Global Formulation Development Outsourcing Market - Key Trends & Drivers Summarized

Why Is Formulation Development Outsourcing Gaining Unprecedented Global Attention?

The global formulation development outsourcing market is undergoing a profound transformation, driven by structural shifts within the pharmaceutical, biotechnology, and generics industries. Pharmaceutical companies are increasingly outsourcing formulation development to reduce time-to-market, mitigate R&D costs, and gain access to specialized expertise and infrastructure. The pressure to accelerate clinical development timelines and respond swiftly to evolving regulatory landscapes - especially in oncology, biologics, and personalized medicine - has pushed innovators to seek the agility offered by Contract Development and Manufacturing Organizations (CDMOs). Another prominent trend is the consolidation of vendor relationships, with pharmaceutical firms favoring full-service CDMOs capable of handling pre-formulation, formulation optimization, scale-up, and analytical testing under one roof. This shift not only streamlines operations but also facilitates seamless technology transfer across the drug development lifecycle.Furthermore, there is a notable surge in demand for complex drug formulations including sustained-release, targeted-delivery systems, and poorly water-soluble compounds. CDMOs are heavily investing in advanced drug delivery platforms, nanotechnology, and lipid-based delivery systems to meet these emerging requirements. The growing market for biosimilars and biologics - particularly monoclonal antibodies (mAbs), peptides, and vaccines - is further amplifying the need for sophisticated formulation development capabilities, particularly in parenteral dosage forms. With increasing drug molecule complexity and stricter regulatory scrutiny around formulation stability, bioavailability, and patient compliance, outsourcing has become not just a cost-saving measure but a strategic imperative for pharmaceutical companies.

How Are Technology Advancements Redefining the Outsourcing Landscape?

The adoption of innovative technologies has radically changed how formulation development outsourcing is structured and delivered. Digitalization and data analytics are playing a transformative role in optimizing formulation processes. Predictive modeling and artificial intelligence (AI)-driven simulation tools are enabling CDMOs to forecast formulation performance and improve decision-making early in the development cycle. This reduces experimentation costs and enhances formulation accuracy, particularly for complex therapeutics such as high-potency active pharmaceutical ingredients (HPAPIs) and targeted therapies. Moreover, the integration of Quality by Design (QbD) principles into formulation outsourcing workflows ensures greater product consistency, regulatory compliance, and process control - an increasingly vital factor as global regulatory standards become more harmonized and stringent.Continuous manufacturing and 3D printing of pharmaceuticals are emerging as disruptive innovations within this space. These technologies not only support greater customization but also significantly cut down production timelines. CDMOs are leveraging such tools to offer faster and more flexible formulation services, particularly to small and mid-sized biopharma firms that lack the internal infrastructure. In addition, advances in high-throughput screening and process analytical technologies (PAT) are enabling real-time monitoring of formulation attributes, helping reduce failures and increase first-time-right outcomes.

Which End-Use Segments Are Shaping the Future of the Market?

End-use dynamics in the formulation development outsourcing market are undergoing rapid evolution, with significant implications for future growth. Pharmaceutical companies remain the dominant end-users, but the surge in biotech innovation is shifting the outsourcing demand matrix. Biotech firms, particularly those working on novel biologics, gene therapies, and RNA-based drugs, are increasingly reliant on external formulation expertise to navigate the complexity of biologic drug stabilization and delivery. With limited in-house infrastructure, these firms turn to CDMOs with proven capabilities in aseptic processing, freeze-drying (lyophilization), and sterile formulation development. Similarly, the rise of niche therapeutic areas such as orphan drugs and cell & gene therapies is creating a demand for customized, small-batch formulation services - an area where specialized CDMOs are excelling.Generics and over-the-counter (OTC) pharmaceutical manufacturers are also driving demand, especially in emerging markets where affordability and rapid product introduction are critical. These players seek outsourcing partners who can deliver cost-effective, scalable, and compliant formulation services to support large-volume production. Another key segment includes nutraceutical and wellness product companies, which are increasingly leveraging pharmaceutical-grade formulation expertise to enhance product efficacy and stability. As consumer demand for high-quality, science-backed supplements grows, CDMOs with cross-domain formulation knowledge are emerging as preferred partners. Pediatric, geriatric, and veterinary formulations - segments often underserved by traditional pharma - are also gaining traction as specialized formulation niches ripe for outsourcing.

What’ s Fueling the Market Expansion - Are We Seeing a Structural Shift?

The growth in the formulation development outsourcing market is driven by several factors, each rooted in tangible shifts across technology, therapeutic development, and end-user demand. One of the primary growth drivers is the increasing complexity of drug molecules - particularly large-molecule biologics and next-generation therapies - which necessitate specialized formulation approaches not readily available in-house for many companies. Coupled with this is the rising demand for novel delivery systems such as transdermal, inhalable, and long-acting injectables, which require advanced formulation capabilities that only select CDMOs can offer.Moreover, the decentralization of pharmaceutical R&D activities, especially among start-ups and virtual biotechs, is fueling the demand for agile, innovation-oriented outsourcing models. Regulatory pressure to demonstrate formulation robustness and stability across global markets is also leading companies to engage partners with global regulatory expertise and advanced analytical capabilities. Another significant driver is the rise of personalized medicine, which is pushing the boundaries of conventional batch manufacturing and necessitating rapid, flexible, and small-batch formulation services. CDMOs that can incorporate personalized dosage design and rapid prototyping using advanced manufacturing technologies are seeing increased traction. Finally, favorable government incentives, growing venture capital in biotech, and increasing M&A activity within the CDMO space are accelerating innovation, capacity expansion, and service diversification - further propelling the formulation development outsourcing market into a new era of strategic indispensability.

Report Scope

The report analyzes the Formulation Development Outsourcing market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Preformulation, Formulation Development); Formulation (Oral, Injectable, Topical, Others); Therapeutic Area (Oncology, Infectious disease, Neurology, Hematology, Respiratory, Cardiovascular, Dermatology, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Preformulation Service segment, which is expected to reach US$41.3 Billion by 2030 with a CAGR of a 7.3%. The Formulation Development Service segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.6 Billion in 2024, and China, forecasted to grow at an impressive 10.2% CAGR to reach $11.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Formulation Development Outsourcing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Formulation Development Outsourcing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Formulation Development Outsourcing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Chevron Lubricants, Condat Lubrifiants, Cortec Corporation, Exxon Mobil Corporation, Frontier Performance Lubricants, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Formulation Development Outsourcing market report include:

- Aizant Drug Research Solutions Pvt. Ltd.

- Cambrex Corporation

- Catalent Inc.

- Charles River Laboratories International, Inc.

- Dr. Reddy’s Laboratories Ltd.

- Element

- Eurofins Scientific SE

- Hovione

- Intertek Group plc

- IRISYS LLC

- Labcorp

- Laurus Labs Limited

- Lonza

- Piramal Pharma Solutions

- Quotient Sciences

- Recipharm

- Rubicon Research Pvt. Ltd.

- SGS S.A.

- Syngene International Limited

- Thermo Fisher Scientific, Inc. (Patheon)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aizant Drug Research Solutions Pvt. Ltd.

- Cambrex Corporation

- Catalent Inc.

- Charles River Laboratories International, Inc.

- Dr. Reddy’s Laboratories Ltd.

- Element

- Eurofins Scientific SE

- Hovione

- Intertek Group plc

- IRISYS LLC

- Labcorp

- Laurus Labs Limited

- Lonza

- Piramal Pharma Solutions

- Quotient Sciences

- Recipharm

- Rubicon Research Pvt. Ltd.

- SGS S.A.

- Syngene International Limited

- Thermo Fisher Scientific, Inc. (Patheon)

Table Information

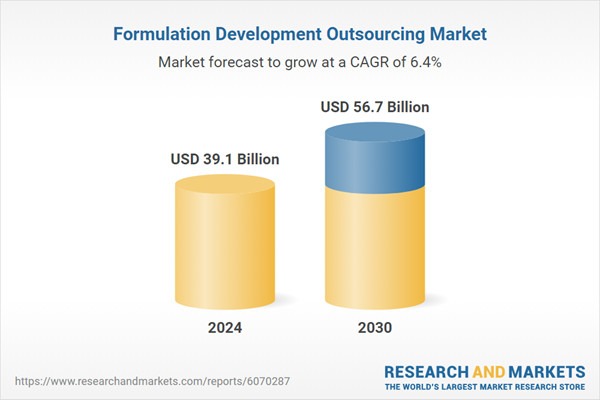

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 39.1 Billion |

| Forecasted Market Value ( USD | $ 56.7 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |