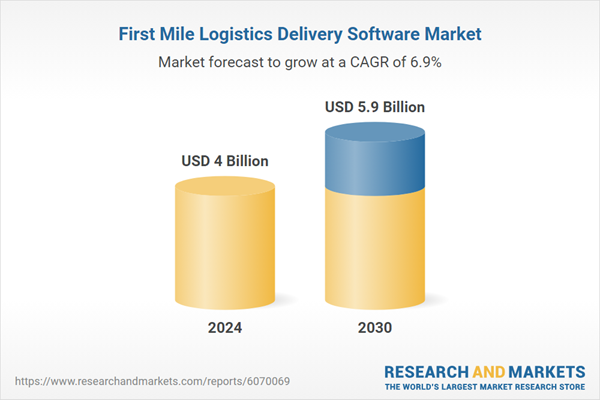

The growth in the first mile logistics delivery software market is driven by several factors related to digital transformation, e-commerce expansion, supply chain decentralization, and the need for real-time operational control. As businesses scale their omnichannel logistics strategies, there is a rising demand for systems that can dynamically coordinate multi-origin, multi-destination networks with speed and precision. The proliferation of micro-fulfillment centers, dark stores, and urban warehouses has increased the complexity of first mile logistics, necessitating advanced software tools to orchestrate these fragmented supply routes. Mid-market and SME players, previously reliant on spreadsheets and phone calls, are now adopting SaaS-based solutions that offer affordability, scalability, and low onboarding friction. In parallel, enterprise customers are investing in custom and API-rich platforms that support high-volume operations and deep system integrations.The report analyzes the First Mile Logistics Delivery Software market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.

- Segments: Component (Software Component, Service Component); Deployment Type (Cloud-based Deployment Type, On-Premise Deployment Type); Organization Size (Large Enterprises, SMEs); Application (Route Planning & Optimization Application, Inventory Management Application, Order Management Application, Shipment Tracking Application, Other Applications); End-User (Retail & E-Commerce End-User, Manufacturing End-User, Healthcare End-User, Automotive End-User, Food & Beverage End-User, Energy & Utilities End-User, Aerospace & Defense End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of a 7.9%. The Service Component segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 11% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global First Mile Logistics Delivery Software Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global First Mile Logistics Delivery Software Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global First Mile Logistics Delivery Software Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cargo Carriers Limited, DHL International GmbH, Dronamics, Dynamon, FedEx Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this First Mile Logistics Delivery Software market report include:

- Bringg

- ClearDestination

- Convey

- Deliforce

- Descartes Systems Group

- DispatchTrack

- FarEye

- Locus

- LogiNext

- Metapack

- Narvar

- OneRail

- Onfleet

- ParcelLab

- Route4Me

- Scurri

- Shipsy

- Shipwell

- tiramizoo

- Zebra Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bringg

- ClearDestination

- Convey

- Deliforce

- Descartes Systems Group

- DispatchTrack

- FarEye

- Locus

- LogiNext

- Metapack

- Narvar

- OneRail

- Onfleet

- ParcelLab

- Route4Me

- Scurri

- Shipsy

- Shipwell

- tiramizoo

- Zebra Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 571 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |