Global Infant Formula DHA Algae Oil Market - Key Trends & Drivers Summarized

Infant Formula DHA Algae Oil: The Future of Infant Nutrition?

The market for Infant Formula DHA Algae Oil has gained significant traction over the past decade as awareness surrounding the benefits of Docosahexaenoic Acid (DHA) in infant development continues to rise. DHA, a critical omega-3 fatty acid, plays a vital role in brain and visual development, making its inclusion in infant formula essential for proper growth. Traditionally, DHA was sourced from fish oil; however, concerns over contamination, sustainability, and dietary preferences have propelled the demand for algae-derived DHA as a cleaner, plant-based alternative. Algae oil provides a sustainable and pure source of DHA without the risk of heavy metal exposure, making it the preferred choice for infant formula manufacturers worldwide.Regulatory changes have also significantly influenced the market, with various health organizations, including the World Health Organization (WHO) and the Food and Drug Administration (FDA), emphasizing the necessity of DHA supplementation in infant nutrition. As a result, manufacturers are increasingly incorporating algae-derived DHA into their formulas to comply with new regulations and meet growing consumer expectations. The shift towards plant-based nutrition has further accelerated demand, as parents seek healthier, vegan-friendly options for their children. Additionally, advancements in extraction and purification technologies are enhancing the quality and efficacy of algae-derived DHA, further boosting its adoption in the infant formula sector.

Why Is Algae Oil DHA Becoming the Preferred Choice for Infant Formula?

One of the major factors driving the preference for algae oil DHA in infant formula is its sustainability and purity compared to fish oil. Unlike fish-derived DHA, which carries the risk of oceanic pollutants and fluctuating supply due to overfishing, algae oil is cultivated in controlled environments, ensuring a consistent and contaminant-free product. This makes it an attractive choice for formula manufacturers looking to provide the highest quality nutrition while adhering to strict safety standards. Furthermore, algae oil is rich in DHA while being free from common allergens, making it suitable for infants with dietary sensitivities.The growing demand for plant-based and vegan-friendly alternatives has further propelled the shift towards algae-derived DHA. As more parents adopt plant-based diets for ethical and environmental reasons, the need for non-animal-derived DHA sources has surged. Infant formula brands are responding to this trend by reformulating their products to include algae oil DHA, ensuring they cater to a broader demographic. The technological advancements in algae cultivation and oil extraction are also improving the bioavailability and stability of DHA, allowing for better absorption and prolonged shelf life in infant formula products.

Another significant factor contributing to the rise of algae oil DHA is its superior taste and odor profile. Fish oil DHA often imparts an unpleasant aftertaste to infant formulas, which can affect palatability and lead to feeding issues. Algae oil, on the other hand, is neutral in taste and smell, making it easier to incorporate into formula without compromising the overall sensory experience. This has encouraged leading infant formula manufacturers to transition from fish-based DHA to algae-based alternatives to enhance product acceptance among both infants and parents.

What Are the Technological Advancements Shaping the Market?

The infant formula DHA algae oil market has benefited from continuous innovation in microalgae cultivation and oil extraction processes. One of the most notable advancements is the use of closed-loop fermentation systems, which enable large-scale, high-purity DHA production with minimal environmental impact. Unlike traditional open-pond cultivation, which is susceptible to contamination and variability, closed-loop systems provide a controlled environment that optimizes algae growth, enhances yield, and ensures consistency in DHA concentration.In addition to cultivation improvements, breakthroughs in oil extraction and purification have played a crucial role in refining algae oil DHA for infant formula applications. Supercritical CO2 extraction, for instance, has emerged as a preferred method for obtaining DHA-rich algae oil while preserving its nutritional integrity. This technique eliminates the need for chemical solvents, resulting in a cleaner, more sustainable product. Furthermore, encapsulation technologies are being employed to enhance DHA stability, preventing oxidation and degradation during formula processing and storage.

The adoption of precision fermentation techniques is another key development reshaping the industry. This cutting-edge technology allows for the bioengineering of microalgae strains to maximize DHA output while reducing production costs. As a result, the affordability of algae-derived DHA is improving, making it more accessible for large-scale infant formula manufacturing. Additionally, research in lipid optimization is leading to the development of enhanced DHA formulations that improve absorption and efficacy, ensuring optimal health benefits for infants consuming DHA-enriched formulas.

What Is Driving the Growth of the Infant Formula DHA Algae Oil Market?

The growth in the infant formula DHA algae oil market is driven by several factors, including technological advancements, the shift towards plant-based nutrition, and the increasing regulatory emphasis on DHA supplementation in infant diets. One of the primary drivers is the rising awareness of DHA’ s critical role in cognitive and visual development, prompting parents and healthcare providers to prioritize formulas fortified with high-quality DHA sources. Algae-derived DHA meets this demand by offering a highly bioavailable, pure, and sustainable alternative to traditional fish oil sources.The surge in demand for clean-label and allergen-free infant nutrition is also contributing to market expansion. With a growing number of parents seeking transparency in ingredient sourcing and product formulations, manufacturers are focusing on DHA algae oil as a premium, traceable option that aligns with consumer preferences. The trend towards organic and non-GMO infant formulas further strengthens this demand, as algae oil DHA is easily incorporated into such formulations without compromising product integrity.

Additionally, the increasing penetration of premium and specialty infant formula products in emerging markets is fueling industry growth. As disposable incomes rise in countries such as China, India, and Brazil, parents are more willing to invest in high-quality infant nutrition products that incorporate advanced nutritional elements like algae-derived DHA. Strategic partnerships between biotechnology firms and infant formula manufacturers are also accelerating innovation, ensuring that the latest advancements in algae oil DHA production are efficiently integrated into infant nutrition solutions. As these factors continue to shape the market, the adoption of DHA algae oil in infant formula is expected to witness sustained growth, solidifying its position as the preferred choice for infant cognitive and developmental health.

Report Scope

The report analyzes the Infant Formula DHA Algae Oil market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Content (30% - 40%, 40% - 50%); Age Group (Below 3 years, 3 - 6 years, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 30% - 40% Content DHA Algae Oil segment, which is expected to reach US$353.2 Million by 2030 with a CAGR of a 7%. The 40% - 50% DHA Algae Oil segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $97.1 Million in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $104.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Infant Formula DHA Algae Oil Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Infant Formula DHA Algae Oil Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Infant Formula DHA Algae Oil Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amsino International, Inc., Angiplast Pvt., Ltd., B. Braun SE, Bactiguard, Becton, Dickinson and Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Infant Formula DHA Algae Oil market report include:

- Algarithm Ingredients

- Archer-Daniels-Midland Company

- Cabio

- Cargill, Inc.

- Cellana Inc.

- DSM-Firmenich AG

- Goerlich Pharma GmbH

- Guangdong Runke Bioengineering Co., Ld.

- Kingdomway Nutrition Inc.

- Meteoric Biopharmaceuticals Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Algarithm Ingredients

- Archer-Daniels-Midland Company

- Cabio

- Cargill, Inc.

- Cellana Inc.

- DSM-Firmenich AG

- Goerlich Pharma GmbH

- Guangdong Runke Bioengineering Co., Ld.

- Kingdomway Nutrition Inc.

- Meteoric Biopharmaceuticals Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

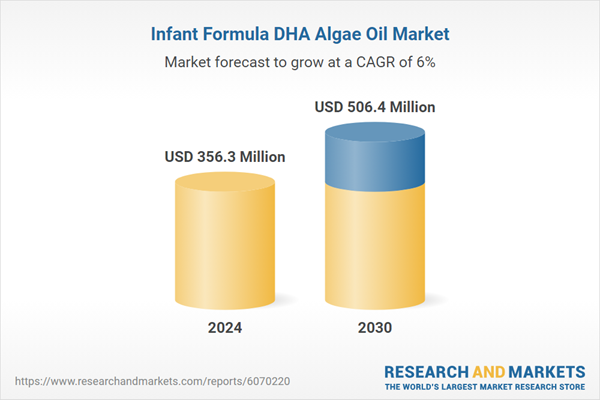

| Estimated Market Value ( USD | $ 356.3 Million |

| Forecasted Market Value ( USD | $ 506.4 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |